While the Government seeks to deepen the decline in the inflation and narrowing the gap between the official dollar and the financiersthe financial analyst Claudio Zuchovicki analyzed the economic measures of Javier Milei and highlighted which was the best in recent months.

“Argentina has been a country for a long time bimonetary because savings occur in Dollarsbut transactions are made in pesos,” Zuchovicki began by saying while analyzing the situation that the country is going through.

Regarding one of the points that the Government focused on the most, namely the rise in prices, the analyst said that “there were very bad expectations and certain variables were adjusted. The inflationary tax is lowered and that can change the thermal sensation by giving a better purchasing power, you removed the worst distortion, now it seems more manageable,” he said in an interview with Vorterix.

It should be remembered that the Minister of Economy, Luis Caputoassured in a meeting with market representatives that inflation in July would be the lowest of the year, in addition to maintaining that it was approaching a number that the Executive Branch would celebrate: 1% monthly.

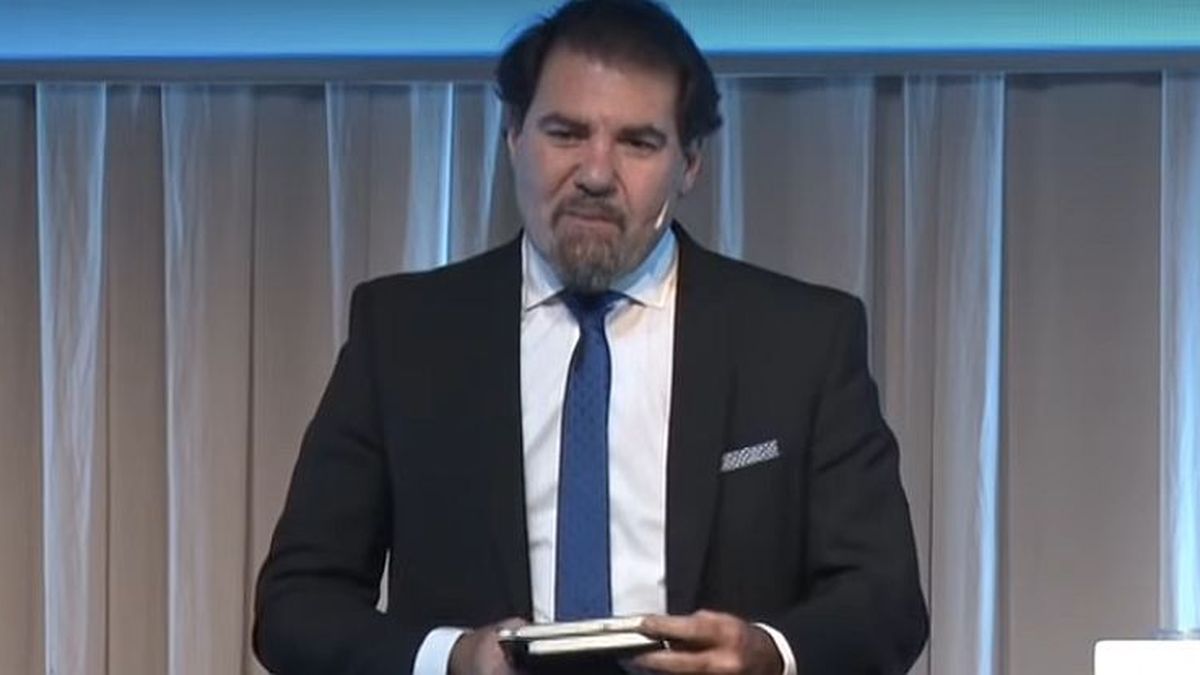

Claudio Zuchovicki’s analysis of Javier Milei

“Now it depends more on each one, before it was more the same, the State does not have to get involved in your business, What you have to do is get rid of the bureaucracy so that things go better for you.“, he explained how the country has changed since the arrival of La Libertad Avanza.

Zuchovicki

He also analysed the Government’s proposal to reduce inflation in July to the lowest level of the year.

Zuchovicki not only gave his opinion on the daily economic situation, but also on the exchange rate policy, which was in the spotlight after the greenback had significant increases in the last two months.

“The exchange rate gap andIt was the worst enemy because it was starting to hit inflationalthough I am not an interventionist, what they tried to do was lower it. It was the least bad thing they had today,” he said about the decision to intervene in the CCL dollar with the Central Bank’s reserves.

On this point, he revealed that “They didn’t intervene much, it was all more verbal. By saying “look, I’m intervening,” not many dollars were spent, it was more than anything the signal that was given, of the credibility that one has,” he concluded.

Source: Ambito