Only the Closing gaps in soybeans between Argentina and Brazil could increase exports by more than US$5 billion. This information was provided by the Rosario Stock Exchange (BCR), which compared grain yields between the two countries.

“If we move forward 20 years in time and take the average yield of the 2018/19-2022/23 campaigns, we get practically the same number: 2.71 tons of soybeans per hectare. Carrying out the same analysis for Brazil, we find a yield of 2.77 tons per hectare at the beginning of the last century. However, we will find that in the last few In the last two decades, soybean yields in Brazil have reached 3.43 tons per hectare in their last campaigns,” they pointed out.

They highlighted in a report that, while Average soybean yields in Brazil have grown by 24% over the past 20 years, while those in Argentina have remained relatively stagnant.Furthermore, the data in this analysis consider the exceptional 2022/23 harvest, which was a production disaster for Argentina and the best harvest in the history of Brazil. However, if we were to exclude this campaign, The average Argentine yield would rise to 2.82 tons per hectare, which would give us a still significant gap with respect to the yields in Brazil,” they indicated.

performance1.png

In fact, the stock exchange entity assured that, “If this productivity gap between Argentina and Brazil were closed, could occur more than 12 million additional tons of soybeans, Valued at current FOB prices, it would represent around US$5.144 million.”

In this scenario, in addition to the growth in agricultural production, “this closing of gaps would also result in an increase in soybean processing by the oil industry, reducing its idle capacity and supporting global demand for oils and flours; the closing of gaps would lead to a much-needed export rebound.”

What factors generate this gap with Brazil?

They explained that they are many factors that show the divergence of yields of the last decades between Brazil and Argentina. “There is no doubt that the climate impact and the rainfall dynamics of each harvest is decisive when analyzing the productive yields of any crop at any given time. However, the use of seeds and the application of technology through multiple developments is one of the key elements when it comes to structurally analyzing the productivity of the agroindustry. Scientific works show that A certain genetic gain was maintained in the country but of lower value than in Brazil, which also had a genetic leap with changes promoted by Argentine companies, according to information provided by Acsoja,” they explained.

In this regard, they said that the higher disposable income of the “Brazilian producers have been able to increase their investments in technology to levels higher than those of Argentine value chains.” Among the many reasons for the latter, “The absence of export duties in Brazil already gives Brazilian production an advantage in disposable income over Argentine production.”

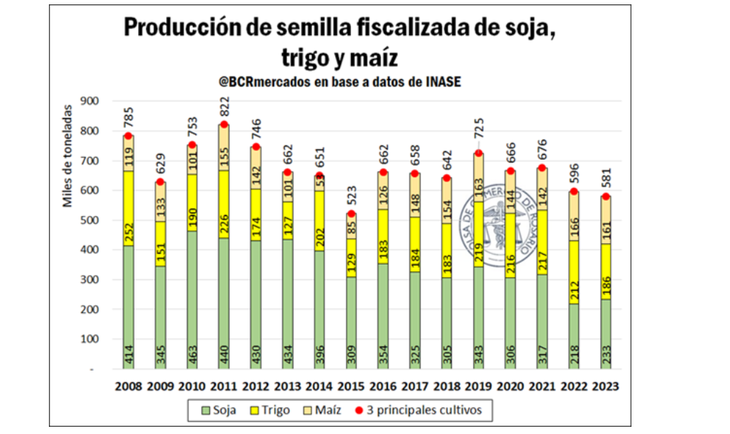

“Consequently, This improvement in disposable income resulted in high investment volumes in the neighboring country, with emphasis on research and development in genetic improvement. In the case of soybeans, one of the data that accounts for this is the registration of new soybean varieties, which in 2023 reached an all-time high,” they commented in the Rosario organization.

“With 337 new events registered, Brazil crowned four consecutive years of growth in soybean variety registration, according to data from its Ministry of Agriculture and Livestock (MAPA) provided by Acsoja. Not satisfied with this, Brazil has been consolidating a volume of registrations far above Argentina, a trend that has been shown since 2011,” they said.

In this sense, according to data from Acsoja, “Brazil has three times more than Argentina in soybean genetic improvement programs.” “Not satisfied with this, with more average investment per program, Brazil doubles Argentina’s number of biotechnology events. The 1997 Brazilian Cultivar Protection Law was relevant in this regard, generating protection through certification and guaranteeing the breeder’s intellectual property of the seed,” they said.

bcra111.png

“The seed sector has had special importance for the productive dynamics of soybeans in Argentina. The increase in agricultural efficiency and the strengthening of defense against diseases, insects and herbicides in the fields, thanks to the development of technological packages, has the seed as an essential input for agriculture. Innovations arising from advances in biotechnology and conventional seed breeding are essential to support production. Furthermore, and as has been pointed out in due course, the main beneficiaries of these developments have been the producers.” they added.

In conclusion, for the BCR, “The persistence of export duties and potential improvements not applied in terms of the recognition of intellectual property are limiting this Argentine productive growth.”

Source: Ambito