Through the General Resolution 5548/24 published in the Official Gazette, It was decided that the obligations may be fulfilled until the following dates:

- CUIT ending in 0, 1, 2 and 3. Filing of DDJJ: 09/18/2024; payment of the resulting balance: 09/19/24.

- CUIT ending in 4,5 and 6. Filing of DDJJ: 09/19/2024; payment of the resulting balance: 09/20/24.

- CUIT ending in 7, 8 and 9. Filing of DDJJ: 09/20/2024; payment of the resulting balance: 09/21/24.

- The same deadlines will apply to the Cedular Tax (financial income).

On the other hand, the AFIP established the obligation of special entry of an amount on account of the aforementioned taxes for those who choose to file their tax returns and pay their taxes on these dates. The amount will be determined by applying 40% on the basis of the calculation of the advances for the 2023 fiscal period, with some exceptions. This obligation must be fulfilled on time. between August 26 and 28according to CUIT ending.

cuit.PNG

Objectives of the extension of the filing of DDJJ

According to AFIP, various entities representing professionals in economic sciences raised the need for additional time for the complete preparation of tax returns.

“Tax administration reasons make it advisable to grant requests from entities to safeguard tax revenues, in order to facilitate taxpayers and responsible parties in fulfilling their tax obligations,” explained the agency headed by Florencia Mirashi.

AFIP: how the payment of “special income of an amount on account” will be made

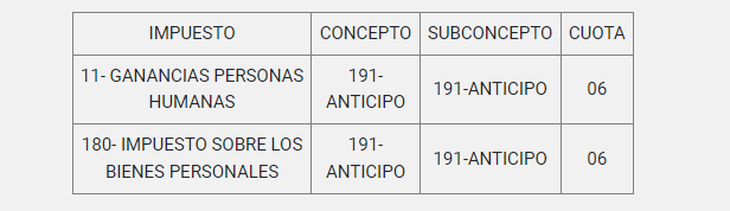

The payment of the “special income of an amount on account” and, where applicable, of compensatory interest and other accessories will be made through the electronic funds transfer procedure via the “Internet” and must be imputed to the 2023 fiscal period and the following tax codes must be used:

payment1.PNG

For the payment of interest and other accessories, the relevant sub-concept codes must be selected when generating the Electronic Payment Slip (VEP).

He Electronic Payment Voucher (VEP) generated can also be cancelled by reading a quick response code “QR”. The “special payment of an amount on account” cannot be cancelled by credit card.

When they consider that the sum to be paid will exceed the final amount of the obligation, They may choose to make the payment on account for an amount equivalent to the result of the estimate that they practice applying the current procedure for reducing advances.

The differences that arise between the sums entered in use of the option and those resulting from applying the corresponding percentages on the actual tax for the fiscal year or the amount that should have been advanced if the option had not been used, whichever was less, will be subject to the payment of compensatory interest.

Facilities Plan

The balance of the sworn statement may be regularized by means of the Permanent Payment Facilities Plan As provided in AFIP General Resolution 5321/2023, if the adhesion is made in the schedule of dates set for the “special payment of an amount on account” – from August 26 to 28 – the payment of the latter will not be necessary.

If you submit the affidavit during the month of August, pmay adhere to the plan without the application of the time restriction provided therein (from the first day of the month in which the payment obligation is due until the last day of the fifth month immediately following). The fees for plans that are accepted during the month of August will expire –exceptionally- from the 16th of October.

It is important to clarify that Those who do not regularize their assets in the Asset Regularization Regime, They may make the declaration of the option to join and make initial payment of the REIBP until the dates established to make the special payment of an amount on account.

Source: Ambito