In this context, EcoGo, the consultancy firm run by the much-heard Marina Dal Poggettopointed out in a report the weaknesses of the Government’s economic plan, particularly with regard to the exchange rate restrictions, and awaiting the “miracle of a friend“such as that of Donald Trump in the United States and his intervention before the International Monetary Fund (IMF) so that Argentina could obtain fresh funds.

The economic plan under the magnifying glass of From Poggetto

Caputo insists that the crawling peg at 2% monthly and the blend are maintained at all costs and that, with a projected primary fiscal surplus of 1.7% of the Gross Domestic Product (GDP) for the year, there is no fiscal dominance.It does not matter that, with a country risk of 1,550 basis points (bps) and a Central Bank (BCRA) without dollars, questions arise about the financial program”, EcoGo analyses.

According to Caputo’s statement at the meeting with Alycs, “the Government has secured the payments of the debt in dollars for the next year and a half.” In detail, he mentioned that it has the dollars for the payment of interest in January (which, by the way, has not yet been transferred to the trustee), that the capital coupons will be paid with a repo (although at these bond prices it is not intuitive given the level of guarantees involved; that is why they are testing using a portion of the gold from the Reserves as part of the guarantees, which they have begun to transfer in installments to London), and that the payments in July of next year will be made with a trade surplus (in agriculture and energy) and the dollars will be purchased by the BCRA with a fiscal surplus.

EcoGo.png

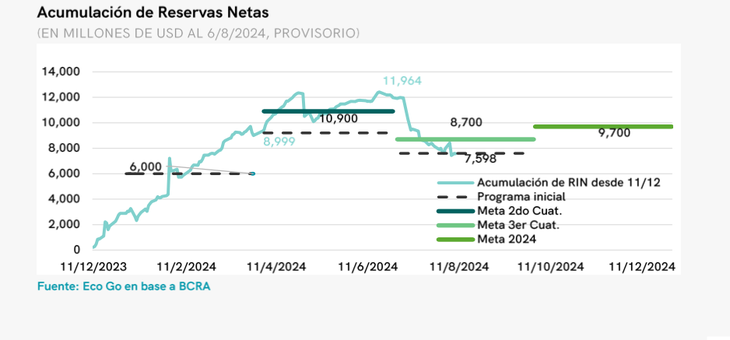

The government has used between US$350 and US$650 million to fill the gap since the beginning of July, EcoGo warns.

“However, in real life, the situation contrasts with a country risk of 1550 bps and a BCRA that has stopped buying dollars.loses reserves (the negative reserves according to the IMF methodology are US$4.3 billion) and has used between US$350 and US$650 million to intervene in the gap since the beginning of July,” the document warns.

He added that the fall in accumulated reserves so far in the third quarter exceeds the amount agreed for the entire quarter with the IMF. Failing to meet the goals, of course.

For the consultancy, with a clampthe peso market begins to “price” that the economic program will reduce inflation to 3% per month. The implicit rate in the bond market is consistent with an annual inflation of 113%, even if this implies slowing down tariff increases (with the fiscal downside of higher subsidies), lower the PAIS tax (with the fiscal counterpart of lower income), limiting the payment of imports in installments (with the counterpart of lower purchases by the BCRA), and using the dollars that are necessary to reduce the gap (with the counterpart of using reserves that do not exist).

“This is done while trying to ensure that wages beat inflation and credit is expanded to the private sector, encouraging a jump in imports that are not financed in a context of exchange rate lag and reduction of the PAIS tax,” he says.

Trump’s helping hand

In the context of the US elections, in which the Government is excited about a possible arrival of Donald Trump to the White House and, as has happened in the past, intervene before the Fund for unlock cool backgrounds For Argentina, EcoGo maintains that: The change of government in the US is not until January 20, by which time, if this scheme is maintained, net reserves could reach negative US$10 billion after the January payment”, so having that letter is “economic shamanism” to put it in the words of the president.

The consultancy warns that the situation could be “somewhat less negative“If the government manages to implement the repo for US$1 or US$2 billion, negative reserves would be US$7.8 billion at the end of December.”Even with Trump as president, an agreement with fresh funds does not seem intuitive given the stock of debt that the country has already contracted with the IMF.becoming the main debtor of the organization. It is worth remembering that the current agreement expires at the end of the year and that the payment of amortizations begins only in 2026,” he says. Added to this is the fact that next year US$3 billion in interest is due; if the surcharges are modified, the bill could fall to US$1.7 billion.

And for now, the IMF’s logic is to look for a program that accumulates reserves, and that does not happen in the scheme “Follow Follow“, starting from a multilateral real exchange rate that in December 2024 would be only 10% above the levels prior to the devaluation of December 2023, with a blend scheme that sends 20% of exports to the CCL. According to our numbers, if this scenario is configured, the Current Exchange Account would go from a surplus of US$2.8 billion in 2024 to a deficit of US$19.8 billion in 2025, which represents 2.6% of GDP.

EcoGo raises two converging scenarios maintaining the cepoas he believes that “the Government will not take the risk of breaking the rules in an election year when the priority is to lower inflation and is part of a BCRA balance sheet with negative reserves, while the cleaning up of the pesos was done by increasing the Treasury debt with very short maturities.”

In both scenarios, the commitment to fiscal consolidation prevails, reaching financial equilibrium next year, which is not intuitive compared to the elimination of the PAIS tax. The interest bill is somewhat higher in the first scenario due to the greater increase in the debt in dollars contracted. In both cases, all refinancing of the debt in pesos within the cepo continues to be done with instruments that capitalize or are issued with a zero coupon.

Scenario 1: “Keep going, Trump saves us”

For this to work, fresh disbursements of at least US$20 billion are required to finance the foreign exchange gap generated by the exchange rate delay scheme, the blend and the new payment schedule for imports in installments. The BCRA would reduce the crawling peg to 1% per month in 2025, trying to control inflation, which would close the year at around 29% per year.

Reservations.png

In the last two months, the BCRA stopped being a net buyer in the official exchange market and slowed down the accumulation process of the first months.

Wages would grow above inflation in the first few months and would be partially eroded towards the end by the acceleration of inflation. The monetary policy interest rate would remain somewhat above inflation and well above the crawling peg, putting pressure on debt stocks. In this scenario, the multilateral real exchange rate would end up at the levels prior to the jump-start and barely above those of December 2001.

The exchange rate gap would be managed with intervention, but would worsen towards the end in the face of post-election corrections. 2025 would end with negative reserves of almost US$9 billion, exchange rate lag and more debt. All this in the context of the fact that, unlike in 2019, Trump’s new investment would work to validate the election result and stabilize the bond market. In this scenario, the economy would grow by 5% and unemployment would fall slightly compared to 2024 levels.

Scenario 2: “Corrections with the IMF”

It includes a 40% jump in January (bringing the exchange rate to the post-PASO level of August 2023, when Sergio Massa devalued), the elimination of the blend, a crawling peg closer to inflation and a slightly positive interest rate. The timing of the correction, if it occurs, It will depend on the timing of the agreement with the bank of last resort.

“Logically, inflation starts higher, although the transfer of the devaluation to prices is more limited than in the initial jump in a context where the remaining tariff increases are smaller and the monetization of the deficit has slowed down,” says EcoGo.

“As we have been saying from the beginning, for this to work, the country risk needs to be reduced. That is to say, in addition to the commitment to fiscal consolidation, a viable financial program must emerge that allows for a reduction in dependence on capital controls. For now, the local market is resting on its laurels, hoping that the gap remains contained with the dollars from the Money Laundering and Personal Property Tax, while it patiently waits for Trump to win, the escalation in volatility to moderate, and the disinflation scenario to be validated,” the document concludes.

Source: Ambito