The main consultants and banks in the city updated their forecasts for the main variables of the economy, which were reflected in the Market Expectations Survey (REM)published this Thursday by the Central Bank. The report leaves much to be desired: Inflation estimates for August rose and fell for the following four months (still far from the 2% monthly that the Government wants)the forecasts for official dollar They accommodated themselves to the follow-follow exchange rate reaffirmed by Luis Caputo, while GDP decline projections worsened resulting from the sharp recession.

City analysts slightly raised their estimates Inflation estimates for August. The median of the forecasts was located at 3.9%that is to say, 0.1 points more than in the previous surveyIf such a figure is confirmed, the consumer price index (CPI) would remain very close to the 4% of July, reflecting the resistance to the slowdown experienced by inflation. The official data will be published by INDEC next Wednesday.

As the last four months began, the REM forecasts did indeed fall back compared to the previous survey carried out by the BCRA, probably influenced by the retrogression of the PAIS tax rate from 17.5% to 7.5%. Thus, For both September and October, a monthly CPI of 3.5% is expected; for November, one of 3.3%; and for December, a rebound to 3.6%. However, market projections are still in the far from the 2% per month that the economic team wants to achieve quickly before moving on to the next steps in your plan.

image.png

Thus, the median of inflation forecasts for the cumulative 2024 were reduced by 4.75 percentage points to the 122.9%. Although the top 10 best forecasters of this variable predicted that the year will close with 123.7%.

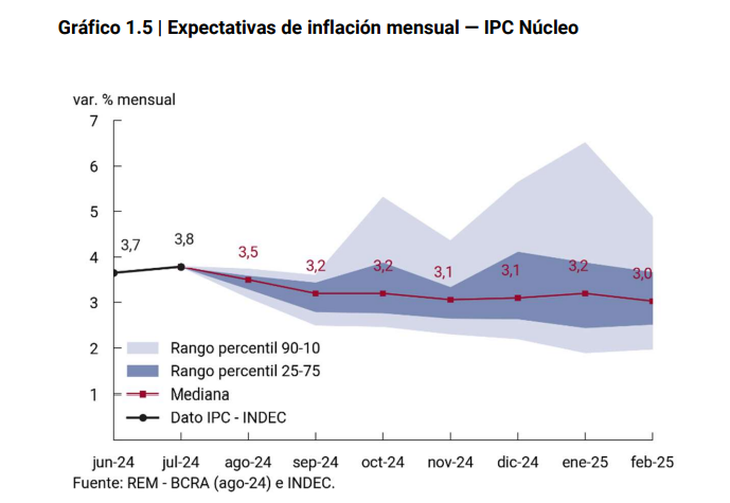

Regarding the core inflation (which excludes seasonal and regulated prices), the group of REM participants placed their forecasts for August at 3.5% and for September at 3.2%. In addition, he projected that will remain above 3% monthly from now until at least February. Also above the 2% monthly that the Government yearns for.

image.png

August REM: What will happen to the official dollar?

Although slower than in previous months, the reduction in inflation expectations is in line with the progressive alignment of the projections that City analysts make for the official dollar with the message of continuity of the crawling peg which Caputo permanently deploys.

This was observed in the cut of the Forecast for the official exchange rate for the end of the year. In the last REM the respondents had located the wholesale dollar at $1,088.20 for December and in the survey published this Thursday they projected it at $1,025.40This level is already very similar to the $1,016 that the Ministry of Economy included in its advance payment for the 2025 Budget project mid-year.

“The year-on-year variation as of December 2024 implied by the forecasts was 59.7% (9.8 percentage points less than the previous REM),” the BCRA said in its report.

In addition, he noted that “the median of the REM’s nominal exchange rate projections stood at $961.9 per dollar for the average of September 2024, which would imply an average monthly increase of 2% in the exchange rate,” coinciding with a possible continuation of the current crawling peg rate.

Recession: GDP forecast worsens

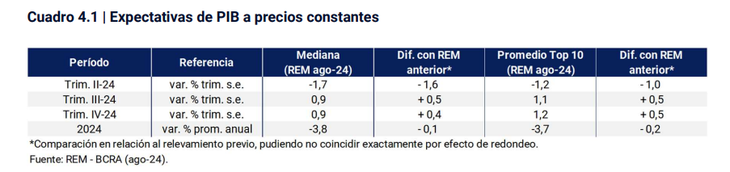

On the other hand, regarding the real economy, the Central Bank’s survey reflects a deteriorating prospects for an exit from the recession. It turns out that REM participants anticipated that Real GDP will fall 3.8% this year year-on-year. In the last survey they had predicted 3.7%.

image.png

“The decline would have been concentrated in the first half of the year. According to the forecasts received, the level of activity would begin to recover in the third quarter of the year, with a 0.9% increase without seasonality. For 2025, the group of REM participants estimated an average growth of 3.5% year-on-year,” the BCRA said.

In this context, the rate of unemployment The open survey for the second quarter of this year was estimated at 8% of the Economically Active Population, the same level as in the previous survey. For the Top 10, the unemployment rate would be 7.8% in the same period (+0.1 percentage point in relation to the previous REM), indicated the monetary authority. The group of REM participants expects an unemployment rate of 8.1% for the last quarter of 2024.

REM: other projections

Beyond the variables mentioned, the REM also left other relevant projections:

- Slight increase in the BADLAR rate to 39% TNA in December

- Total exports in 2024: US$77,857 million (US$663 million more than the previous survey)

- Annual imports: US$59,163 million (US$652 million more than the previous survey)

- Annual trade surplus in goods of US$18,694 million (US$11 million more than the last REM)

- Primary fiscal surplus of the Non-Financial National Public Sector of $7.8 trillion for 2024 ($445 billion higher than the previous REM)

Source: Ambito