According to some analysts, the idea of achieving a Convergence between the official dollar and financial versions due to the fall in the price of free dollarsinstead of an official raise, is beginning to be considered as a possibility. It is no longer 100% disposable.

Everything is linked to the statement made by the Minister of Economy, Luis Caputo, on the social network X, where he published a list of things that will happen in the coming months. It is a appeal to have faith in the program.

In fact, the speeches that the number two of the economic team has been giving, Secretary of Finance Pablo Quirnoin the last meetings with businessmen in which part of the participants recognized that still the program does not have sufficient credibility. He acknowledges that the word of the Ministers of Economy “is devalued” andin Argentina due to the constant failures of economic policy.

At the moment, it would seem that The team at the Treasury Palace appeals to the idea that we must believe based on the results seen so far, But the distrust of analysts and markets persists not so much because of the numbers that are seen but regarding how they were achieved and whether they are sustainable.

Closing the gap above

In that sense, for the alyc Personal Investment Portfolio (PPI) “what was unthinkable a few months ago is slowly starting to become more likely.” This is what is called “closing the gap from above.”

Remember that Caputo listed in his X account some of the things that are already happening in the economy and that will be strengthened in the coming months. “What caught the most attention: the financial dollar will converge with the official dollar. There was no mention of a possible end to the currency controls,” says PPI.

“Closing the gap from above” It is not the base scenario of the market. Precisely, he expects that the convergence will occur from the official to the CCL, which in factThis would result in a discrete jump of 35.8% so that the exchange rate gap disappears today,” the stock exchange company maintains.

caputoenX.png

However, he says that despite this, “Caputo has already given signs that the chosen path It could be the least expected.”

“The reduction of the COUNTRY tax rate from 17.5% to 7.5% goes in this direction. With the measure, the effective exchange rate of imports considering the cost of coverage fell by 8.4%,” adds PPI. It also maintains that “although this widened the spread with the CCL from 11.4% to 21.3%reduced the differential with the official one from -18.8% to -11.4%.”

Fiscal anchor in doubt

For example, one of the numbers Supposedly more solid than the government shows are those that correspond to the “fiscal anchor” which is the heart of the program, since the fiscal deficit is attributed to the origin of inflation.

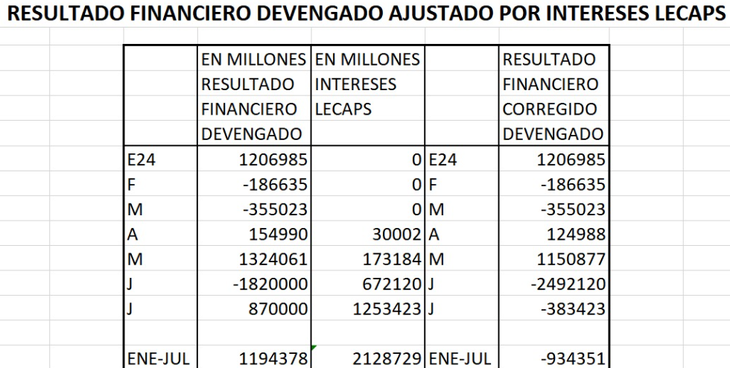

In this regard, the economist Roberto Cachanosky questions the numbers presented by Caputo to reach the surplus: “The financial deficit is greater than that published monthly.” “The reason is that they do not include in the interest the interest accrued by the LECAPS.

lecaps-interests.png

This means that In the first 7 months of the year there was no accrued financial surplus of $1.2 billion but there was a financial deficit of $934,351 million,” says Cachanosky.

The liberal economist points out that “in the seven months, four had a financial deficit and three had a surplus” while “the cumulative total for the first seven months is negative.”

Will the ceiling continue to drop?

The remaining approach The next few weeks will determine whether the market will be fully convinced by the economic team’s call to faith.and if he sees a decline in financial markets.

The market analyst Christian Buteler recalls that “the dollar is approaching $1,250 again, a price it has already bounced off three times at the end of July and in mid- and late August.”

“Will it rebound again?” he asks. In the week that just ended, it is true that the official dollar was close to those levels. It is the threshold to be surpassed for Caputo’s forecast to come true.

Will there be dollars in 2025?

The consulting firm Quantum warns that There is nothing in the background that suggests that Argentina will have dollars to pay its debts next year. of bonds and with organizations.

“Going forward, the seasonality of exports and the gradual lifting of some of the exchange rate restrictions on the current account would tend to generate a greater loss of reserves in the last part of the year,” he warns.

The report states that “the Government is seeking, through money laundering and obtaining external financing, to reverse the trend and accumulate reserves, in addition to generating conditions to encourage the entry of private capital, which is already showing good dynamism in access to financing in 2024.”

“As an additional comment, in 2025 the government faces agricultural campaign prices that would be less favorable than this year and “gross principal and interest payments of USD 15 billion (of which USD 5 billion are interest payments to the IMF)”the study says.

In principle, the government would need return to voluntary markets to refinance maturities, something that should happen in the next few months according to the IMF staff reports of the latest reviews. To do so, it must Raise the value of global bonds and close the gap, something that is not happening precisely because the government is having a hard time convincing foreign investors to have faith that the economy will be fine next year.

Source: Ambito