The chimerical task that represents the ambitious goal of achieving carbon neutrality, as for example proclaimed by the European Union for 2050 with its European Green Deal or China by 2060has finally welcomed the development of the “nuclear alternative” for the production of energy.

It has been seen that the limited generation capacity of renewable sources and the high global demand for electricity has imposed a renewed look at the nuclear power. In this context the nuclear power is back in the ring, this time and given the circumstances as the great saviour that will accompany renewables in the transition towards a generation without carbon emissions.

The turning point for the assessment of the nuclear source has undoubtedly been the war in Ukraine, which by putting the normality of the gas supply in crisis has given the necessary push for the return of atoms. The first step was taken by the European Commission, putting on the agenda at the end of 2021 the consideration of the nuclear power as green at least until 2045 and ratifying that status the following year. Then the gas restrictions to Europe from Russia, the increases in the price of fossil fuels and the most recent instabilities in the Middle East have ratified the need to “recover” nuclear energy.

The dimension of this change in the assessment of nuclear energy is based on the historical events that have weighed on the matter. The nuclear accident in Fukushima (Japan) in 2011, caused by a tsunami, meant a shock to the consideration of atomic energy, which had already generated distrust since the disaster of Chernobyl (USSR, 1986): both accidents, beyond their unique characteristics, fueled people’s perception of the apocalypse and pushed the governments of many countries not only to dismiss an escalation in the development of this industry but even to take many nuclear plants out of active service. While nuclear energy came to represent more than 15% of the world’s electricity generation in 2006, its production currently only reaches 10% of the global electricity matrix.

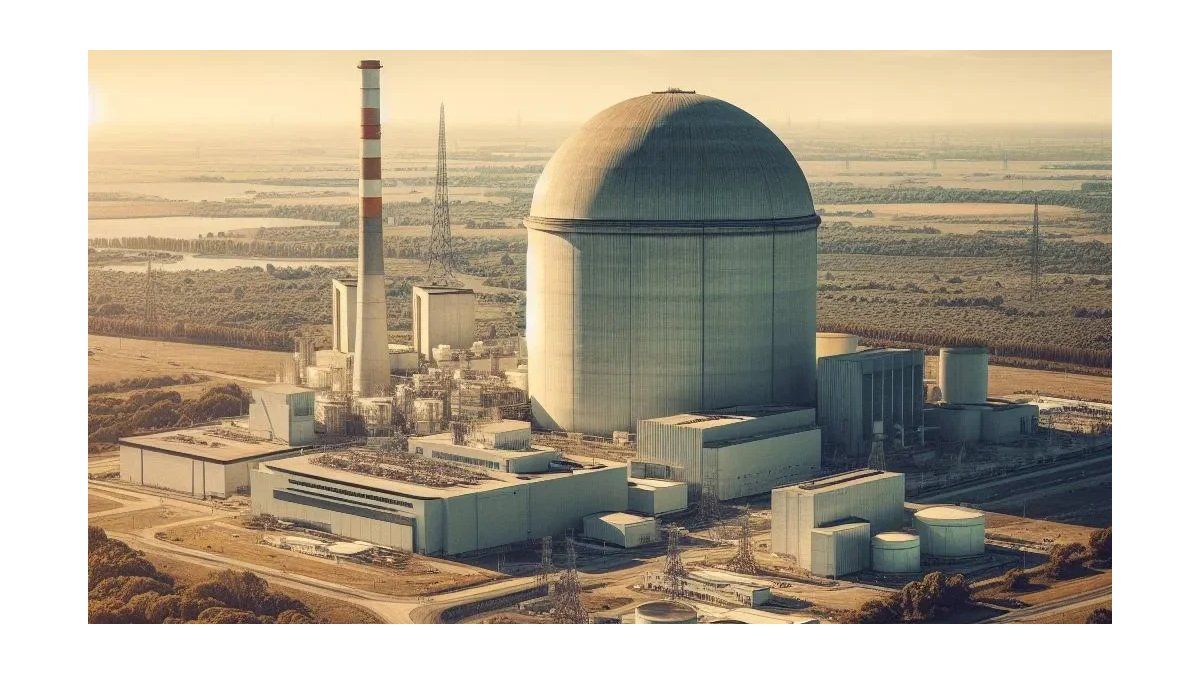

nuclear energy.jpg

Pixabay

With the success of Fukushimainfluential core nations such as Japan and Germany have given nuclear power the thumbs down. The Germans went from obtaining more than a quarter of their total electricity from the supply of 17 nuclear reactors in 2011 (133 TWh – terawatts) to shutting down their last 3 operating units in April 2023. With a total national consumption of 480 TWh, the Germans had to resort to deepening the use of coal until reaching 30% of that total (179 TWh). In Japan, which in 2011 covered 30% of its electricity demand from its nuclear reactors, this source of generation was reduced until it represented only 6% of the total electricity supply in 2019.

Beyond the cases mentioned, both the United States and China remained expectant after Fukushima in terms of scaling up their nuclear projects. The balance began to weigh more in favour of both countries in favour of recovering and increasing their atomic production capacities when energy demand and prices became more pressing. Both nations tacitly recognise that maintaining global preeminence requires having sufficient, technologically sovereign energy sources of their own that can sustain a projection of power.

These movements, eminently geopolitical, confirm the early view of investors: technological projects on nuclear fusion and fission are receiving strong consideration from venture funds, and Investments in the atomic industry throughout the nuclear fuel cycle are bullish (buyers), from uranium mining to final waste disposal. As an example, we mention that a recent prospective study carried out by the Crunchbase platform on investment in nuclear projects, places the contributions of more than US$3.4 billion. venture capital to finance nuclear technology, both that related to atomic fission and fusion.

Today we find a series of firms and projects that are more highly regarded than in years past, developing modular nuclear reactors and/or researching and technologically seeking the possibility of making nuclear fusion a commercially viable alternative. Companies such as Terra Power, General Fusion and NuScale Powerwhich have obtained more funding and more time to achieve their goals: as an example, behind Terra Powera firm based in Washington State (United States), includes Bill Gates and the South Korean chaebol SK Groupfinancing the development of Natrium, A new technology for small modular reactors (SMRs)with a generating capacity of 345 MW (megawatts) – traditional reactors in the United States produce around 1,000 MW. It is also worth noting that China has been the first to begin commercial activities of an SMR in December 2023, by inaugurating a 200 MW modular plant in Shandong province.

In this segment of the technological market, Argentina has an opportunity. Among the countries that are accompanying this SMR development route, we can highlight Russia, China, France, the United States, Canada, South Korea, the United Kingdom and Argentina, in the latter case with a plant under construction: the CAREM reactorlocated adjacent to the Atucha power plant.

The Argentine Central of Modular Elements (CAREM) has been in development since 1984, when its concept was presented during a conference of the International Atomic Energy Organization -IAEA-; it remained on standby until 2006, when it was relaunched within the Argentine Nuclear Reactivation Plan, seeking the construction of a prototype of a low-power fourth-generation nuclear plant: 32 MwCivil works began only in 2014, progressing slowly. The reactor is now expected to be operational between 2028 and 2030.

WORK-CAREM-AUG2022_DJI_0378.JPG

Taking this into account, It is auspicious the recent announcement of a partnership between the firm INVAP and the National Atomic Energy Commission (CNEA) to jointly explore opportunities for exporting the reactor CAREM and spur the project. On the other hand, The announcements of disaffection are alarming of public funds from the National State for the completion of the prototype, which, by all accounts, is an excellent opportunity to develop wealth-generating capabilities based on high technology, which can translate into higher levels of social well-being for Argentina.

It is worth highlighting in this regard that the country is part of a small club of nations in the world with technological capabilities in the nuclear field, and this is a very relevant asset in view of the global objectives of decarbonisation and expansion of energy sources, increasingly in demand by a world that consumes more and more each year. It would be very damaging to Argentina’s projection as a middle power if the current political noise were to throw overboard the work already done, especially considering the opportunity that is presented for the Argentine nuclear industry.

Director of ESPADE. Member of IRI-UNLP.

Source: Ambito