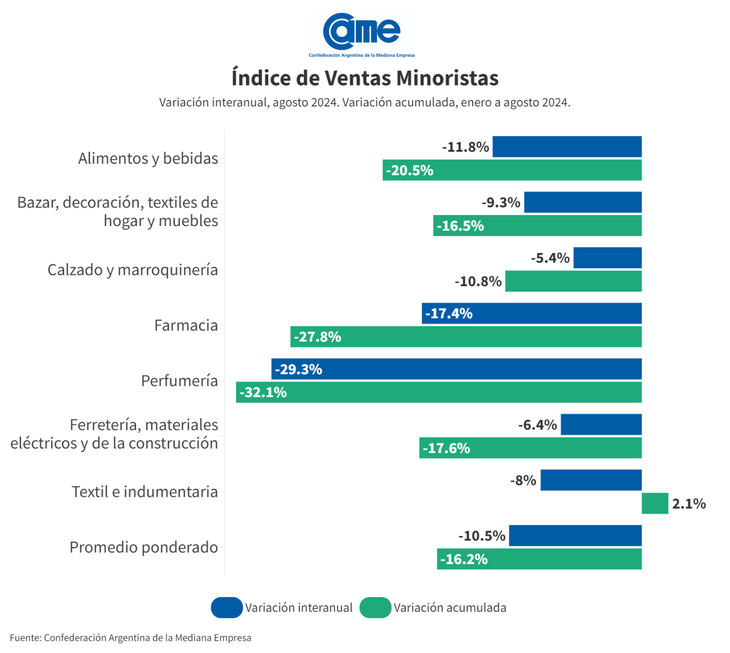

The SME retail sales fell 10.5% year-on-year in August at constant prices, and have accumulated a decline of 16.2% in the first eight months of the year. In the seasonally adjusted monthly comparison, they fell 1.6%.

The retail commercial activity of SMEs maintains a marked downward trend despite the greater supply of financing and the incipient resurgence of personal loans. Declines on credit card purchases Lack of a “limit” was another notable feature of commercial activity this month.

In the analysis by category, All seven sectors evaluated experienced declines compared to the same period last year. This is according to the SME Retail Sales Index of the Argentine Confederation of Medium-sized Enterprises (CAME), prepared based on a monthly survey of 1,300 retail businesses in the country, conducted from August 2 to 6.

unnamed.png

Consumption still has not recovered

SME sales: sector-by-sector analysis

In August, the Seven sectors surveyed registered year-on-year declines in sales. The largest annual decline was detected in Perfumeries (-29.3%), followed by Pharmacies (-17.4%). In the year-to-date, the largest decline was also recorded in Perfumeries (-32.1%) and Pharmacies (-27.8%).

Sales fell by 11.8% year-on-year in August, at constant prices, and have accumulated a drop of 20.5% in the first eight months of the year, compared to the same period in 2023. In the inter-monthly comparison, they fell by 1.8%. It was a difficult month for commerce, which in large consumer centers had to compete with very aggressive offers launched by the main hypermarket chains, which got rid of stocks with early expiration dates.

- Bazaar, decoration, home textiles and furniture

Sales declined by 9.3% annually, always at constant prices, and have dropped by 16.5% in the first eight months, compared to the same period in 2023. In the inter-monthly comparison, they fell by 0.4%. Stores expressed great concern that activity is not picking up and operating expenses have increased week by week.

Activity fell by 5.4% annually in August and has accumulated a fall of 10.8% in the first eight months of 2023, always compared to the same period last year. In the inter-monthly contrast, it fell by 1.2%. Children’s Day activated sales for a few days and then consumption flattened out again. In the stores consulted, it was commented that even the sales had to be very strong to arouse interest. Some did 2×1 combining a current season shoe with an old season one.

Sales fell by 17.4% at constant prices, and amounted to a decline of 27.8% in the first eight months of the year, compared to the same period in 2023. In the inter-monthly comparison, they fell by 1.9%. Pharmacies indicated that in August drug prices continued to rise significantly, complicating sales.

The decline was 29.3% at constant prices, to accumulate a fall of 32.1% in the first eight months, compared to the same period in 2023. In the inter-monthly comparison, the decrease was 2.8%. The sector is very compromised by including mostly products that are not essential. In the perfumeries consulted, they expressed that, in the case of personal care products, it is noticeable that people dose more and try to space out the purchase between product and product.

- Hardware, electrical materials and construction materials

A 6.4% drop in August, with a 17.6% drop in the first eight months, compared to the same period last year. In the inter-monthly comparison, they fell by 0.4%. There was a little more movement in the sector, especially in the hardware and construction materials sector, where large and small projects were activated, with a greater number of purchases than in July, but for smaller amounts. The offer of interest-free installments of up to 24 months contributed to this increase.

Sales fell 8% year-on-year in August at constant prices, but still accumulated an increase of 2.1% in the first eight months of the year compared to the same period in 2023. In the inter-monthly contrast, they declined 2.6%. There were many price decreases, especially in branded clothing, and sales with discounts of up to 60% that boosted sales. However, in the final balance, although many stores noticed more people buying than in July, turnover was lower even at current prices. Children’s Day boosted demand in many stores, although the date still ended below last year (-12.5%).

unnamed (2).png

The biggest drop was in the Perfumery category

Source: Ambito