The speech he made Javier Milei This Sunday in the Congress It turned out to be a signal to creditors that the only thing guaranteed is the primary surplus to pay the interest on the debt in 2025 and not the presentation of a Budget detailed. Beyond the fact that the difficulties shown by the economic program are centered more on the lack of dollars than on the fiscal aspect, the market welcomed the wink. Many economists considered that the project later sent to Parliament has a spirit similar to the presidential speech. The text itself, in addition to the classic optimism of the macroeconomic projections, It raised a number of questions and triggered numerous warnings about inconsistencies between the outlined scenario and the income and expenditure guidelines.

The signs range from forecasts of inflation from 18.3% year-on-year by the end of 2025, implying a monthly average of 1.4%, to the dubious engines for a rebound of the Gross Domestic Product (GDP) of 5%. Since the mismatch of the doubling of what is collected by withholdings with estimated exports and the exchange rate table until a rebound in activity that does not match the imports expected.

“The budget project has been deceptive from the start,” said a report by the consultancy firm Outlierdirected by Gabriel Caamano Gomezand stated: “In addition to the expected excess of optimism in macroeconomic projections, The consistency of the macroeconomic scenario itself and its relationship with the budgetary forecasts is very low, if not almost non-existent.”

Budget and waste of optimism?

In dialogue with Scope, Harold Montaguformer Deputy Minister of Economy and current Chief Economist of Vectorialfocused on the 18.3% monthly inflation budgeted for two reasons. On the one hand, he pointed out that “such low inflation is striking, especially considering that August was 4% when less was expected and so far in September the first data indicate that it will be at least above 3% and there are still planned increases in rates and other services.” “The 104% they are targeting for 2024 is already striking, and the 18% for 2025 is even more striking”argument.

image.png

On this point, Outlier highlighted a kind of project blooper. The 18.3% accumulated inflation for next year is equivalent to an average monthly CPI of 1.4%. For 2024, the Budget foresees an accumulated inflation of 104.4%: for that to happen, a monthly average of 1.2% would be needed in the last four months; and if September were 3%, in the fourth quarter it would have to average less than 1%. “The project It would seem to predict that the inflation rate will accelerate slightly in 2025 compared to the end of 2024, which is contradictory”the report stressed. The Treasury Department is hiding behind the fact that the macroeconomic scenario included in the project was drawn up last June and that today they are forecasting a somewhat higher CPI for this year.

On the other hand, Montagu highlighted that this inflation pattern for the next fiscal year is consistent with a projection of devaluation of the equivalent official exchange rate (wholesale dollar at $1,207 at the end of 2025): “We are going to a appreciation difficult to sustain in this framework without reservations”.

In the City, this was largely read as a kind of tacit ratification of the continuity of the stocksFor now, the text does not include any reference to exchange control or to a unification of the dollar, something that Outlier also noted: “The whole issue of exchange rate flexibility is the great omission”.

About 5% real growth of GDP projected for 2025, there were also complaints. “It is not clear who the drivers will be”the Vectorial economist said. What does the official message say? That it will be driven mainly by industry and commerce, with increases of 6.2% and 6.7%, respectively, while agriculture will advance only 3.5% after an extraordinary 2024 compared to a drought in 2023. “The text says that it will boost industry, but industry has been falling by double digits year-on-year every month, so it is not clear,” added Montagu.

image.png

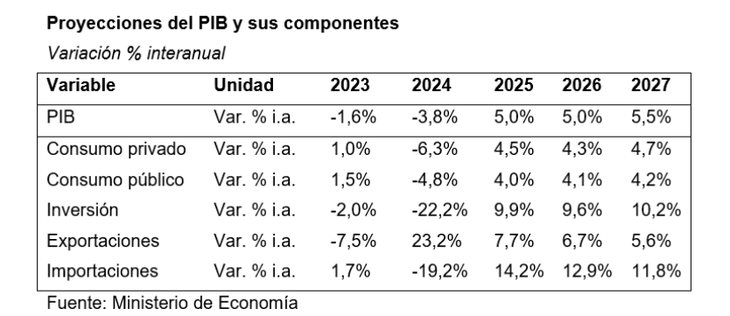

As for GDP components, the official scenario predicts that private consumption will grow by 4.5% (after falling by 6.3% in 2024); public consumption, by 4% (after falling by 4.8%); investment would rebound by 9.9% after sinking by 22.2% this year; exports would rise by 7.7% in quantity and 9% measured in foreign currency; and imports would rebound by 14.2%.

At that point it appears One of the main inconsistencies pointed out by various economists. “A strong recovery of economic activity is projected in 2025 (+5% in real terms), after a 3.8% drop in 2024 (this assumption is slightly more pessimistic than the local consensus). However, the balance of goods and services is hardly affected, falling by only US$1 billion, with export values slowing down and imports accelerating. But the acceleration of the latter seems too low, especially considering that a strong recovery in investment is projected for 2025,” said Outlier.

Along the same lines, Fundar’s director of Productive Planning, Daniel Schteingartrescued a striking fact. “The budget shows that Argentina would have a higher GDP in 2025 than in 2023, but imports of almost US$10 billion less. How can this be explained, especially considering the ongoing trade opening? It doesn’t make sense,” he asked on his X account. To which he later added: “It occurs to me that part of it may be due to: 1) fewer energy imports due to the ripening of Vaca Muerta, 2) fewer imports of soybeans, which in 2023 were high due to the drought. Still, even so, The numbers don’t add up”.

“It seems that we are heading towards a regime of import substitution industrialization. Peronism at its finest,” said another economist consulted by this newspaper.

Are incomes doubled by withholdings?

The point that generated the most commotion among analysts was the income scheme budgeted for next year. Not only because, with the exception of the COUNTRY TAX (which will not be renewed) and Personal Property (the tax paid by the richest would collect 22% less than this year due to the benefits approved in the fiscal package), in the rest the tax burden will increase. In particular, the doubling of the collection by withholdings from one year to the next aroused all the suspicions.

A report from the consulting firm Epycawhich directs Martin Kaloshe said: “The biggest increases would be in the single tax (which would triple from one year to the next), fuels (155% increase), export duties (which would double). This last piece of information is curious: With an average increase of 23% in the official exchange rate and a 9% increase in the value of foreign sales of goods and services, why would the amount collected in export duties double?”.

Outlier highlighted the same “inconsistency” and noted that “something similar occurs with the import tariffssince with a 15% growth in imported values and an adjustment of the official exchange rate by 18%, it is projected to collect 50% more in nominal terms.”

The Government assures that the unusual jump in withholdings foreseen responds to factors that go beyond the projected macro variables. “The change in the payment terms of export duties and the soybean dollar caused the collection of export duties of 2024 leave one low comparison basegiven the higher payments in 2023. This affects the year-on-year variation expected in 2025,” he explained. Martin Vauthieradvisor to Luis Caputo and BICE official.

However, one of the interpretations circulating among economists from different sectors is that the Government is seeking to endorse the Budget with a zero deficit fiscal rule, but without establishing a clear roadmap on how this would be achieved. Outlier summed it up as follows: “The Milei administration shows that it is neither willing nor interested in engaging in this discussion, thus ensuring a considerable discretion on the matter. Probably, as happened this year, because he knows that many decisions will be made on the fly.”

Source: Ambito