Byma and Nasdaq continue to advance infrastructure and technology to simplify the architecture of post-trade services.

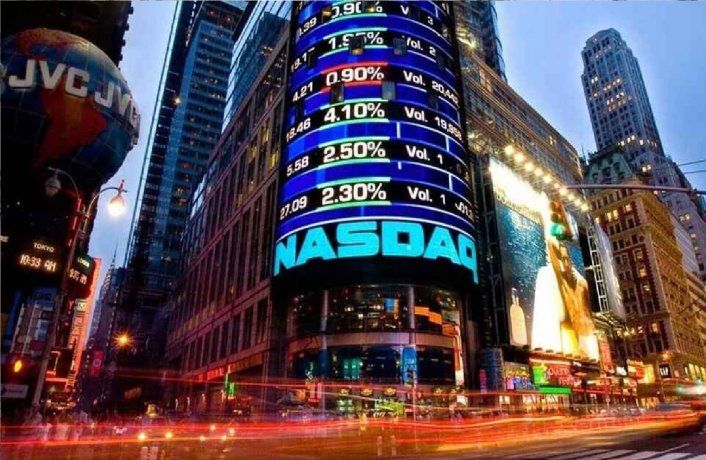

Nasdaq (Nasdaq: NDAQ) and BYMA (Nasdaq: BYMA), Argentina’s leading stock exchange, announced a major expansion of its technological association which will allow BYMA to base its entire ecosystem of post-trade services on Nasdaq technology.

The content you want to access is exclusive for subscribers.

With this new agreement, BYMA will adopt Nasdaq’s IT platform for its settlement and risk systemknown internationally as clearing. This is a technological milestone, as the trading cycle can be carried out end-to-end with world-class technology, which allows essential services for market activity to be offered with greater agility, scalability and security. Trading and custody, which complete market activity, are already carried out on leading technological systems.

Benefits of implementation

- Overall, the platform enables BYMA to improve the speed, capacity and connectivity of its post-trade services network.

- Incorporation of technological tools for real-time risk control, which introduce new functionalities.

- Improving the digital experience for all market participants. The settlement and risk system will be able to rapidly scale up its capacity during periods with higher transaction volumes. Its modular architecture also offers BYMA the flexibility to launch new products and services with much shorter timeframes.

- Optimizing collateral management for the benefit of all market participants.

- Strengthening BYMA’s current infrastructure as a provider of essential services for the operation of market activity.

nasdaq

With Nasdaq technology, BYMA’s current infrastructure is strengthened as a provider of essential services for the operation of market activity.

The project will be carried out collaboratively by teams of professionals from the local Stock Exchange and Nasdaq.

Magnus Haglind, Senior Vice President, Market Technology, Nasdaq, said: “Market operators globally are navigating a range of market reforms, tighter regulations and increasingly complex operating environments. Nasdaq is playing a critical role in helping to simplify the architecture of post-trade services, providing operators with the technology to respond to new challenges, to take advantage of new market opportunities and to scale as they grow. capitalize on a new wave of innovation. The consolidation of BYMA’s post-trade services provision through the Nasdaq platform demonstrates another major step forward in the growth and development of the Argentine market.”

In this regard, the President of BYMA, Ernesto Allaria, He confirmed: “We are taking a pioneering step in the local market, which seeks end-to-end integration of the entire operating cycle in a system with standards of the most evolved markets “Our goal is to provide participants with the opportunity to conduct their business on leading platforms. We welcome this new step in our strategic partnership with Nasdaq.”

For its part, the CEO of BYMAGonzalo Pascual Merlo, said: “This incorporation together with a world-leading strategic partner such as Nasdaq reconfirms our commitment to innovation to transform investment into work and development. In a context of significant market growth, our priority is to build the basic infrastructure that will drive Argentina’s economic growth. We understand the role that the Capital Market plays in this objective and for this reason we provide scalable and efficient systems that allow the investment and financing needs of Argentines to be met.”

Source: Ambito