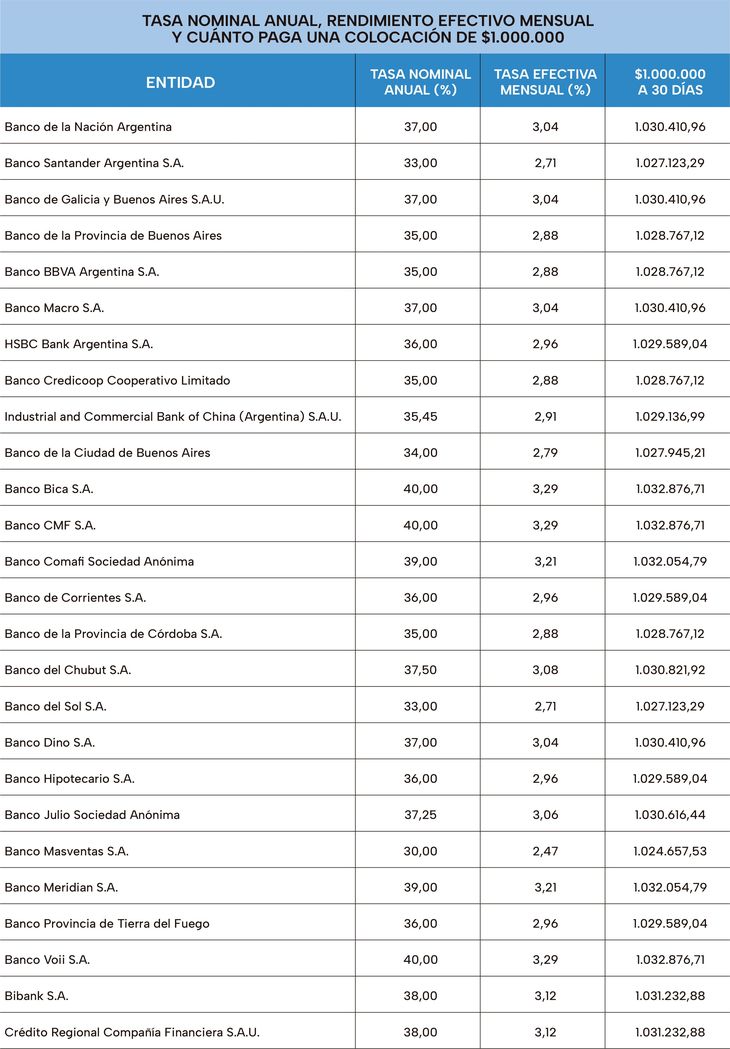

The Central Bank publishes the interest rates offered by 25 public banks on a daily basis. This way, savers can choose where to invest.

Currently, a fixed-term deposit yields around 3% at 30 days.

Depositphotos

Some banks and other entities that offer to invest in deposits fixed term Interest rates have improved, and with inflation falling, they have become a more tempting and safer option. At the moment, the highest paying loans are 40% per year.

The content you want to access is exclusive for subscribers.

The Central Bank publishes the interest rates offered by 25 public banks on a daily basis, allowing savers to choose where to invest. It is worth remembering that it is not necessary to have an account and be a client of an entity to be able to open a fixed-term deposit.

Currently, a fixed-term deposit yields around 3% at 30 days. Thus, a saver who deposits $1,000,000 will earn around $30,000 after 30 days.

The bank that raised its fixed-term deposit rate the most was HSBC, with 5% compared to the beginning of August, raising the Annual Nominal Rate (ANR) to 36%. This implies an effective monthly rate of 2.96%. Thus, a saver who deposits $1,000,000 will receive $1,029,589.04 after 30 days.

fixed-term[1].jpg

How much do virtual wallets pay?

The rate hike also impacts the returns offered by the remunerated accounts of digital walletswhich are mainly linked to money market mutual funds or fixed-term funds.

Ualá is the one that offers the highest performance with an APR of 45%, followed by Naranja X (42%) and Mercado Pago (37.6%).

Source: Ambito