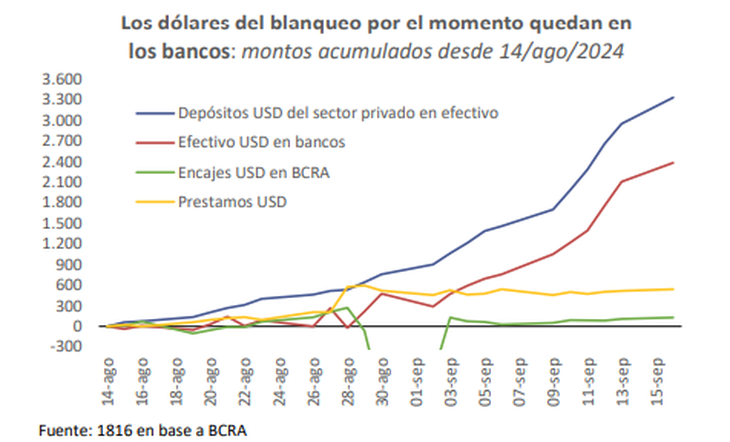

The externalization of funds will have little impact on net reserves, although a positive effect on gross reserves is expected. However, this has not yet materialized.

In recent weeks, Adherence to money laundering has accelerated. This was reflected in the growth of deposits in dollars in the financial system: they rose US$3.337 million Since August 14thThe expectation was that asset regularization, beyond having almost no impact on net reserves, would help improve the level of gross international holdings of the Central Bank. However, so far, that has not happened. During this period, gross reserves fell by US$442 million. after closing this Thursday at US$27.129 million. What is the reason?

The content you want to access is exclusive for subscribers.

The Dollar deposits exceeded US$22 billion this weekthe highest level since 2019. The driving force behind the growth is the strong adherence to money laundering that was recorded, above all, during the last few days. In particular, the impact is on the cash declarations which had remained off the AFIP radar until now.

In the asset regularization process enabled in the Fiscal Package that was approved together with the Bases Law, a first stage was established that will be open until September 30. It is in this stage that cash can be declared.

A few days before the closing of this first tranche, various officials went out to encourage support through social networks. They emphasize that amounts below US$100,000 and above can be laundered free of charge, as long as they are kept within the system until the end of 2025 and with the possibility of investing them in a wide range of financial and productive options.

The truth is that in recent days the income from money laundering has actually increased. For example, Banco Nación reported that it is already opening an average of 1,000 WAX beads (Special Account for Asset Regularization) per day and estimates that it could exceed 10,000 openings that I had originally anticipated.

Why has money laundering not yet affected reserves?

In any case, the increase in dollar deposits by US$3.337 million It has not yet been reflected in the long-awaited improvement in gross reserves.For the Government, this is a key issue: with negative net reserves of more than US$5 billion, it is seeking to achieve a bridge that will give it greater room for maneuver through an increase in gross international holdings to sustain its exchange rate scheme.

image.png

What happened then? A report by the consulting firm 1816 indicated that, according to official data, in the same period the lace (which is the part of the deposits with a direct impact on the reserves) rose only US$128 million.

“What we see so far is that Banks are leaving the new dollars deposited in the branches (instead of depositing them in the BCRA)perhaps while waiting to see what percentage of the laundered cash will remain in ‘argendollars’ starting in October,” said 1816. It turns out that people who have laundered up to US$100,000 will not have to wait until the end of 2025 to withdraw their money without penalty; they will be able to do so starting October 1.

This is happening to such an extent that, since mid-August, Cash holdings in bank branch vaults grew by more than US$2 billion and exceeded for the first time in the entire series (which begins in 1996) the US$6.2 billion.

Once the process is refined, it will be necessary to see how much of that money is sent as a reserve to the BCRA. That amount will have a correlation in the coffers of the monetary authority in gross terms. In addition to the little that is collected by the 5% penalty (given the wide possibilities offered to avoid it), The other way in which it could have an impact on net reserves is that, eventually, a part of it is lent to companies since local bank loans in foreign currency must be settled on the official market.

Source: Ambito