The currency front remains the most problematic for the sustainability of the plan. Luis Caputo. Although, in recent days, the Central Bank has gotten some air from its side Gross international holdings: in the last two rounds, they grew by US$1,488 million. Although there is still no updated official data to confirm this, analysts link the movement to the fact that Banks began to send to the BCRA a part of the dollars from money launderingwhich until now were kept in the branches.

In parallel, the buyer performance of the monetary authority in some rounds. In particular This Tuesdaywhen it was made US$191 million in the official square, a movement that awoke Speculations in the City.

In addition to the limited demand for foreign currency in the official market, some operators linked the data to an attempt by officials to reduce the distance that separates them from meeting the goal of net reserve accumulation agreed with the International Monetary Fund through a Boosting dollar loans to companies through helping hands: As Ámbito reported, as of last week they were missing more than US$2 billion to meet the quarterly target. In any case, This Wednesday the BCRA resumed sales.

Money laundering, reserves and deposits

Without drawing up a clear roadmap regarding the exchange rate restrictions, Caputo has been trying for some time to convince the market that his exchange rate scheme is sustainable. Logically, doubts have always been about the lack of foreign currency. For example, Net reserves are now negative by more than US$5 billion. Although its impact on the BCRA’s net position is expected to be limited, The Government bet on money laundering as a way to get oxygen in gross holdings and try to build a bridge during the most seasonally unfavorable months of the year.

During the last 40 daysthe inflow of undeclared money into the capital regularization plan accelerated and prompted a Increase in dollar deposits of more than US$7 billionThis occurred, above all, in what was to be the final stretch of the first stage (in which cash can be laundered) that was to conclude on September 30, but which was finally extended for a month. This Monday alone, deposits in US currency grew by US$1.085 billion. Until now, however, these revenues have not materialized in the BCRA’s coffers.: Since August 15 until that day, gross reserves had fallen by US$71 million.

In addition to debt payments, intervention on financial dollars and other factors, this was due to the fact that The banks retained in their branches most of the banknotes received through money laundering instead of sending them to the BCRA. The laces (the minimum cash portion that entities must leave immobilized from deposits due to precautionary regulation) had barely moved in that timeMarket sources explained that banks preferred to keep high liquidity in branches due to doubts about how many people would go to withdraw the regularized dollars starting October 1.

According to the sources consulted, some of this began to move in the last two rounds. Although there is still no updated official data that allows comparing the factors, the Recovery of almost US$1.5 billion of gross reserves during the last two days seemed to respond to an increase in reserve requirements. “Banks began to send part of the laundered dollars to the BCRA”he told Scope a foreign exchange operator.

image.png

A report by Personal Investment Portfolio (PPI) The US dollar broke down the movements of this Tuesday, the day in which gross reserves increased by US$893 million: US$84 million corresponded to the currency swap with China due to the appreciation of the yuan, US$4 million to the holdings of special drawing rights (the “currency” of the IMF), US$56 million to the rise in the price of gold, US$21 million to purchases of foreign currency in the official market on Monday (they impact with a lag wheel) and US$728 million did not have a clear explanatory factor. And they mentioned that the latter It could have been due to an increase in reserves.

“The sharp jump in private sector dollar deposits as a result of money laundering was not translating into an increase of equal magnitude in reserves or loans. Banks opted to keep cash in branches. As a reference, private sector dollar deposits rose by US$5.942 billion between August 15 and September 20, while reserves barely increased by US$153 million and loans and others by US$541 million. On the other hand, cash in branches rose by US$4.901 billion in the same period. Without official data from yesterday, we believe that banks may have started sending dollars to the BCRA to deposit them,” said PPI.

“Banks were hoarding a lot of dollars in branches because they were afraid of October 1,” a City consultant told this newspaper, referring to the possibility that from that date on there will be a lot of withdrawals of laundered currency. His hypothesis is that, a few days before the end of September, Possibly the entities were exceeding the regulatory limits of liquidity in branches and they transferred it to the BCRA so as not to exceed the monthly average.

If confirmed, this will have no impact on net reserves since the reserves are actually dollars from depositors, although it will still provide liquidity to the BCRA to operate in the foreign exchange market.

Purchase, IMF, loans and helping hands?

There is another game being played by the Government at this time. With just a handful of rounds left until the end of the third quarter, is far from reaching the reserve target agreed with the IMF for the end of September. As of Monday, it was more than $2 billion below the level necessary to meet the commitment to accumulate US$8.7 billion since December 10.

According to analysts, beyond the over-fulfillment of fiscal and monetary objectives, everything was heading towards a order of waiver (exemption) for the foreign currency front in the tenth review of the current program. The last disbursement of US$550 million depends on the approval of the third quarter goals. Although the audit corresponding to the previous quarter (in which all quantitative objectives were met) for another US$530 million is still pending, Caputo suggested last Friday in the Rosario Stock Exchange the possibility of unifying both reviews in search of accessing a total of almost US$1.1 billion. There has not yet been any news on this matter.

With that open front, The magnitude of the purchases made by the BCRA this Tuesday drew attention on the official market: US$191 million. Although the situation was not repeated on Wednesday (Central sold US$30 million) due to the usual higher demand at the end of the month, speculations arose in the City.

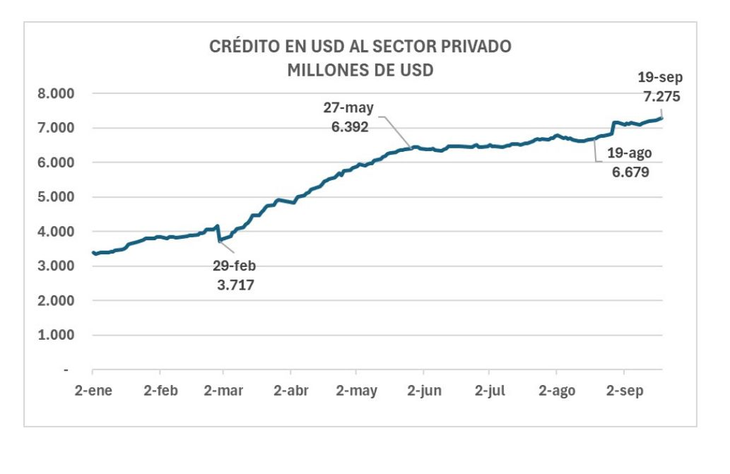

“Part of the improvement in the pace of purchases in recent days is likely to come from a reactivation of dollar credit to the private sector.. Since a month ago, since dollar deposits began to grow more vigorously due to the money laundering, the demand for credit in dollars has been reactivated after two and a half months of stagnation. From August 19 to September 19 (last official data) credit in dollars to private individuals grew by about US$600 million. This apparent supply helped the BCRA to remain neutral in the foreign exchange intervention during that period,” said a report by Aurum Values for its customers.

image.png

By regulation, The currencies that companies obtain through financing from local banks must be settled in the official market, which increases the supply. Thus, they appear as net reserves “lent” to the BCRA since when the credit expires the firm will look for the dollars to return them to the lending entity.

Along these lines, two market sources consulted by Ámbito considered that the purchase could respond to “Tricks to minimize friction with the IMF”. “As there are plenty of deposits and the banks are quite comfortable, they are apparently encouraging loans in dollars. They have room to mark reserves and to set up loans in foreign currency through friendly banks or friendly companies“, one of them said.

If so, The sales balance on Wednesday seems to show that it is still very difficult to reverse the red in the reserves target in the few rounds that remain. However, the other source said that we must be attentive to what happens between Thursday and Monday: “Asking for a waiver for $100 million is not the same as asking for one for $1.5 billion.” Even more so considering that the main discussions with the Fund are about the level of the dollar, the currency controls and the monetary scheme, in view of the negotiations for a future program (with which Caputo intends to obtain new debt to support his plan) that have not yet formally begun.

Source: Ambito