For the first time in the current administration, in August the demand for dollars to pay for imports exceeded the value of purchases actually made throughout the month. The data comes from the Exchange Balance, which the Central Bank published this Friday, and accounts for the increasing pressure on scarce reserves. In fact, the next three months will mark the peak of import payments.

The report of BCRA reflected that the Importers accessed the exchange market for a total of US$5,024 million in August, 23% above the same month of the previous year. This value exceeded imports of FOB goods (free on board) of the month, which were US$4,541 millionwhich “would indicate a reduction in commercial debt or a decrease in external assets,” according to the entity that presides Santiago Bausili.

This implies that Payments for the month represented 110% of purchases abroad of the period. Until now, the access fee to the official dollar that the BCRA had planned had led to a progressive growth of that ratio but always less than 100%.

In fact, during the summer months, this scheme (which initially gave access in four monthly installments of 25% of the imported value for most of the goods) was one of the keys that allowed the BCRA to make large purchases in the MULC. and rebuild reserves. In December, only 17% of foreign purchases had been cancelled; in January, 23%; in February, 41%; and in March, 60%.

image.png

The ratio was growing to the extent that the quotas corresponding to imports made in the previous months overlapped. In April 70% was paid; in May, 79%; in June and July they were around 90% and 95%; and by August they exceeded 100%.

“Of the total payments for imports of goods observed in August in the exchange market, a 96% were carried out on a deferred basis2% as demand payments and the remaining 2% in advance,” stated the monetary authority report.

And he added: “Import payments from most sectors during the month of August showed an interannual increasehighlighting the Automotive Industry, Chemical Industry, Rubber and Plastics, and Commerce sectors, with increases of 109%, 91% and 44%, respectively. The exceptions were the Oilseeds and Cereals and Base Metals and Processing sectors, whose payments fell by 43% and 18% year-on-year, respectively.

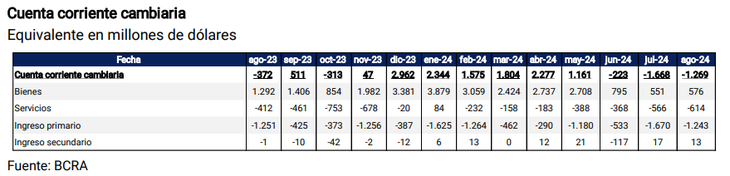

In parallel, the Export charges totaled US$5.6 billion last month. Therefore, the surplus of the goods account was barely US$576 million for the BCRAa number similar to that of July but much lower than that of the first semester (which reached peaks of US$3,879 million in January). It is worth remembering that 20% of exports are settled in the CCL due to the blend dollar, which is why the bulk of the trade surplus registered by the INDEC ends up going to the financial market and does not enter the reserves.

image.png

Reservations: challenging months ahead

However, the real complication will come in the next balance sheets. In August, a flexibility in the terms of access to the official dollar for the payment of imports began to take effect.which was reduced to two 50% installments at 30 and 60 days.

This will cause the payment versus import ratio to jump in the September-November quarter since in those months 25% quotas corresponding to the old scheme will overlap with 50% quotas corresponding to the new one.

Although the effective level will depend on the dynamics of imports actually realized in the different months, in theoretical terms (that is, if the level of purchases remained constant) In September, 125% of what was imported would be paid; in October, 150%; and in November, again 125%. This will imply extra pressure on the BCRA’s reserves, which in net terms are already negative by more than US$5 billion.

In October there will be an additional factor. Since the rollback of the PAIS tax ratemany companies postponed imports that were scheduled for August until the following month. As the first installment of these purchases will be paid after 30 days, it is expected that in the tenth month of the year there will be that additional boost.

Source: Ambito