As the stock market looks to maintain its momentum after a strong session, investors are preparing for a key week marked by important economic data and the start of earnings season on Friday.

Wall Street stays afloat this Wednesdayas investors look to spin off the gains from the previous session. The S&P 500 rose 0.7%, while the Nasdaq Composite fell 0.2%. The Dow Jones Industrial Average rises another 120 points, or 0.5%.

The content you want to access is exclusive to subscribers.

US-listed Chinese stocks faced difficulties as investors took profits from the recent stimulus-driven recovery. China-based indices closed lower, with China’s Shenzhen recording its worst day since 1997. The iShares China Large-Cap ETF fell 2%. Elsewhere, Boeing lost 3% after union negotiations ended without an agreement and the company withdrew its contract offer.

Wall Street: the data analyzed by the market

Wall Street is coming off a strong session driven by tech sector gains and declining oil prices.

These moves appear to reflect growing optimism that the Federal Reserve can navigate toward a soft landing, especially after last week’s jobs report showed continued strength in the labor market.

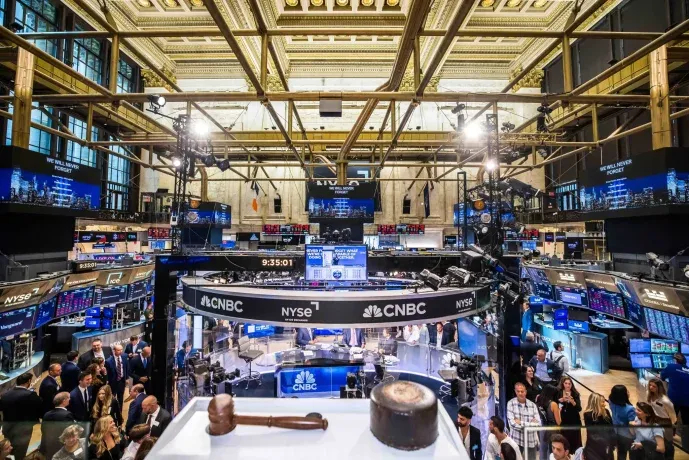

wall street markets NYSE.jpg

Wall Street is coming off a strong session driven by gains in the technology sector and declining oil prices.

NYSE

Even with an underlying bullish trend, the market could face more volatility in what is historically the most volatile month of the year, especially ahead of the US presidential election.

On the economic front, investors anticipate the latest minutes of the Fed meeting on Wednesday, which will be published at 3:00 p.m. Argentina. Consumer and producer price index readings for September will be published on Thursday and Friday , respectively.

Earnings season begins Friday with big banks JPMorgan Chase and Wells Fargo.

Source: Ambito