The monetary base contracted again in real terms in October. Yes ok The Central Bank issued money to face the important foreign currency purchases to the private sector in the official exchange market and there was expansion due to the limited percentage of renewal of debt maturities in pesos from the Treasury at the end of the month, the bulk of that money was reabsorbed through the increase in the stock of Liquidity Fiscal Letters (LEFI) held by banks and the sale of dollars to the Government.

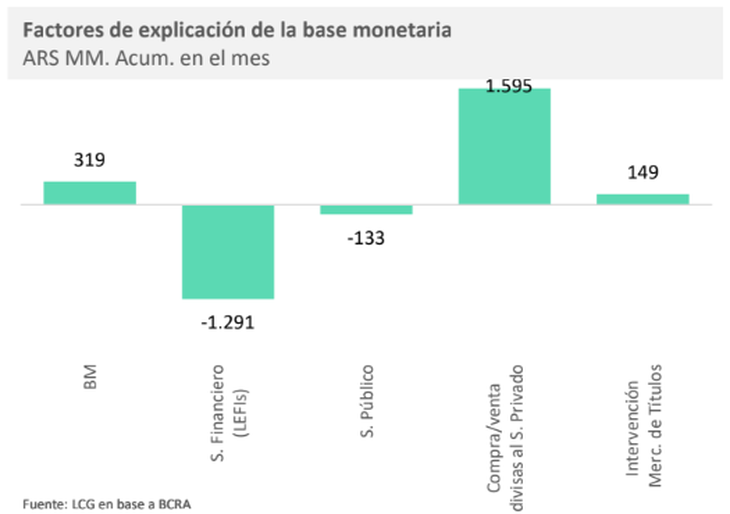

The result of the movements was a increase in the monetary base of $319,240 million throughout October, according to official information from the BCRA. This implied a nominal increase of 1.4%. Measured In real terms, there was a contraction of 1.2%, the consulting firm LCG calculated.

Yet, if compared against October 2023the base (which includes the circulating money and the balance of the current accounts that financial entities have in the BCRA) shows a real growth of 10.6%. This expansion responds to the process of disarmament and elimination of the Central’s paid liabilities, which culminated in July.

In any case, the $22.7 billion it had at the end of last month is equivalent to 3.5% of GDP. This is a historically low level, although higher than the first part of this year after the remonetization that occurred around mid-2024.

image.png

Factors of contraction and expansion of the monetary base

During October, The main factor of monetary expansion was the extraordinary purchase of US$1,530 million from the private sector by the BCRAdriven by the liquidation of loans in dollars and the issuance of negotiable obligations by companies (in both cases strongly driven by money laundering) and also by exports from the agricultural sector. The “carry trade” incentive fed back into that dynamic. Thus, BCRA dollar purchases involved a monthly issuance of $1.6 billion.

LCG explained that most of those pesos were deposited in the banks, who increased their stock of LEFI, which operated as a contractive factor of the base. $1.2 billion were absorbed in this way. Likewise, the direct intervention of the BCRA in financial dollars (included in the “Others” factor of the monetary authority’s data sheets) contributed to a limited contraction of $148,573 million.

Regarding the operations of the public sectorimplied a slight contraction of $133,000 million. It happened that, on the one hand, the base expanded by $987,000 millionamong other things, due to the non-renewal of all month-end maturities of the debt in pesos of the Treasury (Economy offered only indexed bonds and suspended the placement of Lecap). But, on the other hand, the Government began the purchase of the US$2,701 million to guarantee in advance the payment of the January capital amortization to the bondholders of the 2020 exchange, which involved the sterilization of $1.1 trillion during October.

image.png

At the same time, there was some recovery in the demand for money. In the case of currency, it reversed the fall of September and rose 1.3% monthly in real terms, as calculated by LCG. The consulting firm analyzed: “This corresponds with the forecasts of downward inflation, with expectations of having barely broken the 3% floor for this month. Along the same lines is the increase in M3 (which includes time deposits) of 2.1% real monthly. On the contrary, M2 showed a fall in real terms of 1.2%, reflecting the fall in demand deposits.”

Perspectives after the BCRA rate cut

The question is what will happen going forward after the Central Bank reduced (for the first time since May) the monetary policy rate, taking it from 40% to 35% nominal annually. “We do not believe that this will alter the scenario, since the monthly rate (2.9%) is in line with this month’s inflation forecasts. The M3 will remain stable or increase, even despite this decline. The decline in inflation will surely consolidate the demand for currency, although we do not expect substantial changes,” LCG considered.

Finally, the consultancy projected that “this level of neutral rates in real terms will be maintained to the extent that tranquility continues in the exchange market, which will also depend on what the future balances of foreign trade and tourism are like.”

Source: Ambito