The Bitcoin marks a meteoric rise after the vote count in the US that ended in favor of Donald Trump. As Ámbito anticipated, so much The cryptocurrency market and the stock market reacted to an increasesince these binary events rarely stop the long-term trend, on the contrary, the result can boost it.

According to available data, Bitcoin surged following previous election cycleswith 42% the month following the 2020 elections and an increase of 336% six months later. Similarly, BTC posted gains after the 2016 and 2012 elections. He S&P 500 It also shows a trend that is already typical after presidential elections, a pattern that has proven consistent over recent decades.

In this context, the latest report of Standard Charteredthe London-based banking giant, maintains that the Republican victory “is the best scenario for digital assets”, since involves regulatory changes and other adjustments. So the financial institution estimates that “this will boost the total market value of this asset class to $10 trillion by the end of 2026, from $2.5 trillion currently.”

It is worth remembering that After the strong rise in Bitcoin, the cryptocurrency displaced silver in the ranking of assets by market capitalization and he was a few million dollars away from doing so with the Arab kingdom’s oil company, Saudi Aramco. If Standard Chartered’s projection is correct, as of today, The crypto market is on track to far exceed the market cap of Nvidia and Apple togetherthe most valuable companies in the world by financial back to today’s sun.

Bitcoin: what is the bank’s projection

The financial colossus maintains that that increase in market capitalization “would benefit all digital assets; those with the greatest exposure to end-use cases would reap the greatest benefits,” such as Bitcoin, Ethereum and other cryptocurrencies.

The document states that The Republicans took “almost total” power in the US, since a victory for Trump in the Lower House seems very likely, “which we take as our base case.” It indicates that a “sweep” would allow the new administration to promote policies supporting digital assets shortly after taking office in January 2025, in line with the president-elect’s campaign promises.

Standard Chartered.jpeg

Standard Chartered’s projection on the cryptocurrency market is optimistic.

“We hope several positive developments for the asset class at the start of the administration: regulatory changes (including the repeal of SAB 121 and stablecoin regulations) and changes at the Securities and Exchange Commission (SEC) that would lead to a stance laxer on digital assets. “The new administration could also consider a Bitcoin reserve; although we see this as a low probability event, it would have a significant impact,” the bank maintains.

And, as he explains well José Luis del Palacioco-founder of Decryptoin dialogue with ScopeBoth the international stock markets and the crypto market are in an upward process that is already more than confirmed. “The trend for 2025 is bullish. It is likely that we will see Bitcoin be worth double, triple, it doesn’t matter how much, but the trend is not going to change,” he maintains in line with the bank’s analysis.

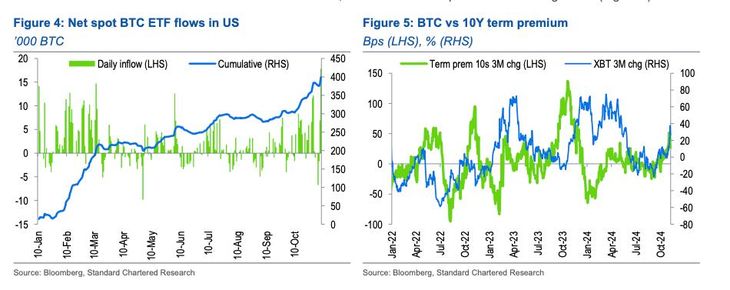

A no less important fact that Del Palacio highlights is that the ETFs They were consolidated and are now listed on the US stock market. “This means that large investment funds, such as JP Morgan, BlackRock and Platinumthey already have exposure to these products,” he points out. For the crypto expert, this is key because “they are not funds that come and go within 24 hours. They take a large position with many millions of dollars when they are thinking about the medium term, that is positive for the market and for the ecosystem, “because they are not people who speculate in the short term”

Price for Bitcoin according to Standard Chartered

The bank is conclusive in pointing out that it reiterates His current target for Bitcoin towards the end of 2025 is around $200. 000 and US$10,000 for Ethereum (ETH). He also warns that digital assets more exposed to end uses are likely to benefit the most; in particular, “we hope that Solana outperforms both BTC and ETH“says the bank.

About the crypto summer

The bank determines that, with the Republican victory in the US election, “it is now a real possibility” that the crypto summer has begun. “Over the next two-year period we foresee a similar increase in digital asset prices (in percentage terms) as in 2021. As in 2021, existing digital assets are likely to see price increases and new sub-sectors emerge; this time , real-world use cases are finally shaping up to become mainstream,” the report adds.

Thus, driven by these trends, the financial giant estimates that Total market capitalization of digital assets increases to $10 trillion by the end of 2026. By then, he also anticipates that Bitcoin’s share of the total digital asset market capitalization will fall to just over 40% from the current 60%.

Standard 1.jpeg

Standard Chartered’s projection on the cryptocurrency market is optimistic.

The bank is optimistic that The new administration in the US continues the Trump campaign’s proactive approach to digital assets. Additionally, the changes are likely to be made “relatively soon to take advantage of Republican control of Congress ahead of the midterm elections in November 2026,” another driver for the crypto market.

Thus, aligned with this impulse, Bitcoin and other cryptocurrencies are expected experience an increase in capitalization, although with a possible decrease in Bitcoin’s participation in the total market driven by the incoming administration in the US: the scenario seems without a ceiling for the crypto market.

Source: Ambito