Federal Court of Justice ruling

Unacceptable bank fees – what do customers get in return?

Copy the current link

Increase account fees without the active consent of customers? The BGH has already banned banks and savings banks from doing this in 2021. Now it was a question of how far reimbursement claims would decline.

Many consumers pay monthly account management fees for their checking accounts. If your bank or savings bank wants to increase fees, it must first obtain active consent from customers. In the past this was not always the case. Not for the first time, the Federal Court of Justice (BGH) is strengthening the rights of customers in the dispute over inadmissible bank fees. What it was all about this time in Karlsruhe:

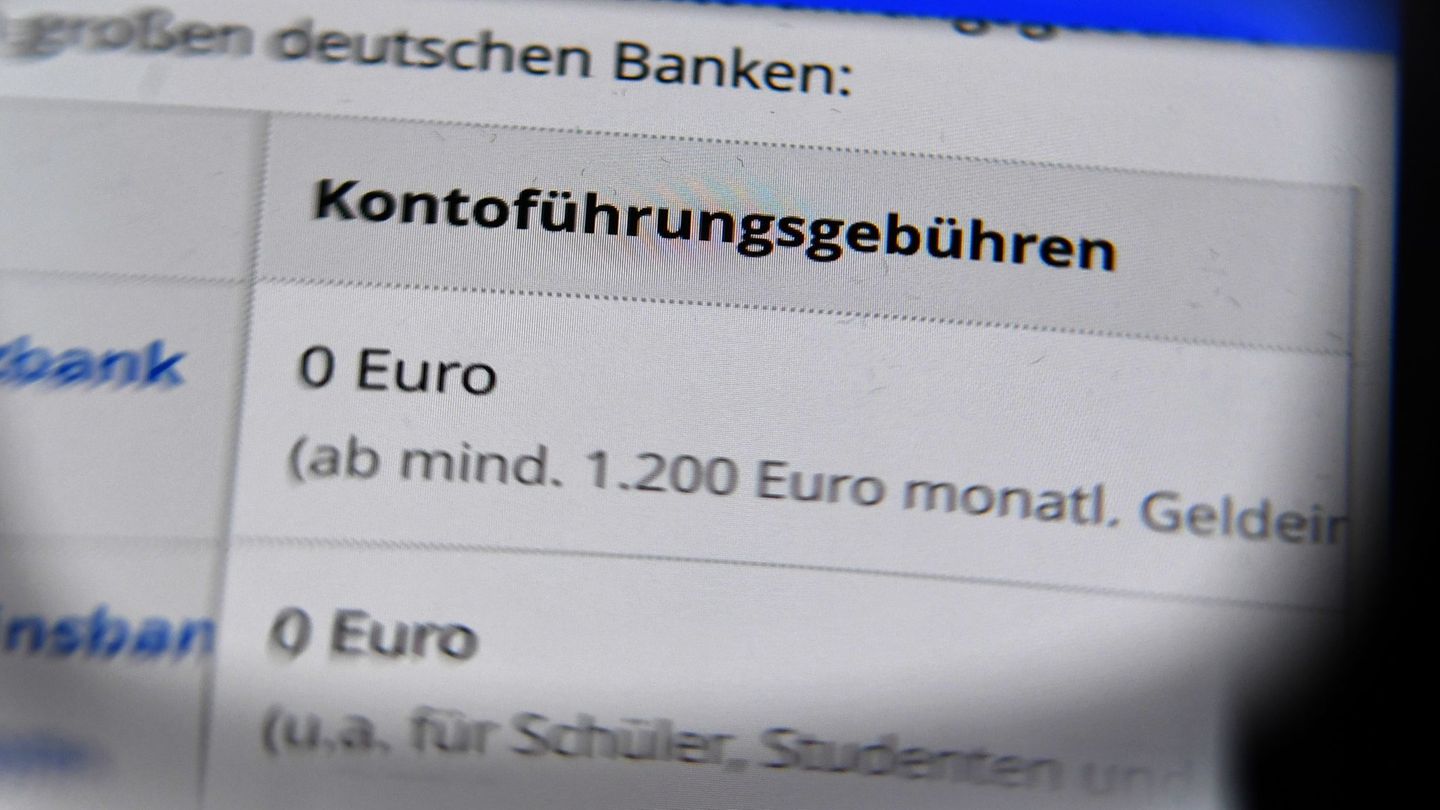

What are account management fees?

“The administration and operation of a current account naturally incurs costs,” says Christian Urban, head of the finance and insurance group at the North Rhine-Westphalia Consumer Center. “In principle, it is therefore not objectionable if banks and savings banks charge a fee for this.” Whether and in what form fees are charged can therefore vary: from free current accounts to those with account management fees to models in which each individual booking has to be paid for.

What can consumers do if the bank increases fees?

If the account becomes more expensive, consumers can either actively agree, cancel or refuse their consent, says Urban. In the latter case, however, there is a risk of termination by the bank. Even then, there is still enough time to look for a new bank, as the institution must give at least two months’ notice. However, anyone who wants to agree to the fees should generally do so actively, according to the financial expert. “Unlike in the past, banks are no longer allowed to assume that customers agree to the price increase if they simply do not respond to notification of the price increase.”

What is a consent fiction clause?

The so-called consent fiction clause is a contractual clause that states that changes to the contractual terms and conditions are deemed to have been accepted if customers do not object within a certain period of time. This is also called tacit consent. There have also been corresponding clauses in the general terms and conditions of banks and savings banks in the past, says Urban. However, the BGH declared them ineffective in 2021 because the clauses were too far-reaching and customers were unreasonably disadvantaged (ref. XI ZR 26/20).

What was it about in Karlsruhe this time?

“As a result of the Federal Court of Justice’s decision in 2021, many consumers were able to demand back bank fees they had paid if they were based on an ineffective fictitious consent clause,” says Urban. At the highest German civil court the question was how far back these reimbursement claims go and how high they are. The so-called three-year solution used by the Federal Court of Justice in energy supply contracts played a particularly important role. According to this solution, only the ineffective price increases of the last three years would be reimbursed.

The 11th Civil Senate, which is responsible for banking law, has now ruled that the three-year solution cannot be transferred to ineffective fictional consent clauses from banks and savings banks. The fact that a customer pays the wrongly charged fees without objection for more than three years does not mean that the savings bank is allowed to keep the money. Unlike the ineffective price adjustment clauses in energy supply contracts, the content of the contract in the present case is not determined by the ineffective fictional consent clause. In its ruling, the BGH also referred to the existing statutory statute of limitations.

What was it about in this specific case?

In the case heard on Tuesday, a savings bank began charging fees for a customer’s checking account at the beginning of 2018 without the active consent of a customer. In doing so, she relied on a consent clause. The account holder filed an objection in July 2021 – and demanded in court a repayment of the fees charged from 2018 to 2021 totaling 192 euros. The Ingolstadt regional court ruled in the lower instance that the plaintiff was not entitled to reimbursement of the fees because he only objected to their collection after three years. (Ref. XI ZR 139/23).

How did the procedure end?

The BGH overturned the district court’s ruling – and also ruled on the matter itself. The Karlsruhe judges awarded the plaintiff the full amount of repayment required. They also obliged the savings bank to compensate the plaintiff for any further future damage that he might incur as a result of the collection of non-agreed bank fees after 2021.

How many customers are affected?

Despite the consumer-friendly BGH ruling in 2021, only a few consumers have made reimbursement claims against their own bank in recent years. This is shown by a representative survey conducted by the comparison portal Verivox in the spring. According to this, only 11 percent of all customers asked for money back from their bank – even though at least 40 percent had their accounts become more expensive in the three years before the ruling. The credit institutions got off lightly, said Verivox managing director Oliver Maier.

dpa

Source: Stern