Both the stock and bond markets will be closed on Thursday for Thanksgiving. Trading will resume on Friday during Black Friday, but will end early: Wall Street will close at 1 pm and bonds at 2 pm US time. That is, 15 p.m.

European stocks rise this Thursday along with the global dollar after having fallen the previous day, while the Asian markets fell on a day with lower trading volume due to the holiday Thanksgiving Day in the United States.

The content you want to access is exclusive to subscribers.

The pan-European Stoxx 600 index rose 0.6% in early trading, after falling 0.8% in the previous two sessions. Elsewhere, MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) was down 0.5%, while Japan’s Nikkei (.N225) was up 0.6%.

Although the US stock and bond markets were closed, Wall Street futures registered slight increases. S&P 500 futures are up 0.1%, after the index fell 0.4% on Wednesday.

On Wednesday, economic data showed that US consumer spending rose in October, while the Federal Reserve’s preferred measure of inflation rose to 2.3% in that month, from 2.1% in September.

The data analyzed by the market

These factors, along with the possibility of higher tariffs on imported goods, could limit the scope for interest rate cuts next year. Kristina Clifton, economist at Commonwealth Bank of Australia, commented: “We continue to expect the FOMC to cut the federal funds rate by 25 basis points at its December meeting. However, another strong rise in core inflation in November would defy the view. of the FOMC that inflation is falling towards 2% annually.

The dollar index, which measures the US currency against six peers, rose 0.22% to 106.33 after falling 0.7% in the previous session.

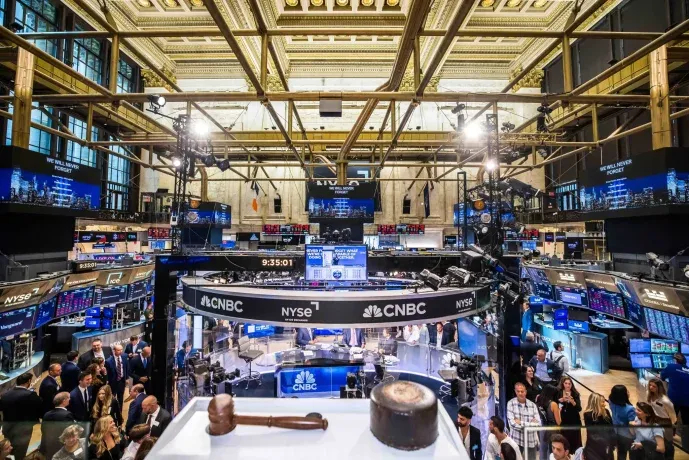

wall street markets NYSE.jpg

Global markets showed mixed movements in a day marked by lower activity due to the holiday in the United States.

NYSE

Chris Turner, global head of markets at ING, noted that the dollar’s decline on Wednesday was likely driven in part by investors taking profits in U.S. stocks and bonds before the end of the month. “Presumably, some of this activity occurred in more liquid markets yesterday, rather than waiting for reduced Thanksgiving conditions.”

In an unexpected move, South Korea’s Central Bank cut benchmark interest rates for the second consecutive meeting on Thursday, after inflation fell more than expected. The won weakened after the decision.

Source: Ambito