This is compared to a year ago. The main origin of the flows was Brazil, followed by China. The US also stood out with the highest percentage of FDI.

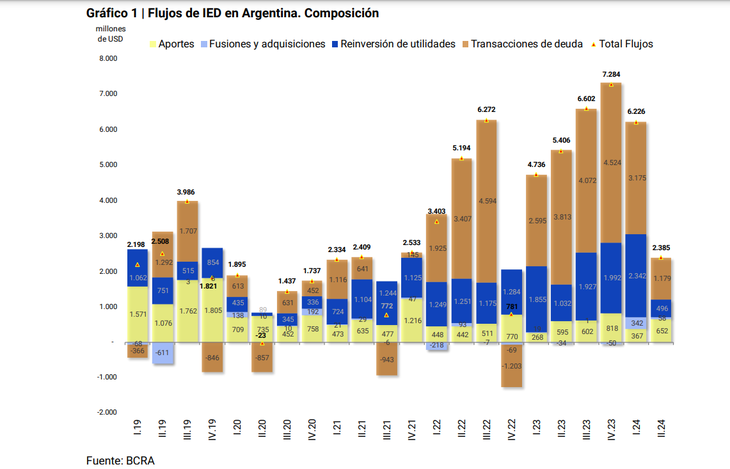

Foreign direct investment (FDI) fell 56% annually in the second quarter, to US$2,385 million, minimums since the pandemic for that period, according to a report from the Central Bank (BCRA), published this Thursday.

The content you want to access is exclusive to subscribers.

This amount was driven mainly by debt transactions, which totaled US$1,179 million, and secondly, by capital contributions, which reached US$652 million. Additionally, Net income was recorded from reinvestment of profits of US$496 million and US$58 million from mergers and acquisitions.

In year-on-year termsa drop in net income of US$3,021 million was evident. The sectors that captured the largest FDI flows in the second quarter of 2024 were: “Manufacturing industry”, with US$969 million; “Deposit-taking companies, except the Central Bank”, with US$900 million and “Exploitation of mines and quarries”, with net flows of US$851 million.

The origin of investments

The main origin of FDI flows was Brazil, with net income of US$839 million, followed by China, with US$324 million. Then came Switzerland, with US$241 million, Canada, with US$192 million and the Netherlands, with US$183 million.

The gross passive FDI position reached US$165,032 million as of June 30, with equity participations of US$109,377 million, and debt instruments of US$55,655 million.

The United States was ranked as the main source of FDI in Argentina, with a stock of US$30,176 million according to data until June, which represented 18% of total holdings. In second place, Spain was found, with a gross liability position of US$24,602 million (15% of the total), and in third position is the Netherlands, with US$18,826 million (11% of the total). These three countries concentrated 45% of the FDI stock in Argentina.

Screenshot 2024-11-28 194956.png

Comparing with the net income from the previous quartera drop in quarterly transactional flows of US$3,841 million was recorded, mainly explained by the slower speed at which the debt with related creditors has been growing, a lower reinvestment of profits as a result of the fall in financial sector income and a greater distribution of profits and dividends, mainly in the “Information and communications” sector. In year-on-year terms, a drop of US$3,021 million was evident.

Source: Ambito