Wall Street It is on track to close its best year in decades in terms of returns, scoring 26.5%. Some voices maintain that the current increase is the strongest in the S&P 500 since 1928others disagree with this analysis, but recognize that it is one of the best years in their history, so the question arises if after the juicy profits, The rally will extend into 2025.

In this regard, history offers a mixed verdict on what could happen next year. According to available data, in 2023, the S&P 500 ended up 24%. While, in 2024, an increase of more than 26% is estimated. If this performance continues, it will be only the fourth time in the last 100 years that the index has posted superior gains. at 20% for two consecutive years, according to a study by Bank of America (BofA).

These historic streaks offer some indications about what could be expected in 2025. While in the north, the main banks of Wall Street They are divided about what will happen in the New York square in the coming years, although There are more optimistic looks than alarm ones.

He S&P 500 so far reached 52 all-time highs to close in 2024. The only years with more historical highs are: 1995 (77), 2021 (70), 1964 (65), 2017 (62), 2014 (53) and 1961 (53), according to private calculations.

Wall Street: history does not offer a definitive answer

On two occasions, during the decades of 1920s and 1930safter two years of returns greater than 20%, the S&P 500 retreated in its third year. After great advances in 1927 and 1928, the 1929, which included the infamous “Black Monday“, when the shares fell 13%. Then the events occurred that led to the Great Depression.

The 1935-1936 upswing turned out to be a false dawn in the middle of the crisis of 1929. Just when it seemed that the “New Deal” had put the US economy on the right path, it plunged again into a deep recession that lasted until the Second World War.

S&P 500.jpeg

After big gains in 1954 and 1955, the S&P 500 made only a modest advance in its third year, 1956. It was the end of a long post-war bull market, which began in June 1949 and ended in August 1956. In 1995-1996, the S&P 500 rally continued, with significant gains in the next three years until 2000, when the index suffered three consecutive years of losses.

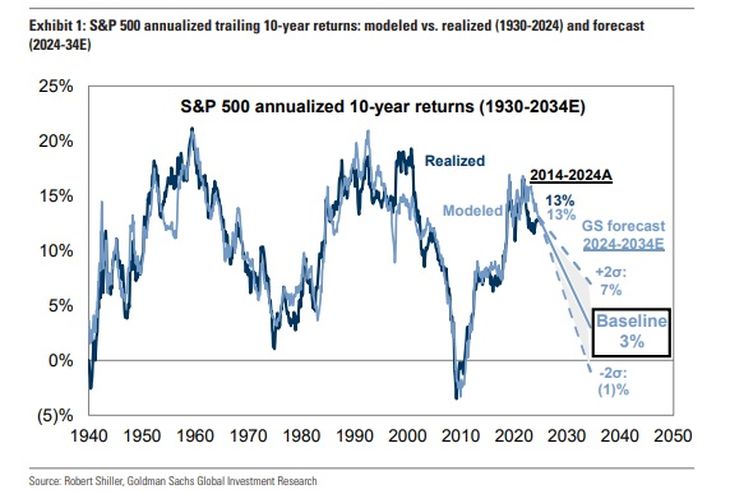

A recent report by Goldman Sachs It is not very positive in relation to the main Wall Street index. He assures that the prognosis is due to market concentration“which is currently near its highest level in 100 years”, which affects long-term returns due to difficulties in maintaining sustained growth in sales and margins, both at the company level and in concentrated indices.

However, other banks such as JP Morgan and Wells Fargo They remain “optimistic” for the stock market. The first changed his bearish projection that he has maintained since 2022 for the S&P 500 and the second expects the index to reach 7,000 points in 2025. The objective is just seven points higher than Deutsche Bank and Yardeni Researchwho project that the S&P 500 will close next year very close to 7,000.

The S&P500 under the scrutiny of analysts

Diego Ilan MendezTeam Leader of Corporate Credits in Personal Investment Portfolio (PPI), maintains in dialogue with Scope that from the outset the projection for 2025 is positive. The strategist analyzes that the reality is that going against the technology sector “it is extremely difficult“.

He explains that these companies are “true cash generators, with impressive cash flow,” which is why he considers that the technology rally tiJan margin to continue precisely for this reason. In addition, “Donald Trump’s nationalist approach could benefit the technology industry,” says the strategist.

For its part, Thomas Ambrosettidirector of Guardian Capitalanalyzes that it is natural that doubts arise about the future of US stocks, since 2024 was a great year for the New York stock, “which generates thoughts and doubts about whether the increases will continue in 2025.”

S&P Goldman Sachs.jpg

Ambrosetti indicates that optimism can be maintained because growth in the American economy is anticipated over the next year, which would boost the share price. “Large banks like Bank of America (BofA) also lean their predictions in that direction and project an S&P500 with values 10% higher than the current onel,” he analyzes.

He also adds that an interesting point to keep in mind is that the increase could occur due to actions that are not part of “The Big 7”: “Apple (AAPL), Alphabet (GOOG), Microsoft (MSFT), Amazon (AMZN), Meta (META), Tesla (TSLA), and Nvidia (NVDA)but “it could be distributed in the other 493 index companies”.

Wall Street: what companies the market likes

Ilan Mendez He believes that Trump’s position on imposing tariffs on other countries could generate some protection for American companies. There it turns out that, the delay that the Dow Jones and the Russell 2000 regarding the S&P 500 from the end of 2022 could be reversed. “Historically, these indices have had a subsequent catch-up, which could represent a value opportunity in the short term,” he says.

The fear, indicates the strategist, for Russell companies, is that the tariffs could lead to higher inflation. In turn, this could lead to higher interest rates, which would eat into the margins of companies that, in many cases, are more leveraged. Despite these risks, in general terms, the expert promotes the idea of increasing exposure in this segment, although it is clear that this does not mean that he is against the technology sector, which he believes will continue to grow. Warns about Nvidiabecause it is a company that generates more caution due to its valuation multiples being “extremely high.”

Ambrosetti, for his part, recommends rotating investments towards the Invesco S&P 500 Equal Weight ETF (ETF RSP) or similar. Which are “equal weight” funds where the 500 companies in the S&P500 each have the same weight, regardless of the size of the company.

This egalitarian approach seeks to offer a more balanced exposure to the S&P 500, without giving disproportionate weight to the big technology companies that dominate the traditional index, so the RSP ETF may be attractive to investors seeking diversification and who believe that stocks Smaller caps within the S&P 500 may perform better relative to, for example, the Magnificent Seven.

Source: Ambito