The Customs Collection and Control Agency (ARCA) updated, via General Resolution 5614/2024, the regulations that regulate tax transparency for consumers. The new measure obliges companies in Argentina – starting in 2025 – to break down how the final price of a product is made up. In this way, VAT – and other taxes – They will appear as separate items on the invoice.

This measure is part of the implementation of the tax transparency regime by ARCA in order to offer greater clarity in the taxes that final consumers pay for the products and services purchased. The measure will be mandatory from January 1st for large companies and while the The rest of the taxpayers will have an additional period until April 1.

What the invoices will be like from 2025:

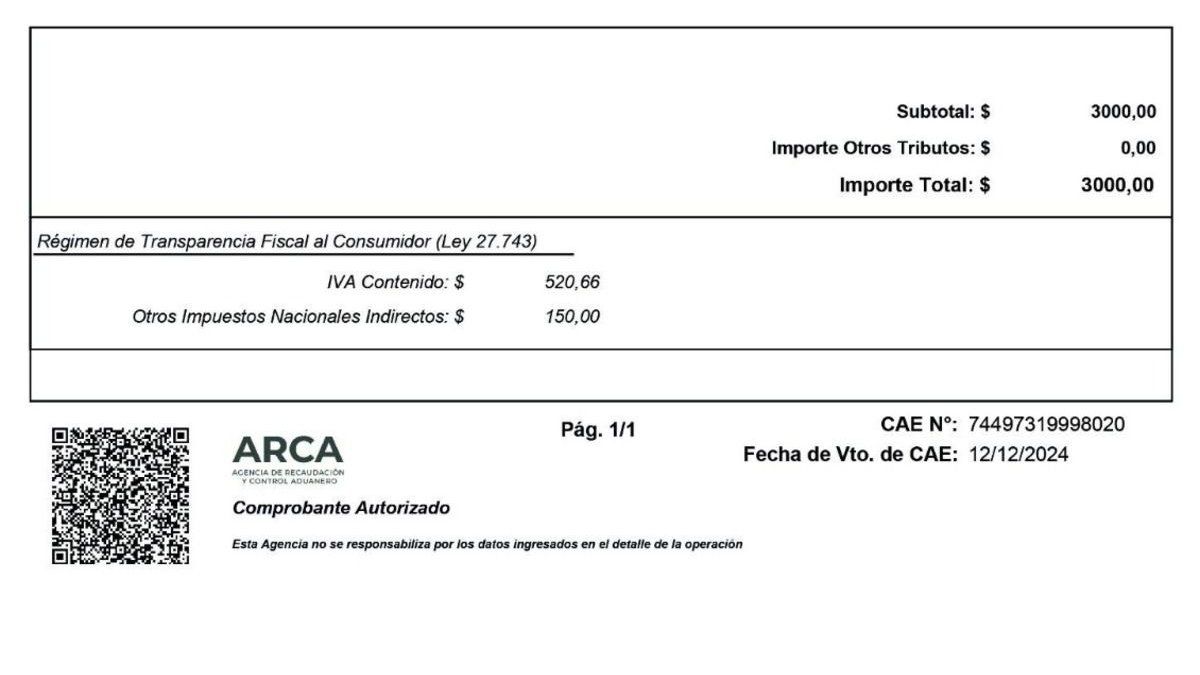

The changes established by ARCA for the case of invoices and other receipts of large companies, their objective is for consumers to have a clearer vision of how the cost of a product is made up. In this way, invoices must include an additional line in which show the amount corresponding to VAT and, in those cases that apply, also the internal taxes applicable to the final price paid by the consumer.

image.png

This is how the new invoices will reflect the VAT contained in a product.

ARK

In the example shared by ARCA, the last two additional lines reflect:

- VAT Content

- Other indirect national taxes

One of the great advantages of this regime is that the end consumer will not have to do any additional management. The receipts you receive for your purchases will already contain, in a clear and detailed manner, the legend “Consumer Tax Transparency Regime Law 27,743”, indicating the taxes that affect the final price of the product or service. This will allow them to know more precisely the impact that taxes have on the prices they pay.

The Chamber of Commerce supported tax discrimination on invoices

Following the measure announced by the national agency, the Argentine Chamber of Commerce and Services (CAC) He supported tax discrimination in invoices and assured that it is a way to gain transparency. The head of the House, Natalio Mario Grinmanmaintained that “the very high tax pressure registered by the national economy is a hindrance to the business growth, employment generation and economic and social progress”.

“We Argentines have suffered the fiscal voracity of numerous governments that have had a key ally: the opacity of the load. I mean that many taxes are not clearly perceived by citizens,” added the manager.

notice_318151.pdf

The Government communicated the ARCA resolution and made it official with its publication in the Official Gazette.

Official Gazette

On the other hand, the head of the CAC also explained that “there are numerous – and understandable – workers’ complaints against income tax; while a tax as relevant as VATwhich often has a much greater impact than that on the family economy, many times ‘goes under the radar’ of end consumers”.

“They do not detect this tax and frequently blame merchants for prices. that they consider excessively high, when in reality, to a large extent, commerce, more than a seller of a product, acts as a kind of delegation of the collection agencies of the different levels of the State,” he stated.

Regarding the future, Grinman predicted that “clarifying a situation is an advance to then correct it; evidencing the excessive tax burden is the first step towards a future reduction”.

Source: Ambito