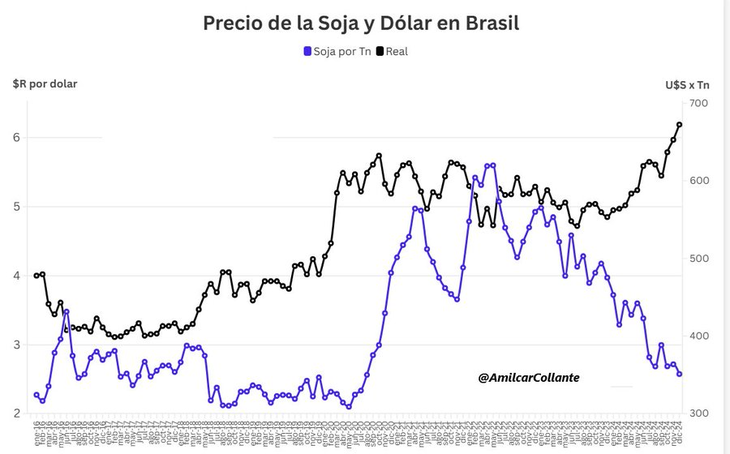

To the considerable parallel dollar rally In recent days, a combo of negative data was added for the external front. Although they were already showing marked weakness throughout the year, This week both soybeans and their derivatives and the real accelerated their falls. Thus, these variables add pressure to the exchange rate scheme implemented by the economic team, in a context of peso appreciation and still negative net reserves.

The cocktail is highly negative for the plans of Luis Caputo and Javier Milei. On the one hand, it affects Argentina’s main export products, whose international price is decisive when calculating the flow of dollars that will enter the country in 2025. On the other, the devaluation of the currency of the country’s largest trading partner It reduces the exchange competitiveness of local production and will also impact the currency balance.

Soybeans plummet in Chicago

This Wednesday, the ton of soybean sank 2.63% in the Chicago market and the January contract It pierced the floor of US$350: it closed at US$349.7. In this way, the oilseed deepened the sharp weekly fall: since Friday it has accumulated a decline of 3.7%.

During the year, soybeans have already accumulated a decrease of more than 22%. And, according to the economist’s calculations Salvador Vitellifrom Romano Group, “the price of oilseed returns to September 2006 values, in real terms”.

image.png

So far this week it was Even more abrupt is the fall in the price of soybean oil, which represents 40% of Argentina’s exports of primary products and manufactured goods of agricultural origin.. In Chicago, a collapse of the 7.2% from Friday to this part and this Wednesday it was sold at $871.91. At the beginning of 2024 its price was 17.2% higher.

“The market continues to be influenced by the good environmental conditions for the evolution of the campaign in South America, which could leave a record supply in the world’s main producer and exporter of the oilseed and its by-products,” said a Granar report on the causes of the decline. And he added: “The uncertain future of demand for soybean oil from the biodiesel industry in the US after January 20, when Donald Trump takes office, keeps the prices of this by-product in sharp decline.”

Finally, the report mentioned that “the third leg of the bearish current is the persistent devaluation of the real against the dollar” since it “supports the competitiveness of Brazil’s exports, a few weeks before the start of the 2024/2025 harvest, and “which improves the margins of producers, who obtain more reals for their grains.”

The devaluation of the real is accentuated

Precisely, the devaluation of the real It is another focus of concern on the Argentine external front. This Wednesday the dollar rose 3% to 6.30 reais. So far in December, the accumulated increase is 5.5%even though, in the last three days, the Bank of Brazil sold more than US$5.5 billion to contain the run. In 2024, the increase accumulates close to 30%after a period of appreciation at the beginning of Lula Da Silva’s mandate.

image.png

Source: Amílcar Collante

The combination of both factors represents bad news for the Argentine external front and for the scheme set up by Caputo.. It is that the exchange rate anchor policy deployed by the Government to slow down inflation led to a continuous appreciation of the real exchange rate, which is already at the lowest levels in recent decades and at a level similar to that prior to the megadevaluation of December 2023, Milei barely took over.

If this “cheap dollar” already incubated warnings about the deterioration of exchange competitiveness for large sectors of the Argentine economy and the possible worsening of the current account red (due to the tourism boom abroad and the compression of the trade surplus) , these factors come to add pressure. Even more so if one takes into account that the Minister of Economy indicated that in January or February the reduction of the rate of devaluation of the official exchange rate from 2% to 1% monthly could be achieved.

For case, Brazil is the main destination for both industrial exports and tourists who decide to spend the summer abroad due to the rising prices of Argentina in dollars. In the case of soybeans and their derivatives, they constitute the largest source of foreign currency to the country.

The Government seeks to extend the currency bridge built from the balance left by laundering and the increase in credits in dollars (stimulated by bets on the “carry trade”) that in recent months allowed the exchange current account deficit to be compensated and the BCRA to achieve a significant purchasing balance , while seeking to close a new agreement with the International Monetary Fund (IMF) during the first quarter of 2025 that includes additional debt to reinforce the Central Bank’s coffers.

However, the news on the external front comes at a time when Net reserves remain in negative territory for around US$8,000 million (if Treasury deposits in the BCRA and Bopreal maturities 12 months ahead are discounted) despite the strong currency purchases by the monetary authority.

Source: Ambito