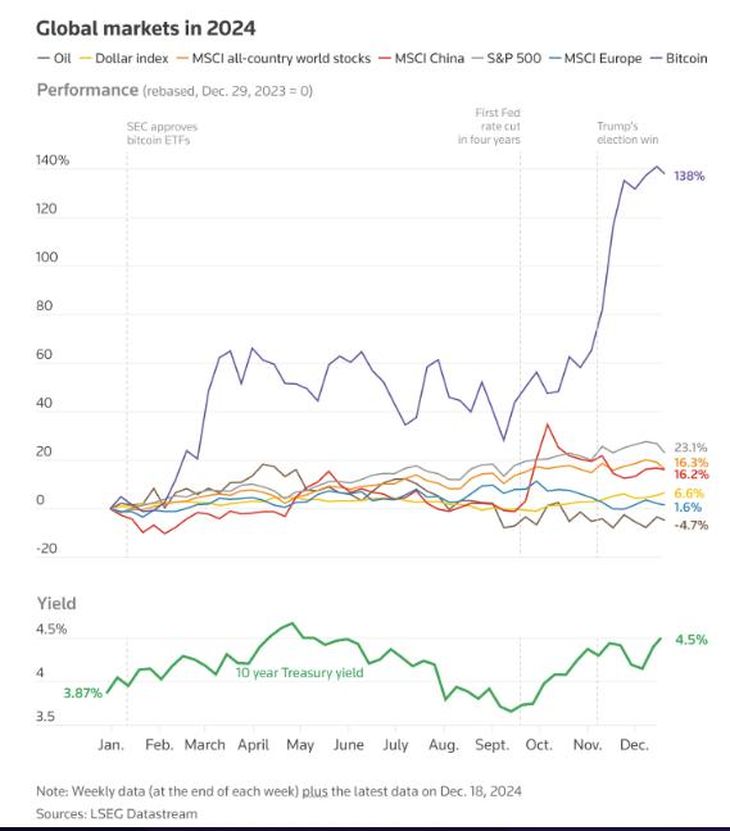

The New York plaza closes an exceptional 2024. On Wall Street, the S&P 500 rose more than 23% after a 24% increase in 2023 – its strongest two-year streak since 1998 – while the Morgan Stanley Capital International (MSCI) indices, which measure the performance of stock markets in different regions , countries or sectors, that is, outside the US, barely advanced 9% in 2024.

However, there is a pattern that is keeping investors guessing. It happens that, in the last two decades, the New York square marked a bullish streak for two or three years to stop the next. If history repeats itself, investors could opt for caution in anticipating a bad year, the question will be whether it will be in 2025 or 2026.

And the biggest concern for investors is whether stocks can extend gains in a market that, in terms of multiples, looks overvalued. Although it is worth remembering that even the most optimistic analysts were wrong in 2024, since the initial estimates for the S&P 500 They ranged between 4,200 points (JP Morgan) and 5,400 points (Yardeni Research), with a median target of 5,000. However, the actual performance of the index exceeded by more than 18% these expectations, since it reached 6,000.

Wall Street: what banks expect by 2025

In its latest projections report, JP Morgan analyzes that 2025 will be profitable again for investors, but with some changes, in particular, in the sectors that will lead this cycle and the erosion of others, such as the so-called “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms).

The document of the giant Wall Street indicates that the US had a strong bull market in the last two years, with an increase of close to 60% in stocks, driven by economic resilience, the monetary easing of the Federal Reserve (Fed) and the rise of Artificial Intelligence.

JP Morgan.jpeg

Source: JP Morgan projections 2025.

JP Morgan warns that it is expected a change in the composition of profitswith growth of the “Magnificent 7” slowing to 20% annually, while other market sectors will accelerate. Although he recognizes that artificial intelligence will remain the key to the market, “concerns about return on investment will drive a more inclusive market.” In 2023, the Magnificent 7 accounted for 63% of the S&P 500’s returns, but their share fell to 47% this year.

For its part, the outlook report for 2025 published by economists and strategists in the area of Bank of America (BofA) Global Researchnotes that the bank expects US economic and earnings growth to outpace that of other developed economies.

Likewise, it projects that US stocks They will start the year strong and close 2025 with the S&P 500 at 6,666. “Policy changes, including tariffs, taxes and the regulatory environment, could have a significant impact both in the US and the rest of the world,” he warns.

Regarding the key points of the market, Savita Subramanianhead of US Equity Strategy for BofA, expects upside of more than 10% for the S&P 500, with earnings growth of 13% in 2025.

Wall Street: how they analyze it from the city

While S&P 500 earnings are expected to rise 14% in 2025, inflation persists and Wall Street fears a rebound in consumer prices could lead the Fed to stop its easing. Stock valuations are already at high levels, increasing the risk of volatility.

Flavio CastroAsset Management Analyst at Criteriaexplains in dialogue with Scope that, given the solid performance of the US economy, the positive scenarios outweigh the negative ones, particularly after the recent victory of Donald Trump. In this context, he points out that “the exceptional performance of US stocks compared to the rest of the world could be maintained in the coming months.”

And, as Castro explains well, the market is discounting, for the moment, that Trump is going to fulfill his campaign promises and will promote protectionist measures linked to foreign trade, although he warns about another key point: the immediate implementation of fiscal measures , since they require greater political consensus in the US Congress.

Castro analyzes that if this scenario materializes, it could generate a reflationary impact in the US, which would strengthen the dollar and hit emerging currencies and commoditieswith a Fed that, after the last meeting, is no longer so lax regarding its monetary policy interest rate.”

Reuters.jpeg

For the strategist, The proposed tax reduction and economic deregulation benefits the US stock market, while protectionist policies could raise inflation and slow global growth, with the fiscal front a major concern for markets.

Castro analyzes that, despite the uncertainty about the priorities of the new government, which could adopt more aggressive policies and drag the rest of the world into a recession, “a bear market is less likely after Trump’s victory”. However, they indicate that they do not share the optimism of the main investment banks, “which foresee returns of between 10% and 12% in the next 12 months.”

In the long term, the rise of AI presents a favorable outlooksimilar to the 1994-2000 period, when a productivity boom drove corporate profits and strong stock performance, he says. Well, despite high rates, the economy is growing and, if investment in productivity is maintained, inflation could be controlled.

The sectors that experts look at

Fernando Staropolianalyst at Rava Stock Marketagrees with Castro and maintains that next year will be a period of growth for the US economy, but it is expected that companies have more austere performance following extraordinary stock performance during 2024.

Staropoli comments that Trump’s arrival to the presidency represents a change of course in fiscal matters that would lead to an increase in inflation, something of which the Fed has already taken note. Therefore, the strategist warns that Next year it is presumed that the momentum of Trump’s protectionist policies could resent the winning sectors of 2024 (technological, telecommunications and financial) due to the increase in the cost of financing while companies in the industrial sector could be revitalized again.

In that context, Castro sees value in large-cap technology companies within the growth sector, which is his preference in a well-balanced Cedears portfolio. “The main technology companies, with solid fundamentals, reach record levels of investment in ‘capex’ (capital expenditures), even with high interest rates,” he concludes.

Source: Ambito