MERGERS AND ACQUISITIONS IN ARGENTINA 2024 ACCORDING TO PWC.JPG

This increased transaction flow was driven by the process of economic normalization and pro-market policies that the national government has been implementing, together with the rebound in the level of activity, making expectations “very positive” for 2025, the report highlights.

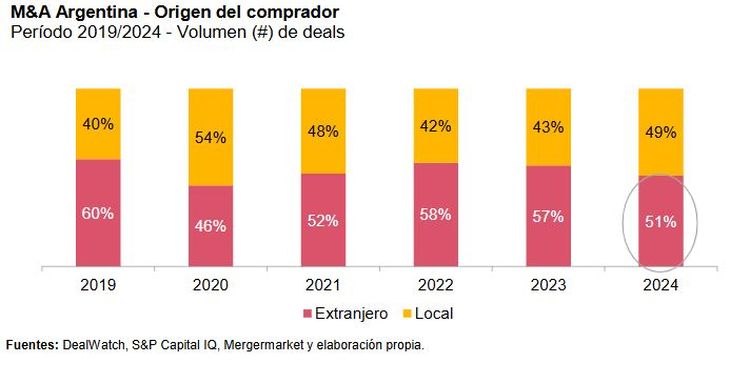

In that framework, buyers of foreign origin continued to be the majoritya trend that has been maintained in recent years: foreign groups (with and without prior local presence) represented 51% of the total volume.

However, heThe proportion of local buyers increased in 2024 compared to previous yearsbeing an example that, in periods of transition and recovery, the local investor in general is more active since interprets and can anticipate better the economic cycles that characterize the Argentine economy.

On the other hand, the study reveals that it continued the very low presence of financial operatorssince less than three transactions were recorded in which financial/private equity buyers participated.

This type of investor in general seeks long-term financial predictabilityso as the country consolidates its economic stabilization process, it could be expected that they will have a more active participation, estimates PwC. In any case, he clarifies that this process will surely occur gradually and ensures that There are several funds that are already analyzing opportunities in the country.

MERGERS AND ACQUISITIONS ACCORDING TO ORIGIN OF THE BUYER.JPG

In the world of corporate purchases and sales, financial players they participate between 30% and 40% of the transactions and they are usually a very relevant source of investment.

“This type of investor generally seeks long-term predictability, and as the country consolidates its economic stabilization process, they could be expected to have a more active participation. It must be taken into account that in the world financial investors are a very relevant source investment,” said Ignacio Aquino, partner at PwC Argentina, from the Deals practice.

Other relevant facts of the M&A market in Argentina during 2024

-The departures of multinationals continued. During the year there were at least 12 transactions (vs. 17 in 2023) in which a multinational group sold all or part of its operation in the country. These types of transactions will continue to be seen in 2025, but with a decreasing trend, also taking into account that many of the deals that were closed last year are the product of divestment decisions taken in previous years.

Another factor that can drive more exit transactions is the higher level of risk in Brazil, which can lead international groups to want to leave that country and drag along other operations they have in the region, for example, Argentina. Surely the country will enter a period in which there will be both entries and exits of multinationals.

-The amounts per operation increased. Although the size of the ticket per transaction was mostly less than US$20 million (in line with an M&A market that generally has a focus on small & middle market deals), there was a significant increase in transactions with large tickets . 2 transactions were recorded with amounts between US$500 and US$1,000 million, and 3 transactions with amounts greater than US$1,000 million. It should be noted that this is the first time since 2010 that three transactions, or mega deals, have been recorded in one year with a ticket over US$1 billion.

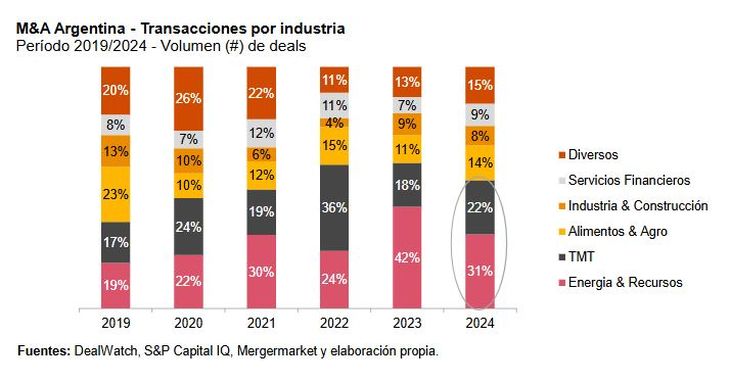

-Energy and Resources was the dominant sector of operations. It concentrated 30% of the number of deals and more than 70% of the traded value (in which Mining was the most prominent subsector). It was followed by Technology, Media and Telecommunications (TMT), Food and Agriculture and Financial Services.

In Energy & Resources The most active subsector was Mining (17 operations), in which activity was mainly concentrated in Lithium, but also in Copper, Gold/Silver and Uranium projects (which will surely gain more momentum from the Nuclear Plan announced by the government). He followed Oil & Gas (13 transactions), where the greatest activity was in Upstream, although there were also 3 transactions in Oil Servicesa segment that with the rise of Vaca Muerta will surely resurface in terms of transactions. Finally, the sector Electric It had very low activity, only one operation was recorded in Renewables, although it is predicted that the rate restructuring that the sector is undergoing will drive more transactions in the coming years.

In TMT There was a slight rebound in transactions (22 deals) compared to 2023 (16), but it is far from the peak reached in 2022 (30). There were 10 transactions in IT-Software Services (which in general is always the most active segment), 4 in Telecom (of which 3 were cable companies from the interior of the country), 3 in Digital Marketing, 2 in Gaming, 2 in Media, and one on the Internet (the largest corresponding to the Despegar deal).

In Food & Agro There were a total of 14 transactions, in various segments, including Food and Beverages (5), Agricultural Inputs and Equipment (4), Refrigerators (2), Grain Value Chain (2) and Poultry (1).

In Financial Services There were 9 transactions, related to the Banking/Financial, Insurance, Stock Market, Investment Banking and Money Transportation segments. Based on changes at the monetary level in the economy and greater availability and better conditions for credit, this is a sector that we expect to be quite dynamic in the near future.

Within the sector Pharma & Health There were 9 transactions, being a year with a lot of activity for this industry, which is also in the process of changes regarding rates and regulations. Deals were closed in the segments of Laboratories and Medicines (4), Clinics (2), Pharmacy Chains (1), Social Work (1), and Animal Health (1).

MERGERS AND ACQUISITIONS OPERATIONS BY INDUSTRY.JPG

Finally, there were 7 transactions related to the Constructiondespite the fact that it was a challenging year for the sector. It mainly included deals in the Construction Materials segments and companies dedicated to Engineering & Construction.

The outlook for 2025 in mergers and acquisitions in the country

PwC analysts also prepared a study on the outlook for the coming year in matters of M&A. “In this new stage of economic opening, the winners will be those that offer the best price, quality and service. Naturally, this will boost strategic M&A activitywhere companies seek to consolidate markets and generate economies of scale and synergies through the purchase of companies.”

But they clarify that there may be undesirable effects in this process: “The other side of an open economy in the process of change is that Not all players will adapt in the same way, some will have a harder time than others, and some may not even survive.. The effects will be felt differently, depending on the sector and the particular conditions of each one. This situation will lead some companies to restructure their operations and/or liabilities, which can also be a driver of purchase and sale transactions.”

In addition to the sectors that have historically been the most active in M&A, it is possible that we will also begin to see greater activity in other sectors such as telecommunications, real estate, infrastructure, pharma or healthamong others.

On the other hand, it is expected that privatizations of state companies are carried out starting in 2025, counting Impsa as the first case, taking advantage of the favorable market context. Given that they are complex processes that require prior preparation and ordering, they will surely occur in stages. They should generate dynamism in the M&A market, with the participation of both local and international investors.

In terms of valuations, the drop in country risk and the reduction in the exchange rate gap are two factors that have had a favorable impact on the value of Argentine companies and assets. Although there were significant improvements in the value of stocks and bonds, the increases in the level of real economy assets have not yet been as pronounced, something that is on the way to occur, but in a more gradual way.

Source: Ambito