Menu

Tax law and rehabilitation training: BFH: Membership in the gym not deductible

Categories

Most Read

Bahn: New boss Evelyn Palla announces major renovations

October 19, 2025

No Comments

Remuneration at stock exchange companies: “No longer a rare species”: female managers earn less

October 19, 2025

No Comments

businessmen distrust that it will reactivate the real economy

October 19, 2025

No Comments

To meet the goal, Luis Caputo must take the chainsaw for subsidies, salaries and public investment

October 19, 2025

No Comments

Due to lower sales in supermarkets, mass consumption fell 4.4% in September

October 18, 2025

No Comments

Latest Posts

Economic situation inhibits environmental protection in companies

October 19, 2025

No Comments

Plastic packages for recycling Harald Hauke, ARA board spokesman The willingness to invest in the circular economy will decline in 2025 compared to the previous

In just seven minutes, they took jewels from Napoleon and Empress Eugenie

October 19, 2025

No Comments

October 19, 2025 – 09:44 Three men broke into the most famous museum in Paris, smashed display cases and fled with nine priceless historical jewels.

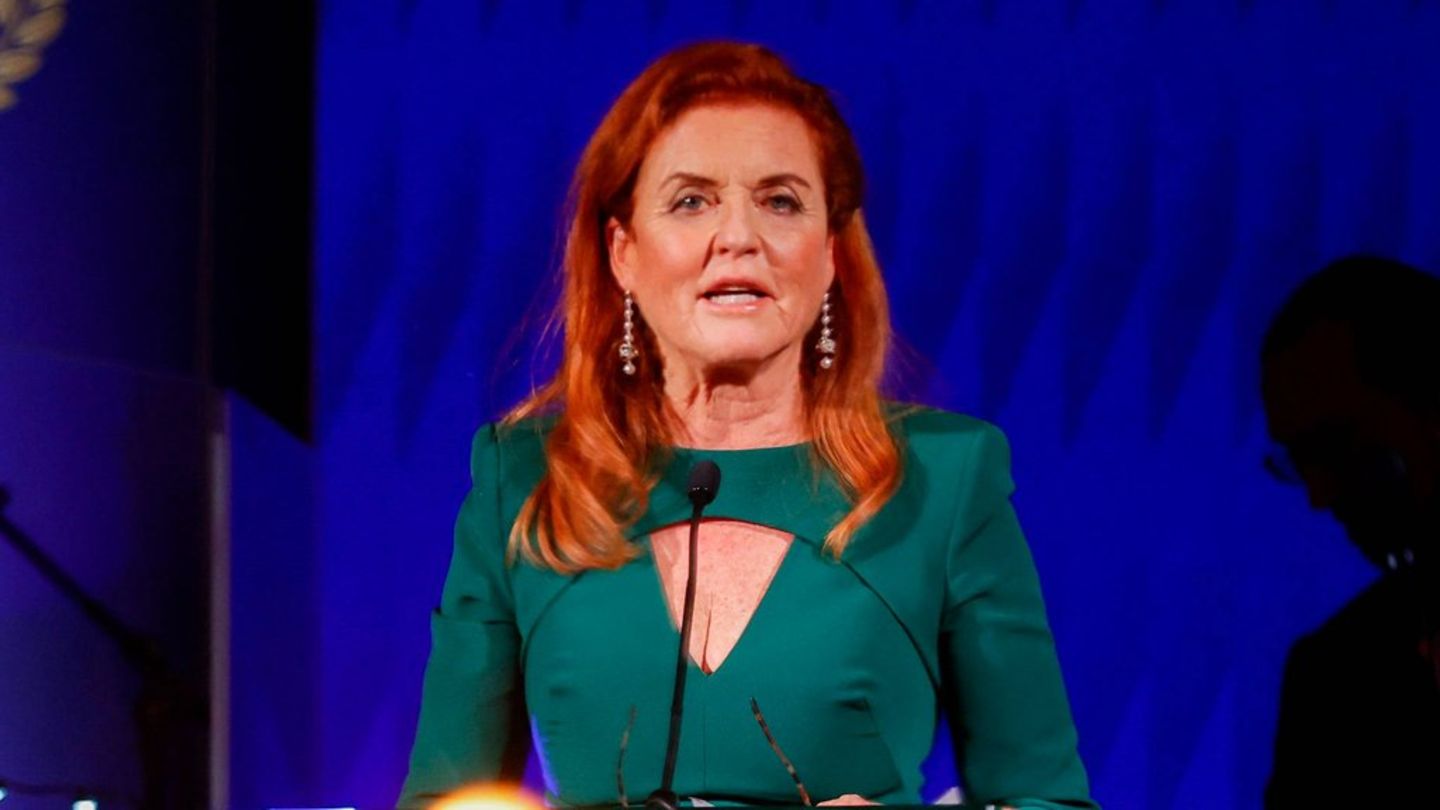

Sarah Ferguson: Massive allegations about Epstein connection

October 19, 2025

No Comments

Lisa HarrisI am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.