The collection of January income tax registered a Increase in the order of 37% real Regarding the same month last year, which would have allowed the government cover much of the loss of resources caused by the end of the country tax.

This is indicated by data from Politikon Chacho and the Argentine Institute of Fiscal Analysis (Iaraf) in relation to federal tax co -participation.

Both consultants estimated that the Profit Tax registered one 37% real improvement Regarding January of last year, which implies A total of $ 2.5 billion. In 2024, the tribute raised $ 1 billion.

This allowed the government to compensate for much of the loss generated by the end of Country tax. In January 2024 he had contributed a total of $ 470,000 million. As inflation in the period was 84% (according to private estimates), this year I should have left some $ 865,000 million.

To that you have to add another tax that has been contributing a lot, which is the fuel tax. In January, according to estimates of the consultants, Its collection grew 328%. That is because of the update of the fixed sums per liter that were behind from the government of Alberto Fernández. This tax would have left the treasury about $ 325,000 million.

NAFTA FUELS SERVICE STATIONS

The fuel tax this year will serve to compensate for the loss of the country tax

Ignacio Petunchi

On the other hand, taxes “Coparticipable internal ones ”would have left about $ 340,000 million to which another $ 29,000 million of “other co -participants” are added.

The tax that It fell slightly is VAT, with 0.7%. That is, your collection It would be close to $ 5.2 billion. The rest of the taxes that rose more than compensated for the decrease in resources.

For the purposes of presenting numbers, The total collection of taxes that are shared with the provinces could have compensated for the decrease in country tax resourceswhich is the most important challenge for the government this year.

Iaraf-Copa-enero.png

The problem is that when shared, Little more than half (56%) were taken by the provincial states, which implies that the nation was left as its own income (44%) For the purposes of the National Public Sector (SPN).

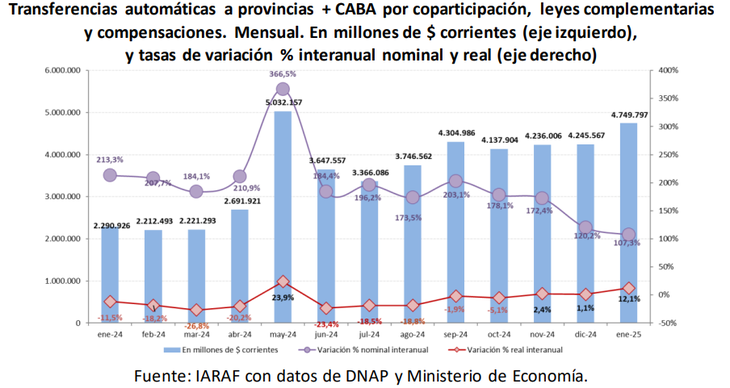

According to him Iaraf “In the month of January 2025, the National Government sent to the consolidated provinces more city of Buenos Aires $ 4,749 billion as co -participation, special laws and compensation.” “This would imply a real rise of 12%. For its part, the net co -participation, that is, automatic transfers less complementary laws and compensation, 9.5% real would have grown ”says the report.

The study indicates that “this rise in the January net co -participation would be explained mainly by the very good performance of the co -participation originated in the Profit Tax (+36.7% real year -on -year) that more than compensates for the slight decline of co -participation originated in VAT (-0.8% real interannual) ”. “Together, the contribution of VAT and profits would have registered a real year -on -year rise of 9.9%,” says the study.

For its side, Politikon points out that “Internal taxes and other co -participated ( +0.8% and +22.4% respectively) They also presented increases. ”

The report adds that “the set of Special laws and regimes Totalized shipments for $ 132,540 million (3% of the total) and showed a real expansion of the 40.2% year -on -year” “Within them, The fuel tax (+238.0%) and the monotax (+75.9%) They exhibited the most magnitude increases, ”says the report.

Source: Ambito