The Bontamthey are the four new treasury bonds that pay the maximum between the accrual of a capitalizable monthly fixed rate – which varies between 2.25% and 2.14% according to the expiration – and the average of the average of the Tamar Rate During bonus life[1]. They were issued on January 29, after the successful voluntary exchange of debt that the government was carried out two weeks ago.

On that occasion, the Treasury offered to exchange a long list of bonds in pesos with maturities between May 2025 and November 2025 for these new dual bonds, whose maturities operate in the months of March, June, September and December 2026. The result was very successful achieving a 64% acceptance on the total of eligible bonds (55.25% if we consider only private sector holdings). In this way, the government managed to clear $ 14 billion debt maturities In the pre -election period, with the aim of reducing future exchange rate volatility.

These new dual bonds are very attractive. First, it allows indirect access to the fixed -term wholesale rate to small investors. Is that Tamar (wholesale rate of Argentina) It is nothing other than the interest rate calculated by the BCRA based on the fixed -term concerted deposits of 1,000 million pesos or more, expiring 30 to 35 days. Since its publication began on October 1, 2024, on average the Tamar has been located 2.5pp above the retail fixed term rate (Badlar).

image.png

Secondly, and even more importantly, dual bonds allow the investor of a decline in the interest rate. When one assembles a fixed term to the typical 30 -day term, one runs the risk that the bank reduces the interest rate when wanting to renew it.

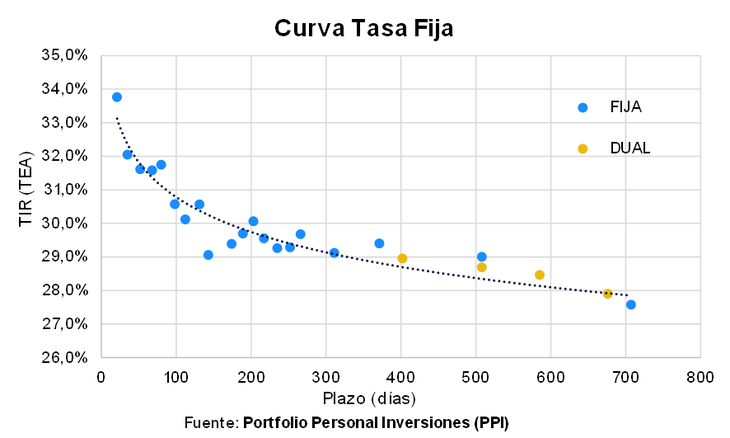

In fact, we must remember that, since this government assumed, nine monetary policy rate cuts have been made. It sank from 133% in December 2023 to 29% currently, negatively impacting on the rate of the fixed deadline of savers. In fact, the market expects the government to deepen this strategy in the coming months. That is precisely what explains that today the bond curve in pesos has a negative slope.

The market is confident that the Government will be successful to deepen the decline in the inflation rate, and this will continue to cut the nominal interest rate. However, since these bonds have The particularity of being dual guarantee a minimum of performanceeven on stage where the interest rate in pesos falls strongly.

To give an example, at the prices of the closing on Thursday (February 6), the Bontam with expiration June 2026 (TTJ26) It offered an annual effective rate of 28.7%.

What is particularly interesting is that this performance does not far from the performance of a traditional fixed rate bonus with the same expiration date.

In fact, the BANCAP June 2026 (T30J6) At the same closing date it offered a yield of 29% annual, Only 30 basic points above its dual pair.

image.png

In conclusion, we believe that there is an opportunity to invest in the new dual bonds issued by the Treasury, being TTM26 and TTJ26 Our chosen for our recommended portfolios of the month of February.

First of all, This instrument is strictly preferred to the fixed term, since it allows a decisive interest rate to accrue instead of the retailer to which most natural persons have access.

In second place, We believe that it is not necessary to be an expert valuing options to notice that, the resignation of only 0.3% annual annual performance with respect to a classic fixed rate bonus It is very low for a bonus that can be very attractive if the government fails to lower the interest rate as fast as the market waiting.

[1] In technical and more precise terms, the average tamar rate is calculated in the period between 10 business days before at the date of issuance of the bonus up to 10 business days before the expiration date.

Research Asset Management of PPI.

Source: Ambito