Orlando Ferreres spoke in a recent interview about the exchange rate and indicated how much should be worth, waiting for an IMF definition.

The debate about the dollar value intensified this week After Javier Milei reaffirmed that the exchange rate is not late and criticized the projections of a possible devaluation in 2025. In addition, he questioned economists who insist on the need for an adjustment in the official price.

The content you want to access is exclusive to subscribers.

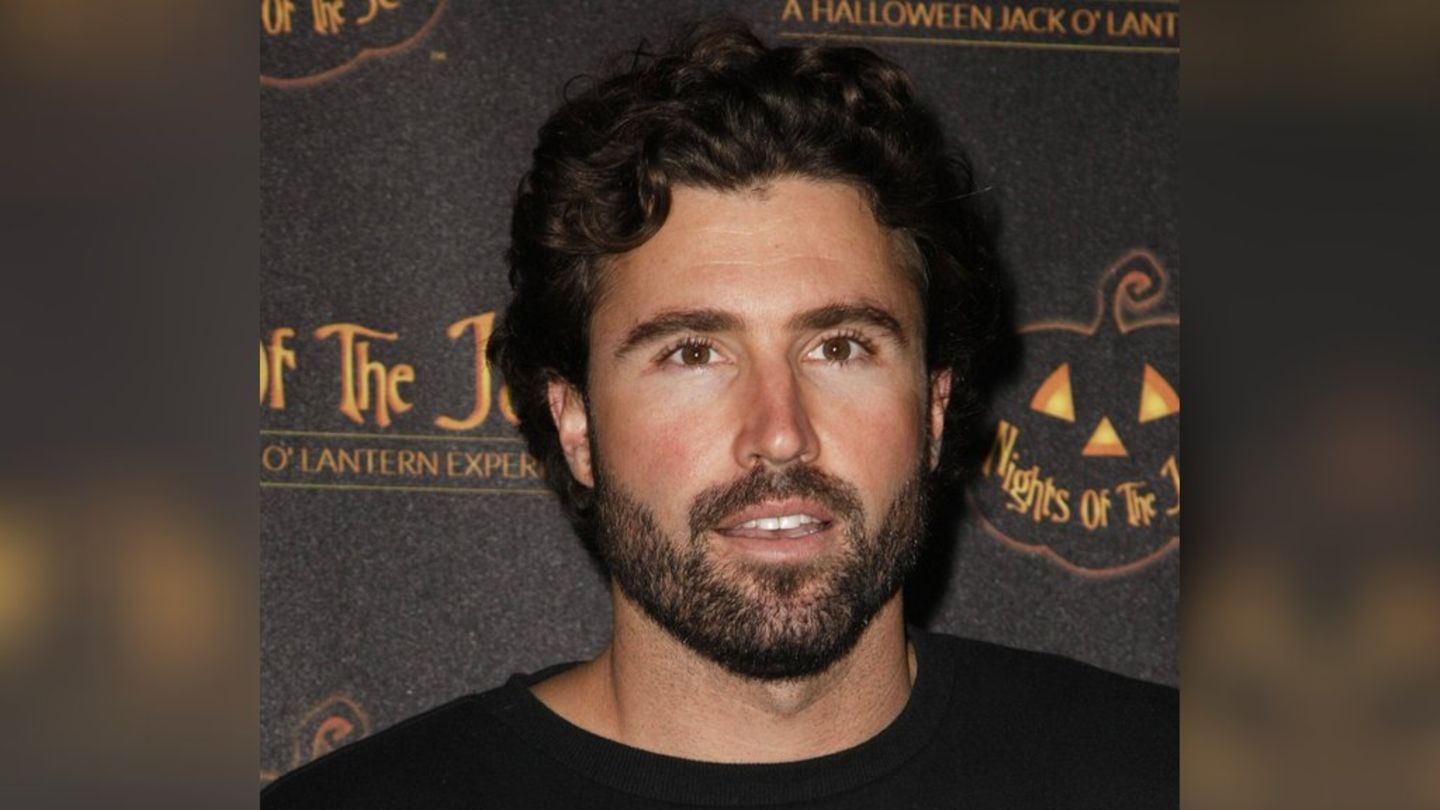

In this context, Orlando Ferreres, Recognized market consultant, he expressed his opinion on the current level of the dollar and negotiations with the IMF. In an interview with Channel E, he said that the Minister of Economy, Luis Caputo, held meetings with the agency both in Washington and Buenos Aires, and He estimated that a new agreement could be completed in April, although the board’s approval is still missing.

Orlando Ferreres on C5N.jpg

According to Ferreres, The IMF puts special emphasis on the need for greater fiscal consolidationreducing spending without increasing taxes. However, It also raises concerns about possible exchange backwardness. Ferreres said that the value of the official dollar should be significantly higher than the current one to avoid exchange delay. According to its calculations, the theoretical balance parity It is located at $ 1,617 per dollar, well above the current contribution of $ 1,075.

Ferreres also warned that IMF disbursements will not be enough to eliminate the exchange rate, coinciding with the recent position of Domingo Cavallo.

“The IMF loan can be temporary relief, but to achieve sustainable growth, confidence and structural reforms are needed, ” The economist said, highlighting that macroeconomic stability is key to attracting investments and facilitating the lifting of exchange restrictions.

Source: Ambito