This was reflected by the “Argentine productive situation report” prepared by productive missiona space that brings together referents from different productive sectors, with experience in both public and private management.

The work in question emphasized four factors that put the productive framework in checkdespite calm in the consumer price index (CPI) and some other financial variables.

1) Commercial Opening and Downt

On the one hand, the report warned about the risks that the Combo Commercial Opening + exchange appreciation generates on the local economy, mainly in those sectors of the manufacturing industry that compete with exterior products. It is worth noting that currently the real exchange rate crosses its Second period of greatest appreciation from the departure of convertibilityonly surpassed by the August-November 2015 period.

This “strength” of weight is more based on the stocks than a productivity gain of the Argentine economy. If this is added the removal of the country tax and of paraarancelar barriers, it becomes obvious that There are increasing incentives for companies to replace local imports.

“While the country has a closed economy and it is necessary to move towards greater commercial integration, this must be done intelligently. The story shows that Open the economy in a low exchange rate context generates deeply negative impacts on the productive structure”, Warned productive mission.

image.png

It is worth highlighting some important differences with respect to previous periods of commercial opening and exchange delay. For example, Today this combo is not accompanied by a significant recovery of the consumption of Argentinesas it did, for example, in the first years of convertibility, which further hinders the process of adapting Argentine companies to the new competition. This occurs largely since only 40% of the population (formal private sector workers) are showing a sustained rebound, although still far from the last maximum of 2017.

In this context, the lack of instruments available so that the sectors affected by the competition can adapt, is already generating Investment operations and brakeas happened in the case of Nissan.

2) Lack of policies that promote suppliers and job creation

Another point indicated by productive mission was the lack of a comprehensive strategy that favors long -term productive development through policies promoted from the State that they have as Horizon value aggregation, better insertion in international markets and reduction of territorial inequalities. According to the report, fiscal and deregulatory incentives promoted from the government do not reach to meet these objectives and need other tools, which include programs and financing lines that were dismantled from the arrival of the libertarians to Casa Rosada.

Regarding the design of the Rigi, the report marked the lack of requirements that allow the development of suppliers and the generation of Employment Borders within the country. “In sectors such as mining or hydrocarbons, the implementation of these incentives without industrial planning that foster productive chains could lead to an enclave logic with low value aggregation and low employment levels”He deepened.

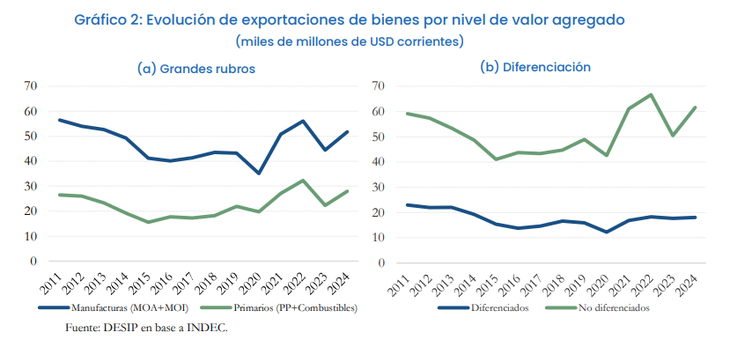

According to a study by the Interdisciplinary Institute of Political Economics (IIEP) of the University of Buenos Aires (UBA), 95% of the RIGI projects correspond to the energy and mining sectors, two of the three sectors with the greatest weight in Commodities exports, only behind agriculture. In that sense, the work highlighted the export potential of these investments but said that “The weak flank of the Rigi is the absence of a broader strategy to promote investments in sectors and activities capable of competing internationally in products and services with a higher degree of differentiation“

image.png

In the same direction, a more recent IEP report reflected that, while commodities exports traced the improvement of external sales in 2024, products with the highest added value barely showed an annual increase of 1.9%. In addition, By 2025 a fall is expected for the shipments of the latter type of goods, mainly due to the negative effect of the exchange assessment.

3) Paralyte Public Works

With a more structural impact, the suspension of public works was a third element underlined by productive mission, which erodes the competitiveness of domestic production since it implies a deterioration of the existing infrastructure and prevents the necessary incorporation of new capital. “Without investments in transport networks, energy connectivity and access to ports, the country’s productive capacities are severely limited, which Increase production costs and weakens export capacity”He said.

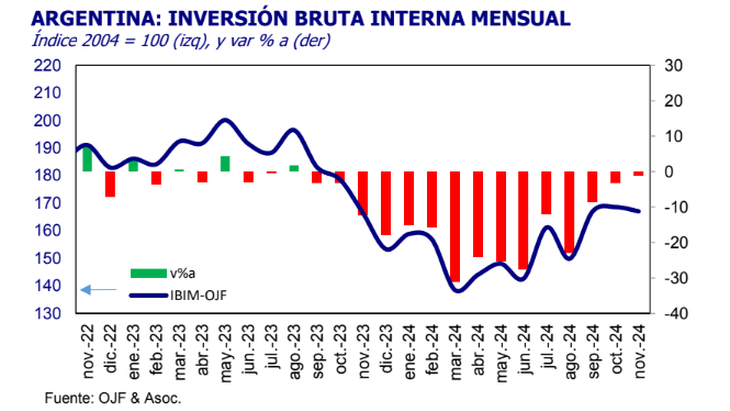

image.png

According to a survey of the PXQ consultant, Infrastructure investment was in 2024 the lowest since the 2001-2002 crisis. This occurred after capital spending suffered a real fall of almost 80%, thus being the most affected item of the budget.

Depending on the official speech, no major changes are expected for this year Since the logic prevailing in the government is that it is the provinces that must take care of the works. However, the electoral situation can generate changes in this regard.

4) Science and technology cuts

Finally, productive mission emphasized the cuts that the government applied to the budget in science and technology, as a decision that can deepen the gap between the Argentine economy and that of the rest of the world to compromise local capacities in innovation and generation of Added value. In that sense, he said that “without a technological development policy that promotes collaboration between the public and private sector, The Argentine economy will be behind in an international context increasingly oriented to digitalization, advanced manufacturing and knowledge industry”

Source: Ambito