The impact of $ pound scandal On the political level it is evident. Although somewhat less clear, the alleged cryptophaf which involves Javier Milei It also left effects on the financial level. While the CCL dollar It accumulates a moderate weekly increase of 1.5%, this does not imply that the demand for currencies has not reheated. Is that, in recent days, the City operators found that The Central Bank accelerated its interventions to contain the gap with currencies of the reservations. And estimate that In the last month I would have used more than US $1 billion With that goal.

There are still no official data that confirms it, but the indications abound. A constant was to see on the screens a strong offer of the bonds with which financial dollars are operated in the last minutes of the wheels, which in the market attribute to the participation of the BCRA.

It is not something new. Since mid -December, the monetary authority deepened the intervention On the gap through the sale of dollars of reserves, which in net terms remain in very negative terrain. In the second half of that month, the BCRA used US $ 325 million; In the first half of January, US $ 619 million. Both data were revealed by the vice president of the entity, Vladimir Werning.

Since then, the strategy continued and some sources consider that it was even accentuated. Is that, despite the warnings about the entire arch of economists, The Government seeks to sustain its exchange rate appreciation to mitigate inflation In the middle of the election year. To prevent devaluation expectations, the official decision is to intervene over the MEP dollar and the CCL each time the currency demand makes the contributions upload.

Dollar, cryptophaf and intervention

In recent days, at the time of the repercussions of the $ Libra scandal, which involve the president, the City’s tables identified a greater presence of the presiding entity Santiago Bausili.

“After the irruption of the ‘cryptogate’, a strong jump in the operated volume of GD30 and Al30 in D and C was recorded (MEP and CCL, respectively) that suggests BCRA intervention. In the last two wheels it was US $ 152 million YU $ S167 million, ”said Personal Investments Portfolio (PPI) In a report sent to its customers.

image.png

It is a negotiated volume of the bonds with which the financial dollars that were not seen since mid -January, despite the fact that in the previous wheels were already observed above the usual ones. From that track, Operators infer that the sale of reserves to contain the gap would have accelerated after the outbreak of crypto -scandal.

It should be remembered that this is the direct route of official intervention on financial dollars, but it is not the only one. Alcista pressures occur despite the continuity of the “Blend dollar”an indirect intervention route that derives 20% of the liquidation of exports to the CCL market and makes those currencies (about US $ 1,300 million per month) do not enter the reserves. The BCRA action reflects that the “blend” It is not enough to supply the growing demand for dollars.

Intervention and Low Reservations

Suffained by the liquidation of private indebtedness in foreign currency, the BRCA sustained a considerable rhythm of purchases so far this year despite the growing foreign currency bleeding due to tourism to the outside and the compression of the commercial surplus, derived from the exchange appreciation and the Importer Opening. However, From January 7 to today the gross reserves fell at $ 4,543 million.

PPI calculated the evolution of reserves from Between January 10 and February 14and the effect of payment to the bonds cleared: U $ 2,103 million fell, despite the fact that in that period the central bought US $ 2,097 million in the official market.

What happened? In the middle there was Debt payments to international organizations (including IMF) for US $ 838 million, lace descended US $ 2,388 million (in the middle of the sustained Output by dripping of dollars in dollars) and operations with the public sector were negative at US $ 363 million. The other great factor was the direct intervention of the BCRA on the exchange gap.

PPI explained that, in the BCRA clues that show the factors that affect the evolution of the reserves, the category “others” subtracted US $ 610 million. That category “consists of variations in value as well as passive passes in dollars with the outside, and the interventions in the CCL/MEP, among other operations,” he said in his report.

However, in the period analyzed, the golden holdings of the central increased their value at US $ 426 million, while the Yuanes in the portfolio rose to US $ 156 million following the rebound of their contributions against the dollar. “Therefore, There is a rest without explaining -u $ s1.192 million “he warned PPI. While there are no official data that ratifies that this amount has been pure intervention of the BCRA in financial dollars, “everything indicates that we could infer it”he concluded. Consulted by the field, an operator of the City, who preferred the off the record, agreed that the amount used in that period would have exceeded US $1 billion. To that, we will have to add the last wheels.

Pressure factors on the exchange scheme

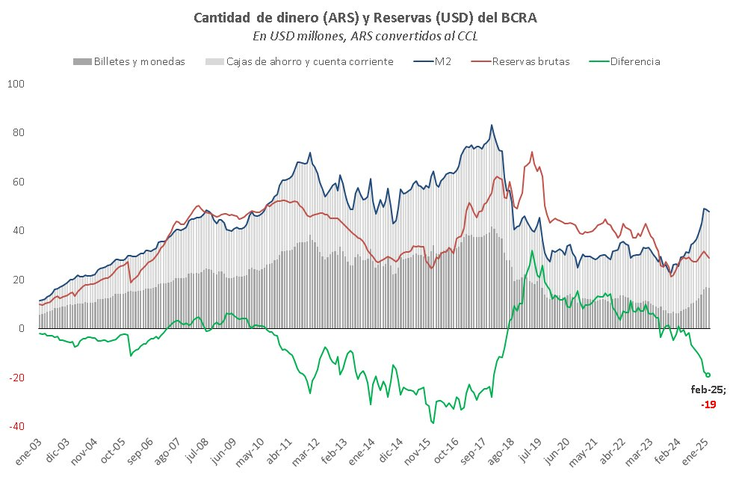

Beyond the impact of crypto -scandal, this dynamic shows that There are factors that press about the strategy of deepening exchange appreciation In a context of currency scarcity. The Economic Studies Management of the Province Bank He analyzed three of them and warned: the amount of pesos grows faster than reserves, imports grow faster than international holdings of the BCRA and debt maturities in the coming months represent a bulky load.

Regarding the first point, he pointed out that, between June 2024 and February 2025, the pesos in circulation added to the stock in savings boxes and private current accounts grew 55% measured to the CCL. In contrast, gross reserves fell 1.5%. “So, There are more liquid weights that could press on the dollar you reserve to answer “Bapro analysts raised.

image.png

Source: Economic Studies Management of the Province Bank.

On the other hand, they pointed out that, between June 2024 and January 2025, imports grew 40% (without seasonality), while gross reserves advanced 4%. “In this way, The demand for dollars grows faster than its offer. As a result, the import months covered by reserves fell from 6.4 to 5.2, ”they warned.

In addition, they calculated that debt maturities in foreign currency both from the public sector and companies ascend to U $ S18.9 billion In the remainder of the year: US $ 6.4 billion here at the end of June YU $ S12.5 billion in the second semester.

While Milei and Luis Caputo seek to close a new program that includes a new indebtedness to prop up the reservations and, as they promise, open the stocks, the Bapro concluded: “The most accelerated increase in the amount of pesos and the demand for dollars in relation to reserves could tighten the exchange rate in the coming months.”

Source: Ambito