The discussion about Sustainability of the current level of the exchange rate It took a central place in recent weeks, after regular signs of periods of periods of backwardness in the price of the dollar. In line with the vision of the government, There are specialists who see conditions given to maintain the strategy.

Such is the case of the consultant Delphos Investment From where, depending on the recent devaluations experiences, they highlighted Three factors that are not present today and that move the possibility of a exchange jumpat least in 2025.

1) deterioration in exchange terms

One of the causes that usually lead to adjustments at the price of the dollar, according to a report by Delphos, is the deterioration in the terms of exchange. In other words, that the fall in the price of exports is more significant than the decrease in the price of imports, or that the prices of external sales fall while the prices of purchases upload.

The survey recalled that between 2003 and 2011 the Boom of the Commodities was key to the thriving dynamics that exports exhibited and for the accumulation of reserves, two necessary conditions to support the level of exchange rate.

On the contrary, the devaluation of 2014 carried out by former Minister of Economy Axel Kiciloff, coincided with a sharp collapse in the value of soy and oil. Likewise, the 2018 run, during the government of Mauricio Macri, was also given in a depressed international prices framework.

image.png

By 2025, the consultant stressed that “The improvement in exchange terms has already generated a gain of US $ 405 million” in January, which arouses some optimism In this matter.

2) Reduction of exports in quantities

Another of the indicated elements that feed the devaluations was the reduction in the exported amounts, a fact that is usually tied to climatic crises Given the dependence that Argentina has of its agricultural exports. As an example, the drought of the 2017/2018 campaign reduced agricultural sales in 10 million tons and was an imponderable that did not contribute to stop the devaluative expectations at that time.

Regarding this point, in Delphos they warn that “The climatic conditions have been normalized to finish the 2024/2025 campaign without shocks”. In parallel, the entity stressed that, despite the increase in imports that are expected for this year, “oil and agricultural exports would contribute US $ 5,450 million”, which would leave a commercial surplus close to US $ S15,000 million.

It should be clarified that Since June of last year the current account of the Central Bank (BCRA) became deficient. On the one hand, this was due to the advancement of imports, in a context of greater normalization in the payments calendar and removes taxes and regulations.

However, the obvious delay in the exchange rate also became an incentive to accelerate purchases abroad. In addition, it was the reason that explained the great deepening in the deficit of the balance of services, explained fundamentally by tourism abroad.

Although a new year of commercial surplus is estimated, all these elements light some alarm signals in case the current exchange scheme is maintained. That is why The financing through the financial account will be essential.

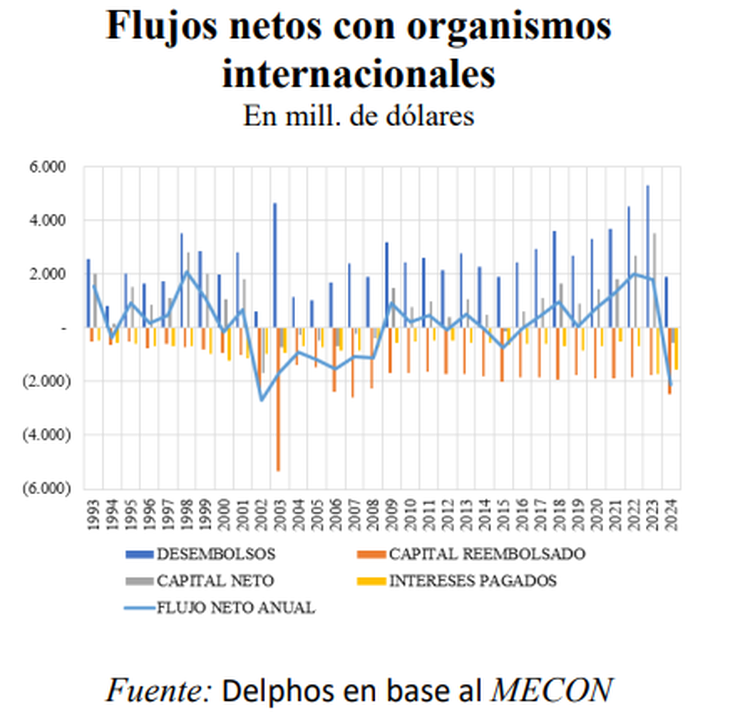

3) Negative balance with international organizations

On the other hand, the Delphos report said that the fact that the country is currently paying both interests and capital of the debt is “unheard of for most globe countries” and happens by the history of Argentina in the field of indebtedness and default

image.png

Taking into account that “historically the disbursements of international organizations have surpassed capital payments,” The perspective is that by 2025 not all debt is canceled, which could grant a financial relief of US $ 4,500 millionof which US $ 2,500 million are already deposited in the BCRA. “In addition, the government is negotiating with the IMF a new agreement (it is believed that for US $ 10,000 million), to reinforce reservations and make the exchange market more flexible,” said the consultant.

What do other economists think about it?

In dialogue with Scopethe economist Jorge Neyro He said that the most important factors to give sustainability to the exchange strategy are the dynamics of exported amounts and net financing with organisms, given that exchange terms usually show volatility. “Trump aims to lower oil prices”he said.

As for exports, the expert avizoras a Positive support in the maturity of Vaca Muerta and a thick harvest that is estimated under normal conditions. Regarding financing with agencies, he said that the currencies from the IMF “would be a bridge towards some type of exchange rate that makes the real exchange rate more flexible. “

“Then we’ll see what comes out of that. Meanwhile, The agreement with the IMF can contribute to wanting any type of expectation“He added.

Source: Ambito