He Unbalance between the current account and the financial account of the Central Bank (BCRA) could generate a missing US $ 13,000 million in 2025, According to private estimates. In that framework, analysts warn that the type of Agreement that is reached with the International Monetary Fund (IMF) It will be essential to calm uncertainty about the exchange strategy in the second semester.

The current level of the exchange rate, the largest commercial opening, the recovery of economic activity and the currencies destinedsa contain the gap between the official and financial dollar of the Central Bank for several months now.

So far, the private indebtedness from laundering dollars allowed to cover that “red”, although that source of financing has an expiration date and needs other alternatives.

Without agreement with the IMF, the BCRA accounts do not close

According to a report by the CP consultant, this year the current account will present a deficit of US $ 19,000 million. The reasons are fundamentally four: the reduction in the surplus of the balance of goods, the deepening in the deficit of the balance of services (not only because of the negative balance of tourism but also due to a lower result in other items due to the exchange rate appreciation), the support of the dollar “blend” and a payment of interest of debt slightly lower than in 2024.

image.png

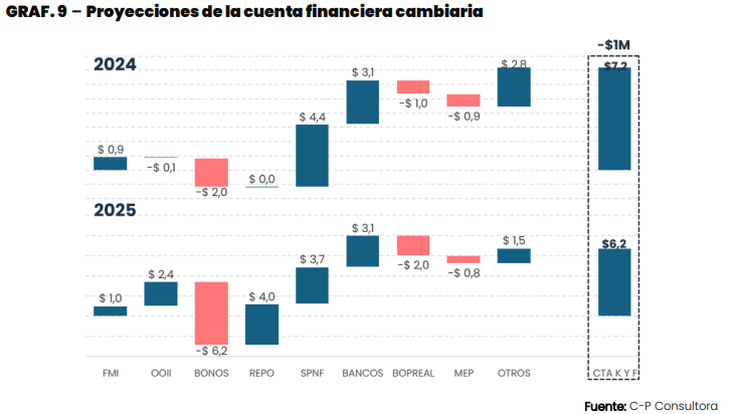

In parallel, according to CP estimates, The financial account will only contribute US $ 6,000 million. “Even in a context of optimistic assumptions regarding the public and private financial account (although without a special agreement with the IMF), the financing contributions are hardly higher than those of the year that happened,” said the entity led by Federico Pastrana and Pablo Moldovan.

image.png

Faced with the shortage of dollars projected, the government is seen before the prevailing need to get some type of additional financing. The disarmament of the “blend” and the direct intervention of the BCRA in the stock market emerge as the solution most at hand to overturn to the official currency market that today are destined to intervene the quotes of the MEP and the CCL.

However, this would imply putting the limited gap at risk, which could feed expectations for devaluation and harm the exchange scheme. It is in that context that negotiations with the IMF acquire great relevance.

“In July 2024 the fund asked the government to disarm the ‘blend’. But the scheme continued and from there there were no more disbursements,” said the economist Matías Rajnerman.

Can you maintain the current exchange scheme and agree with the IMF?

From the Economic Studies Management of the Province Bank They stressed that Argentina’s debt represents 28% of the IMF total portfolio, and that this percentage can be raised to 35% in case the fund makes an additional disbursement of US $ 15,000 million.

In that scenario, the economists of the province They asked “if in 2025, with a more demanding exchange scenario (for less commercial balance and more debt payments), the agency will be lent to new disbursements With this level of dollars spent on containing the gap. “

“Continue to expose its portfolio, with such an intervened exchange market, It can be contradictory to the objectives of the IMF. This year there are no capital payments, so any disbursement would imply increasing net debt, “they warned.

In that context, CP does not rule out that the agreement with the IMF is interpreted as a Transition scheme to which strong reforms will happen after the electoral process. “It is worth asking whether the support of the IMF will allow the government to dispel devaluation expectations or on the contrary, it will tend to coordinate them around the electoral process. It is a no less aspect, as long as it sustains the credibility of exchange policy in the months before the elections is fundamental to guarantee the positive effects and the power of the exchange anchor“The consultant deepened about it.

Source: Ambito