After almost a month of validity of the temporary leave of withholdingsonly on the last wheels began to wake up the liquidation of agriculture. Until last week the income of dollars of the sector had been reduced. This gives him oxygen to the Central Bank to extend your purchases in the official market. However, the BCRA maintains its constant intervention on the exchange gap and drain reservations on that way.

The entity chaired by Santiago Bausili was able to stretch its Buying streak of currencies in the official change market. This Wednesday, he acquired US $ 111 million and managed to accumulate a favorable balance of US $ 917 million in that place during the last six wheels.

So far in February, their purchases amount to $ 1,763 million. Personal Investments Portfolio (PPI) stressed that this is equivalent to a daily rhythm of US $ S97 million, “the highest since May 2024 (US $ 115 million), in full peak of liquidation of the thick harvest.”

Dollar, liquidation and urgency to add reservations

The novelty is that the performance of the last days It was due to a Improvement in the agricultural currency liquidation rhythm. The sector entered $ 134 million on Tuesday. He had already contributed US $ 330 million on Wednesday of last week, US $ 87 million on Thursday, US $214 million on Friday YU $ S152 million on Monday.

image.png

“The agro liquidated an average of US $ 183 million between last Wednesday and Monday, the greatest rhythm since the beginning of August 2023 (U $ S221 million), when one of the export increase programs implemented by (Sergio) Massa was standing, ”he said PPI In a report for your customers.

The number contrasts with what happened in the first weeks after the implementation of the temporary decline of retentions, which entered into force on January 27. The shortening in the liquidation deadlines required to access the reduced aliquot of export rights had put the liquidation in stand by, which in the weeks following the start -up had even drilled the US $ 100 million average daily.

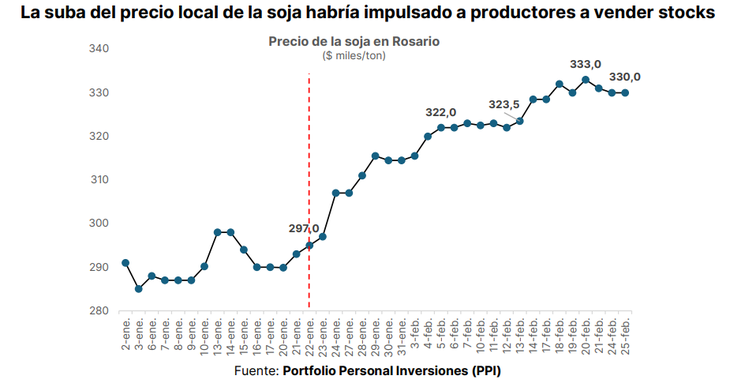

What happened? According to PPI, the improvement is explained by “a change in soy prices dynamics in the local market ”. After oscillating between $ 322,000/323,500 per ton between February 5 and 13, the price of the oilseed in Rosario climbed to the $ 330,000/333,000 range per ton since then.

image.png

“Far from randomly freed, producers sales to exporters since then accelerated, which resulted in a greater liquidation in the sector. This price rise would have been sufficient to boost producers to sell part of the previous campaign stock ”the report said. That remaining stock would be around $ S6,000 YU $ S7,000 million, according to agriculture sources.

Some operators considered that the rains of recent days also contributed to producers deciding to sell part of the accumulated stock.

In any case, the Government is committed to this dynamic being enhanced in the next few days. The thing is Net reserves are still in very negative terrain Despite the purchases of the BCRA and exhibit the urgency to make currencies to try to credibility its exchange scheme based on the appreciation, which receives questions of economists from the entire ideological arch. All this while negotiating with the IMF a new program that includes extra indebtedness, of which there are no major news.

Dollar: The intervention on the gap is extended

The truth is that, Although the BCRA accumulates a strong buyer balance in the official market so far this year, Gross international reserves fell almost US $1 billion since it ended 2024. Some of the factors are the bulky Debt payments external (to the bonds, to the IMF and other organisms) and the incessant Sangría de Deposites on Accountants It impacts the lace.

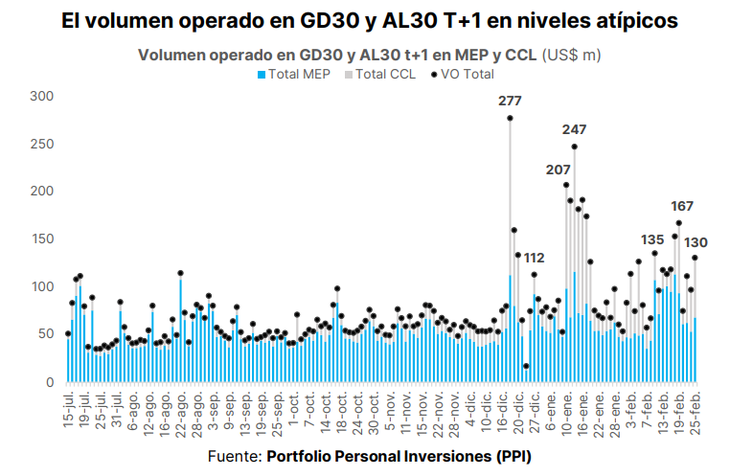

The other great factor is the intervention of the central with the sale of reservations in the bond market to contain the pressures on the MEP dollar and the CCLand prevent the exchange gap from exceeding 15%. That action became incessant. In the absence of more up -to -date official data, it is known that in that way the BCRA released US $ 619 million in the first half of January, according to data showed by its vice president, Vladimir Werning.

However, in the following weeks the intervention became practically constant. As it was afraid, Between January 10 and February 14, I would have spent more than US $ 1,000 million for that purposeaccording to private calculations.

PPI indicated that the BCRA would have been present on Tuesday with interventions in the financial market. The volume operated in GD30 and 30 C and D in T+1, the most used bonds to make MEP and CCL, climbed from US $ 97 million on Monday au $ s130 million in the next wheel. The firm considered that it is “an atypically high value.” He added: “This intervention served for financial dollars MEP and CCL to increase only 0.4% to $ 1.212 and 0.1% to $ 1,215, respectively.”

image.png

Source: Ambito