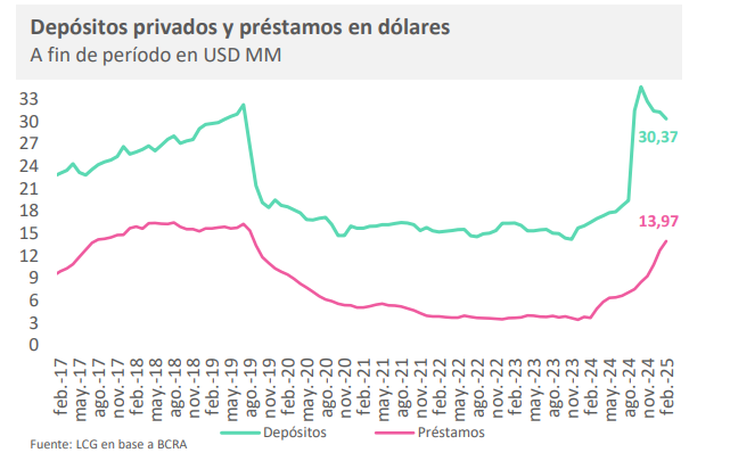

The stock of credits in dollars to the private sector grew for the eighth consecutive month in February, touched the US $14,000 million and quadrupled the December 2023 level. This allowed the Central Bank (BCRA) to compensate for the currency exit for debt payments, intervention in the exchange gap and lace reduction.

According to a survey carried out by First Capital Groupbased on BCRA data, The amount of loans in US currency increased 9.6% Regarding January, to accumulate a stock of US $ 13,966 million. Also, in interannual terms an extraordinary jump of 233.6%was verified.

image.png

The commercial loan line explained the vast majority of financing (76.4%) and was the main engine of the increase Total, with an annual advance of 268.1% and 9.7% compared to the previous month. On the other hand, he highlighted a 10% monthly drop in dollars debt for the use of credit cards abroad, a segment that explained 5.6% of total financing in hard currency.

“The financed balance of the Credit cards registered an interannual rise of 122.9% although with an irregular monthly behavior alternating increases and low. Although the greatest use of plastic abroad stands out, the February numbers have been lower than those of January, “they said from First Capital.

Financing in dollars like BCRA lifeguards

From the consultant LCG They stressed that the stock of credits in dollars grew more than US $ 10.1 billion in 12 months and is already four times higher than the level of December 2023. As a reflection of this jump, In recent months the loans became the main source of foreign exchange supply in the official change market (Mulc).

In the second month of the year the BCRA registered a positive net balance of US $ 1,948 million in the Mulc. According to LCG, this occurred thanks to a higher level of liquidation of the agriculture after the decrease in retentions (US $ 2,400 million vs. US $ 1,900 million in January), to the aforementioned Increase in the stock of loans with liquidation obligation in the official market (US $ 1,310 million) and to place negotiable obligations (ONS) in dollars (US $ 485 million).

These factors achieved more than compensating the output of US $ 800 million for payments to international organizations, the Lace reduction at US $ 400 million due to the fall of deposits in US currency and the US $ 550 million that left the coffers of the monetary authority to intervene the quote of the financial dollars.

image.png

Regarding the decline in the deposits, LCG stressed that “since November 8, at which time ended stage 1 of the laundering and has the possibility of withdrawing its deposits without penaltyUS $ 3,865 million have already been withdrawn, a quarter of the total entered by capital repatriation“

Many analysts argue that currency financing has air still to continue expanding If taken as a parameter, for example, that during the presidential management of Mauricio Macri a stock of US $ 16,000 million was reached. However, the decrease in deposits is still an element to monitor.

In this regard, Melisa SalaLCG chief economist, expressed in dialogue with scope that “the possibility of continuing the expansion depends mostly on demand rather than supply“And that such demand” may be associated with the need to prefinanize exports, or the strategy of advancing liquidations to take advantage of the momentary decline of retentions and the high interest rate in pesos (although the rise of financial dollars of recent days, evidencing tensions in the change market, can stop this effect). “

For his part, Sebastián Menescaldi, director of the consulting firm, said that “the numbers indicate that they would remain between US $ 2,500 YU $ S3,000 million to lendtaking into account what the deposits grew, the liquidity that banks would like to have and the cash surplus that financial entities still have in their vaults. “

Does the dollar loans generate some type of systemic risk?

On the possibility of a significant barefoot of coins for the jump of hard currency credits, Sala recalled that today that risk is low, Since “loans are granted exclusively to people/ companies that can demonstrate income in foreign currency, a macroprudential measure taken post -convertibility.” This despite the fact that the BCRA recently decided to allow foreign exchange in currencies to agents of the economy with income in pesos, as long as the funds of the banks come from ONS or credits abroad, and not of the deposits of the people.

Menescaldi agreed that currently the debt stock is not to be alarmed, as long as the liquidity of the banks is not reduced very abruptly. “With the current level of lace, the liquidity in the treasure and the assets of the banks in dollars, there is no risk in the short term of a systemic stress”he deepened.

The agreement with the IMF, key to supplying the money laundering

In summary, although loans in dollars are still giving the BCRA air, The Government must look for alternatives for when that source of financing is over. In that sense, the revenues of the thick harvest in April/May could be a first bridge.

Then, the panorama is more uncertain. And it is in that framework that For the ruling, it is essential to close the new agreement with the IMF.

Last week the Executive Power reported that it will seek that Congress of the approval of a decree of necessity and urgency (DNU) to seal the treatment with the multilateral credit agency. According to private estimates, the fund could give the country between US $ 12,000 million YU $ 20,000 million.

Source: Ambito