The economist said the Government could lift exchange restrictions this year and explained the reasons why the small print of the agreement with the IMF is not revealed.

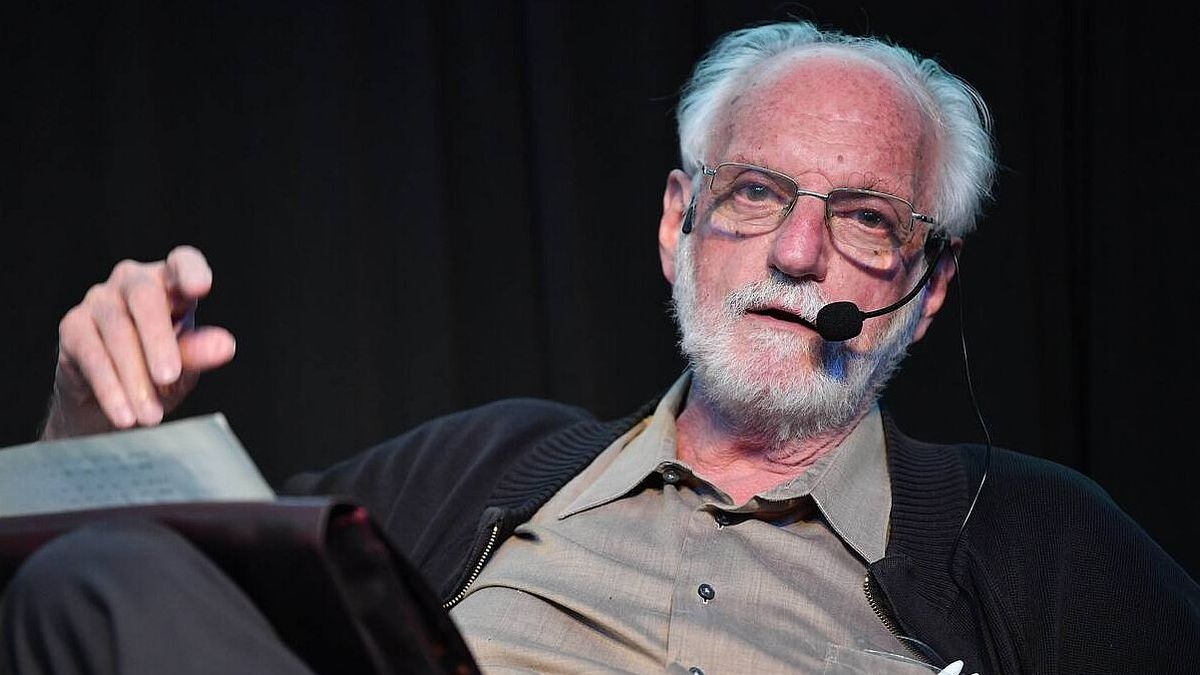

The renowned economist Juan Carlos de Pablo He referred to the country’s exchange situation and assured that there is a weight of weight for the government Eliminate the stocks to the dollar This same year. Besides, He explained why the administration of Javier Milei avoids giving details about the agreement with the IMF in the recent decree of necessity and urgency (DNU).

The content you want to access is exclusive to subscribers.

Uncertainty about stocks and exchange rate

Pablo argued that the government cannot advance how the lifting of the stocks will be, or at what time it will be given, since revealing those details would generate speculative movements. “The DNU does that is to tell the treasure that it can change the creditor and that the gross debt does not increase. Now, do you think the president will send the small print to Congress, with details that may include a devaluation jump with date? That is the same as believing in the Magi, ”he ironized.

About the current exchange policy, De Pablo said that the devaluation of 1% monthly of the official exchange rate “is not written in stone” and that it could be modified according to the evolution of the economy. In addition, he pointed out that in the 69 years of relationship between Argentina and the IMF, almost 30 agreements were signed and none went through Congress.

CEPO EXIT: A REASON OF WEIGHT

Regarding a possible elimination of exchange restrictions, the economist indicated that the strongest argument for the government to make this decision in 2025 is to improve the country’s credit qualification and reduce the country risk. “The best reason I found to justify why I would leave the stock this year is to give time to risk ratingrs to improve the note and that the country risk falls, in order to pay the expirations of 2026 with external financing,” he explained.

He also warned that, although some argue that there is no exchange delay, the decision to lift the stocks is political. “The one who plays life is the president of the nation and the president of the Central Bank,” he said.

The agreement with the IMF and the Argentine economy

In relation to the negotiation with the IMF, by Paul highlighted the support that the agency grants to the Argentine government. He pointed out that the head of the IMF, Kristalina Georgieva, “cannot believe” the fiscal effort that the country has been making and said there will be no problems in the approval of the agreement. However, he warned that bureaucratic obstacles linked to the loan received during Mauricio Macri’s management could arise.

Finally, of Paul reiterated that the government maintains fiscal balance and the 1%crawling. In that sense, he minimized warnings about an alleged exchange delay. “Economists who say that the exchange rate is behind use arithmetic, but the economy is not arithmetic. In the government of Alberto Fernández we bought dollars to flee. If more dollars appear, the exchange rate discussion will have another relevance and other consequences, ”he concluded.

Source: Ambito