Despite the rebound for the activity in 2025, Companies in the manufacturing sector do not see the light at the end of the tunnel. The use of installed capacity pierced 50% in a key category of the industry, according to a recent survey that warns Only 16% of the firms consulted plan to increase occupation. Sales in supermarkets do not rebound and collapse the consumer confidence index.

The data arises from the last report of the Pyme Observatory Foundation. The encouraging closed from 2024, with the rebound of the economy, exchange stability and financial euphoria, did not infect at the beginning of 2025. The fragility on the external front touched the door and The net reserves of the Central Bank retreated until the level of December 2023the country risk returned to the area of the 750 basic points and the rebound cooled in much of the indicators of the real economy.

The most forceful data is that of Mass consumption. According to the survey of the Scentia consultant, the fall exceeded 10% year -on -year in the first bimester of the year and in this case there is no possible comparison with the “Platita Plan”. In that survey There is no face -to -face sales channel that is saved: in February the supermarkets fell 6.5%, the self -service 12.6% and the wholesalers 7.4%.

Deterioration is also reflected in expectations. The consumer trust index (ICC) prepared by the Torcuato Di Tella University fell 6.7% in the March measurementGuarismo worsens more (9.29%) in Greater Buenos Aires, mother of all battles in electoral terms.

WhatsApp Image 2025-03-23 at 16.32.14.jpeg

The great mass consumption firms that operate in the country are disoriented. There is no brand promotion, promotion or relaunch that seduces consumers, who opt for only for “Day to day purchases”as explained by an experience manager in the sector, who acknowledged that the volumes are far from approaching those of previous years.

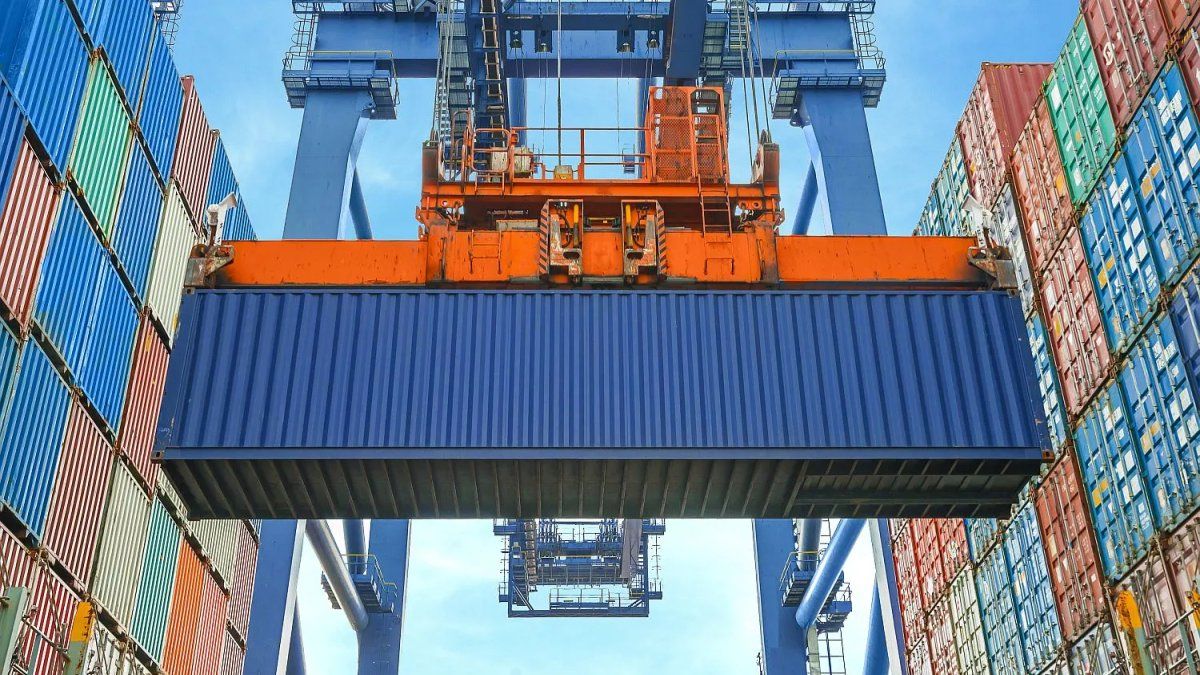

The importing boom

For local manufacturers, not only the cake is shrink, but also the cast is different: Food imports, which have been increasing since the middle of last year, grew an interannual 87% In January and beat a new record, according to data from the Institute for Argentine Agroindustrial Development.

The firms detect a component different from that of convertibility. At that time the fury of imported in the gondolas was very focused on premium products or that did not occur in Argentina. In this case, The phenomenon is more focused on items that enter low cost due to exchange backwardness, such as milk from Uruguay or Albania noodles.

Whatsapp image 2025-03-23 at 16.32.30.jpeg

Import jump exceeds food. In the textile and clothing sector, forced reconversion is being given, from importers to importers: “Sales were stopped at the beginning of the year and the costs are triggered, I just sent a prototype in China, to see if I can improve the equation,” the head of a renowned brand confessed to this medium. To add incentives to this phenomenon, the government will lower tariffs in the sector.

Far from being a sector problem, Import boom is a headache for macroeconomics. In February, purchases abroad jumped 42% year -on -year and significantly reduced the surplus of assets au $ 227 million, which do not even reach the red that produces the service account. Less dollars, more exchange pressure in the prior to the agreement with the IMF.

More machines off

A recent report by the Pyme Observatory Foundation It realizes that the panorama is not very encouraging for the productive sector. Only 16% of the 421 signatures consulted expects to increase their occupation and less than 35% have planned to increase their investments.

All this after a year that closed with a 10% decrease in production and 15% in deflated sales. That is why “2024 ended with the second largest fall in production after pandemic and also the second largest fall in employment, only surpassed by the fall of the year 2009 in the framework of the international crisis.”

In Pyme Observatory they alert for the “Employment Destruction Process” And industrialists believe that the worst did not happen. Metallurgicals begin to see the Stop in the first supplier lines of the different sectors with a lot of national production replacement for imported goods.

The anticipated data of the Association of Metallurgical Industrialists turns on a new alert signal: the use of the capacity installed in the sector fell again and currently already drilled 50%. That is, half of the machines are turned off in that area.

Source: Ambito