Argentine Chancellor, Gerardo Wertheinhe lands on Tuesday in Washington to meet with the United States Secretary of State, Marco Rubiowith a specific objective: set the date of the meeting between President Javier Milei and Donald Trump In the White House.

The appointment, that the libertarian government enarbola as a diplomatic trophy, arrives at a time of maximum economic tensionjust when Kristalina Georgievamanaging director of the International Monetary Fund (IMP), it has just praised Milei’s adjustment as “impressive” and prepares the land for a new financial agreement. However, the horizon is overshadowed with the exchange pressurethe uncertainty of the markets and a new budding: the reciprocal tariffs That Trump could announce tomorrow, April 2, and that they would include Argentina in their protectionist sight.

The Werthein-Rubio meeting, confirmed by the Foreign Ministry, is not just a matter of presidential agenda. In the background it beats the need to align the support of the United States – heavy peso in the IMF directory– To unlock a loan that the Government estimates at US $20 billion. Georgievaat a recent conference, he described the first year of Milei’s economic plan as “one of the most impressive cases in recent history” and, as revealed to Reuters, considered “reasonable” an initial disbursement of 40% –As US $ 8,000 million – as a kick of the new program. The government wants a greater disbursement.

Although the IMF reiterates its support for the “Argentine people”, vagueness on conditions and deadlines feeds doubts. Is that wink enough to calm some markets that saw the blue dollar climb to $ 1,325 and the CCL brushes the $ 1,300, while the Central Bank holds the officer after burning almost US $ 1.8 billion in two weeks.

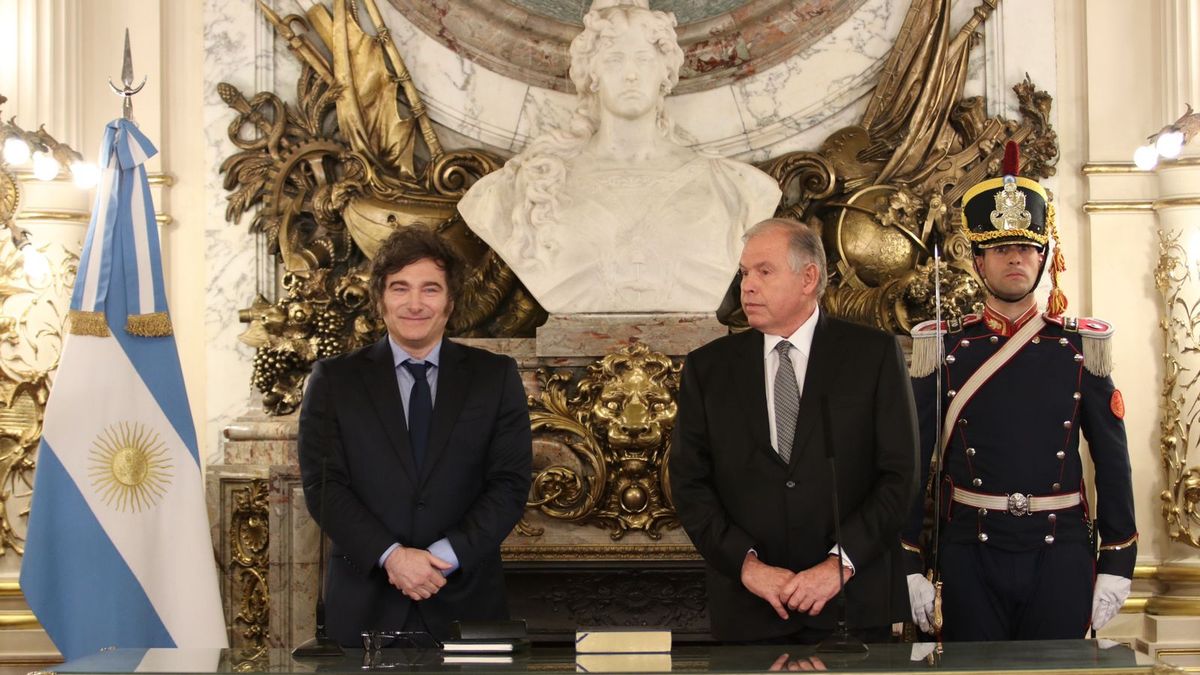

Milei and Trump 03.jpg

The gap rules: what the government wants until October

Official optimism clashes with a financial reality that does not respond. The exchange gap, which is already comfortable above 20%, is a distrust thermometer that neither the fiscal and commercial surpluses manage to dissipate. And now, Trump’s shadow is added to that explosive cocktail.

Tomorrow, the US president could formalize his policy of “Reciprocal tariffs”a measure that would match the rates that the United States applies to imports with which each country imposes on American products. For Argentina, with an average tariff of 12.5% compared to 2.5% of the United States, the coup would be significant: key exports such as aluminum and steel – and punished with 25% since March – could face even higher barriers, affecting giants such as Aluar and Tenaris, which in 2024 sent the US market about US $ 600 million in those metals.

On this chess board, the United States Treasury Secretariat emerges as a decisive player. With Scott Besent in command – a financier of Wall Street with a trajectory in coverage funds – the treasure exerts a direct influence on the IMF decisions, where Washington holds the greatest vote power. Besent, who assumed the position in January, has a previous link with Luis Caputo, the Argentine Economy Minister: both met in New York in September 2024, when Caputo still negotiated with Bonistas and Besent, then a key advisor from Trump, explored the economic course of a possible second republican management.

That meeting, which official sources described as “cordial and productive”, sowed a dialogue line that today could be crucial to accelerate the IMF wink and, incidentally, soften the impact of tariffs on the bilateral relationship. To that we must add the match that Caputo and Besent held at the end of February in Washington. “The Secretary of the Treasury, Scott Besent, He met with the Argentine Finance Minister Luis Caputo, with whom he talked about the impressive measures of administration reform Milei to reduce the inflation, reactivate the growth promoted by the private sector, reduce poverty and Increase real wages“The Treasury Department reported at that time.

Political armor with Donald Trump, dollars in the BCRA

Yesterday, Georgieva tried to clarify her praise with pragmatism. “Argentina has taken huge steps, but the way ahead is still challenging,” he said, stressing that any disbursement will come with conditions – he did exchange or fiscal adjustments – that the Milei government resists explaining. In the market, speculation does not cease. “The IMF always asks for a competitive exchange rate, and with this gap there is no way to hold it without a jump,” warns a financial operator to this medium. The expectation of a devaluation, denied in public but whispered in private, is the elephant in the room that neither the flattery of Washington nor the dollars of the fund seem to be able to exorcise.

Werthein’s play in Washington has, then, a double edge. On the one hand, seeks to consolidate the alliance with Trumpwhose ideological affinity with milei – anti -estatism and preaching promoted – could translate into a wink in the IMF And, perhaps, in an exception to reciprocal tariffs. On the other, he tries to project international strength to counteract the domestic tremor: an inflation that does not yield at all, a social adjustment that crosses and an exchange pressure that threatens to break the dike of the Central Bank. The Milei-trump summit, which could be realized in May, is sold as a political and economic armor for a 2025 that appears stormy.

But the markets do not expect. The volatility of the financial dollar and a country risk above 800 basic points reflect the anxiety of investors, which require tangible facts. U $ 8,000 million of the IMF could oxygenate reserves, but do not solve the structural knot: A model that bets everything to the entrance of external currencies while the local industry is smiling and consumption remains in the subsoil. “It is a race against time: o The world banks us, or the countryside, and oil and lithium take us out of the well,” an economist is close to the government. The threat of reciprocal tariffs, which would hit exports beyond steel and aluminum, adds an emergency layer: if Trump complies, Argentina could lose competitiveness in a key market just when he needs it most.

The big question is still unanswered: Can Georgieva’s praise, Trump’s eventual support and IMF’s dollars become a real lifeless without detonating the stability that the government proclaimed? Or will this other chapter of the Argentine saga, where the promises of greatness collide with a reality that does not forgive? Werthein plays his chips today in Washington, while Trump sneakers his announcement tomorrow and the markets, impatient, look sideways.

Source: Ambito