The study took the data of 2024. In addition, it marked a decline in investor buyers.

A report revealed a rise in the price of real estate.

Image created with artificial intelligence

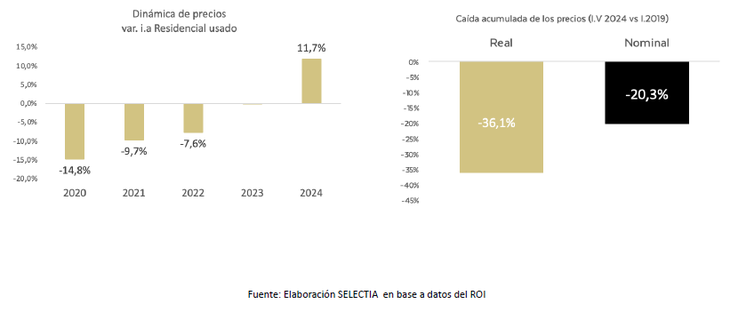

In 2024, the average values of the properties rose between 10% and 12%. Despite the increase, the accumulated fall with respect to the first quarter of 2019 It was 20.3% in nominal terms and 36.1% in real termsreflecting a net with the effect of inflation in the United States.

The content you want to access is exclusive to subscribers.

Besides, It was recorded that the 3 -room properties were the most demanded during 2024. The study was conducted by the real estate network Selectiaon the basis of Real Estate Operations Registry (ROI).

The rise in the average price of properties

Agree the survey, The prices of the properties used in the residential sector increased by 11.7% Regarding the values of the previous year. In turn, the Poprop platform registered a 10% of the departments. On the other hand, the values of the houses remained below, with a minor rise that reached the 4.9% in the same period.

image.png

The price rise was 11.7%.

Selectia

Another indicator that shows the report – which reflects the march of the market – is that of the negotiation percentages or “dribble” That makes a buyer when interested in a property. In detail, the ROI illustrated that the average negotiation percentage compared to the last publication value was 5.7%. While this reflects a fall in 0.9 percentage points fell compared to the same quarter of the previous yearA, also marked an improvement with respect to the numbers of the First quarter of 2019.

What kind of property was the most sought after

The Selectia report also showed that what was most sold during the first half of 2024 were The 3 environments, which represented 30% of the operations. The 2 environments follow on the list, which meant 25% of transactions. The Top 3 was completed by the 4 -room properties, which stayed with a 22% of the best selling.

In this sense, the smallest (monoambientes) and the largest (5 environments or more) are the typologies with less demand with 11% and 12% respectively.

This marks the same trend as the offer registered in its own area where the 3 environments represented 29% of the offer on the platform; 2 environments 28%; 4 environments 18%; 18%monitor; 5+ 7%environments.

Buyer customer type

In addition, the report also contemplated the Property buyer profile. In this sense, the 2024 data reflected that 11% was an investment client, while the rest were carried out with the end of housing for personal use.

This reflects a fall in investor clients with respect to 2023 (12%); 2022 (13%) and 2019 (12%). On the other hand that reflects a rise with respect to 2020 and 2021 (9%), years marked by the Covid-19 pandemic.

Source: Ambito