Economists foresee a reduction in the commercial surplus for this year. Exports fell both for price and quantity in two key sectors for the economy.

In March, Argentina registered a commercial surplus of just US $ 323 million, The lowest since December 2023, despite being the 16th consecutive month with a positive balance. The data reflects a trend: in the first quarter, the accumulated surplus was just US $ 761 million, an abrupt fall compared to US $ 4,401 million of the same period last year. According to data from the Chamber of Exporters of the Argentine Republic (Wax), The setback responds mainly to import growth that exceeded exports, in a context where the official exchange rate remains below $ 1,200.

The content you want to access is exclusive to subscribers.

The four main products exported in March – Harina and soybeans, corn, soybean oil and crude oil – registered falls both in volume and price. This behavior occurs in an economy strongly dependent on primary products. But the current challenge is not limited only to the fall in international prices but also to the loss of competitiveness at the same time that the importing sector is benefited by the exchange rate.

From the consulting firm Abeceb they warned that, even with the recent correction of the official exchange rate within the framework of the new band regime, the Commercial surplus of 2025 is reduced in half with respect to the previous year —Of U $ S18,899 million to around US $ 9,000 million, which shows a significant loss of the external mattress.

Internal level, one of the main obstacles to reverse this trend is the high cost in dollars facing Argentine production, especially in industrial and services sectors. This adds to tax pressure and regulatory obstacles that are gradually disarming.

Screen capture 2025-04-24 095542.png

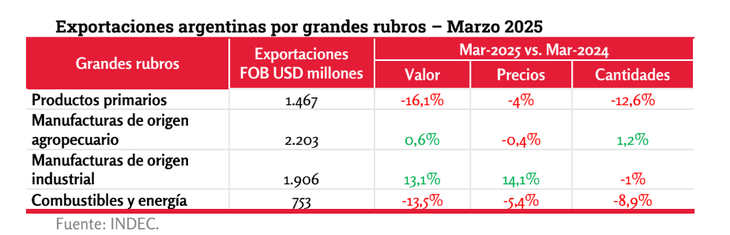

Wax chart showing performance in March of the main Argentine exports.

Provinces: How the tax pressure impacts on exporting companies

In the Pampas regionfor example, withholdings Agro – who represent 4.6% of fiscal collection – are still a strong discouragement to export, according to the IERAL. For the mining and oil sectorsthe lack of infrastructure adequate limits the ability to increase exports.

Meanwhile, the Regional economies —The “another agric” and agri -food industries – face a different barrier: High tariffs They must pay to enter international markets. This limits its competitiveness against countries such as Chile, which has numerous trade agreements that allow it to export with zero tariff to a wide network of destinations.

The solution, the IERAL analysts warn, goes through advancing in the signing of trade agreements that allow to reduce those rates. However, this raises a dilemma: Open the economy by declineing tariffs would also put local industrial sectors that depend on protection In the face of importation, such as appliances, textiles or computer products, all with a strong presence in the national productive framework.

Source: Ambito