From the flexibility of the stocks, the Official dollar for exporters and importers He operated with high volatility, always between the bands set by the government and below the devaluation that the market expected. Anyway, in terms of competitiveness for the Argentine economy, analysts continue to warn problems.

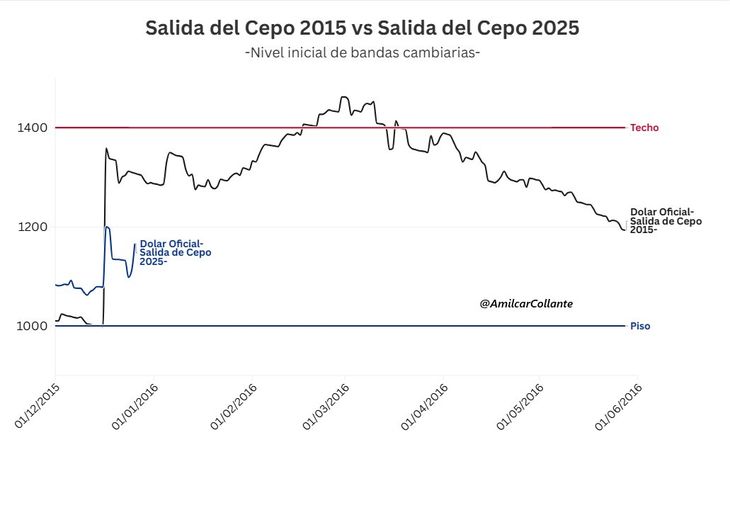

In the first two days under the new exchange scheme, the wholesale dollar rose to the $ 1,200 zone, right in the center of the flotation bands established between $ 1,000 and $ 1,400. That implied a 11% jump in the actual multilateral exchange rate (TCRM)which compares the price of the currency at the local level with that of its commercial partners.

However, that rise did not mean too significant correction of the exchange delay that had been accumulating and the TCRM He returned just at levels of mid -2024, or 2017 To take another reference. Likewise, it remained about 25% below the level of the first four months of Javier Milei mandate, and was even lower than the values recorded during all months of the management of the Front of All, with the exception of November 2023.

At the beginning of this week the officer’s price collapsed to the $ 1,100 zone, so they were received again from appreciation levels similar to those of the end of 2015, which were those that were seen in the prior to the recent elimination of restrictions. Then the price rose again, to accommodate something below $ 1,200.

“We consider that volatility is framed in a logical process given the new scheme, with the market used to flotation and exchange rate looking for a price in the center of the bands. Given the expectations of currency income, it would not be unreasonable to expect an exchange rate that continues to appreciate In the first half of the year, with the liquidation of the agriculture and the flexibility of access to the MULC for non -resident investors such as protagonists, “they said from investing in the stock market.

What does this new dollar imply in terms of competitiveness and what would happen at the ends of the band?

In summary, A dollar in the center of the band implies having a similar appreciation to that of Mauricio Macri’s government, which favored a growing current account deficitthus hindering the sustainable accumulation of reserves in a context in which access to international debt markets was finding a limit. While, a dollar on the band of the band as Milei intends and its economic team would mean to go back to 2015 or times of convertibility.

Dollar Bandas.png

Dollar bands 2.jpg

Source: @amilcarcollante.

“In its anti -inflationary strategy, the government has chosen to deliberately disregard the productive and competitive dimensions of the economy. In this context, It is expected that you try to sustain the tendency to appreciation by entering financial dollars. This not only limits the ability to reverse the current account deficit, but also compromises the competitiveness of key sectors such as industryin a commercial opening scenario and unavailable external conditions “, He held in dialogue with Pablo Moldovan scopedirector of the CP consultant.

The specialist remarked that, while a scenario on the band of the band poses problems of exchange competitiveness, the ceiling of the band forces the government to a contractive policy reaction in the fiscal and monetary level that is also problematic for the world of production. “

For its part, Guido Zackdirector of the Economy Area to Fundar, stressed that An exchange rate at $ 1,200 means a certain competitiveness gain for importers, although it remains low, while the improvement for exporters is much lowersince these previously had the “Blend” scheme, which allowed them to liquidate their sales to the CCL dollar, more expensive than the officer.

As for the extreme scenarios, he said that a exchange rate attached to the lower band would bring positive consequences in the short term, since inflation would be reduced and improved real, but negative income in the medium term since many sectors would be affected. “Sooner or later that unsustainable exchange rate stuck the jump, accelerating inflation and deteriorating income,” he said.

With an exchange rate near the upper band, he added, in the short term there would be problems linked to its recessive impact, while its long -term sustainability would be tied to the government’s ability to anchor expectations and accumulate reserves.

Tourism as a reflection of exchange appreciation

The effects of the exchange rate appreciation were reflected again in March tourism, prior to change in exchange policy. While trips abroad doubled in annual terms, the arrivals of foreigners fell 24%.

This was reflected in its International Tourism Statistics report. In the case of broadcasting tourism, the main increases were verified on trips to Chile (+170.3%) and Uruguay (+104.2%), while Brazil was the country that received the most Argentines, with an increase of 99.4%compared to March 2024.

“Whenever it is cheaper to go to Florianopolis than to go to Mar del Plata, Argentina has a problem. First, because all the dollars of Vaca Muerta will be spent on broad tourism, but also because it affects other sectors of the economy, such as industrialists“Zack said about it.

Source: Ambito