After the elimination of the stocks and the entry of a exchange rate to a band systemthe economist Juan Carlos de Pablo He pointed out that Argentines are facing a right time to use “White dollars”And he said that other opportunities will come to bleach.

“We are kicking,” was the economist’s analysis on the scenario that opened after the government’s decision to implement a new exchange scheme. In addition, Paul also demanded that Casa Rosada Eliminate hits for transactions.

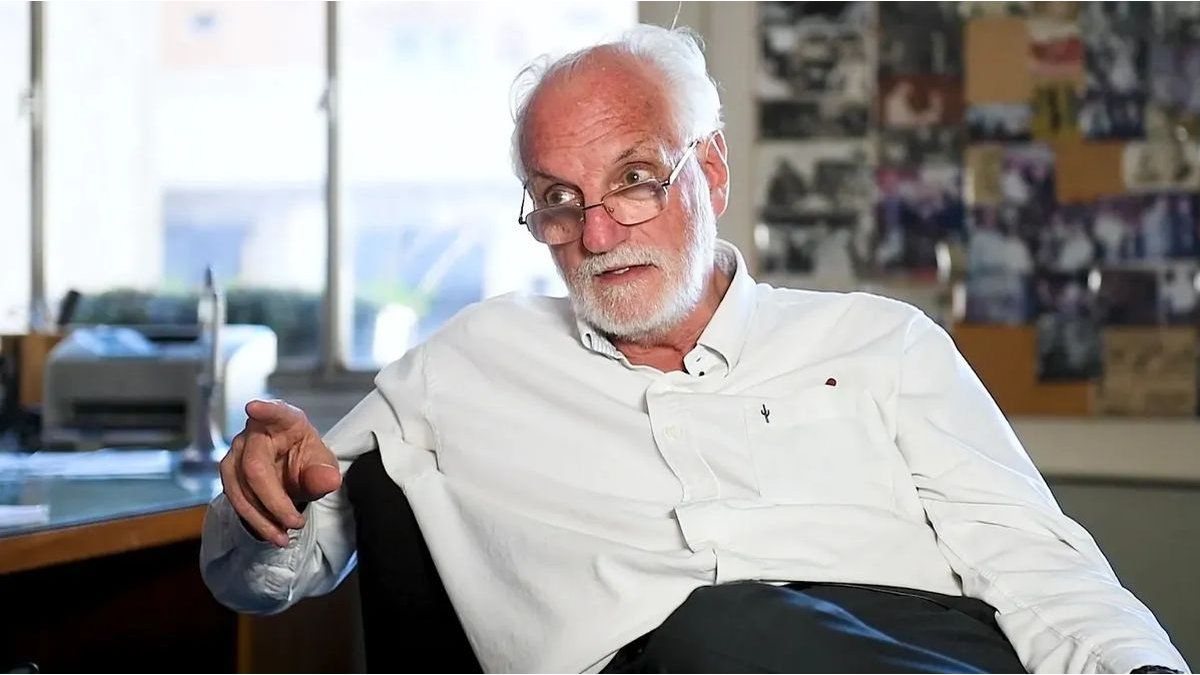

Juan Carlos de Pablo: “You have to use white dollars”

“The main difference is in the fiscal balance. Now we are floating, which makes the discussion of the exchange backwardness becomes arithmetic. You have to see what depends on each one to act accordingly, ”said Pablo.

The specialist also referred to the business sector in LN: “The businessman who does not sell is desperate and the one who sells is worried because he does not know if he wins or loses. We live in a highly uncertain context, we play it every day. Life is action, you have to tell them that I hope they hit it. ”

Juan Carlos de Pablo.jpg

“The Government must be told to eliminate all legal obstacles to make dollars in dollars,” he said.

“In absolute terms, the strong weight means the purchasing power of these moments. As for the time, it implies keeping it,” he said and stressed that Political internal interfere with “very little” in the real economy.

The economist declared that entrepreneurs are willing to assume more risks than the CEOs of a multinational or company, which generates a real effect.

By way of closing, the economist remarked that in order for the country to pierce his floor, it is necessary that risk ratingers improve the rating in a manner That fundamental fund managers can buy bonds from Argentina, That increases them and grow the chances of renewing debt maturities of 2026.

Starting effect of the stocks: in April, the official dollar climbed almost 9% and the financial ones fell up to 10%

In the wholesale segment, which is the reference of the official market, the dollar closed to $ 1,170, that is, $ 5 Above Tuesday’s closure. Within that framework, the Financial dollars The same trend followed: while the CCL rose 0.6% to $ 1,195.43 while the MEP advanced 0.5% to $ 1,179.45.

He official dollar operated in The $ 1,143.55 for purchase and $ 1,193.88 for sale In the average of the financial institutions published by the Central Bank (BCRA). Meanwhile, in the National Bank The ticket quoted $ 1140.00 for purchase and $ 1,190.00 for sale.

Within that framework, the Wholesale dollar rose 9.3% in the month, while the retail advanced 7.9%. As to The types of parallel changessuffered strong losses, the Blue 10.6%collapsed, the CCL 9.4%, and the MEP10.2%.

Source: Ambito