The report was prepared by the Center for Studies on the Argentine Recovery (RA Center) of the Faculty of Economic Sciences. University complaints about the lack of a budget continue.

In the midst of the conflict between the Government and university institutions, the University of Buenos Aires (UBA) He pointed out that the adjustment planned for updating the resources of the university system is equivalent to that made for the laundering and benefit of the richest sectors of the country (0.14%).

The content you want to access is exclusive for subscribers.

The report was prepared by the Center for Studies for Argentine Recovery (RA Center) of the Faculty of Economic Sciences. The tax effort is even greater than that applied to the industrial promotion regime of Tierra del Fuego (0.22%).

The updating of the set of operating expenses of both universities and hospitals, the updating of science and technology funds and the salary recomposition of teaching and non-teaching staff equivalent to a fiscal effort of 0.14% of GDP.

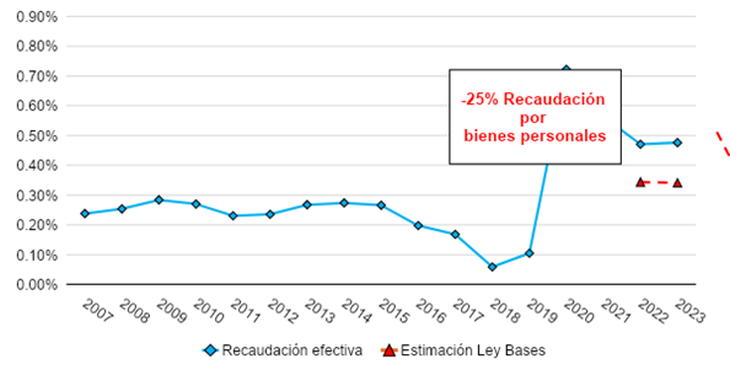

The adjustment in universities is proportional to the reduction of Personal Assets

The text criticizes the adjustment policy of Javier Milei’s Government and states: “The recent tax reform, for example, included a Strong reduction, both present and future, in wealth taxes that fall on those sectors with the greatest wealth in society. The modification of the non-taxable minimum and the corresponding rates of the personal property tax formula would result in a drop in public income of approximately 0.14% of GDP points.”

The reduction in the personal property tax represents the same amount of money adjusted in the university sector. “With these modifications and based on the latest tax data by category of taxable assets (year 2022), it is estimated that the drop in the collection of personal property taxes will be It would be approximately 25%, going from representing 0.52% of GDP to 0.38%“, the text says.

And they point out: “Thus, the tax reduction for the sectors with the greatest resources in society would be equivalent to the same amount as the budget requirement projected by Congress.”

Picture1.png

Adjustment to universities: “There is an alarming discrepancy in priorities”

The proportionality between the increase in the adjustment in universities and the reduction of the tax on Personal Property makes it clear, according to the report, “an alarming discrepancy in state priorities“.

“With a fiscal effort equivalent to 0.14% of GDP, similar to the benefit granted to the wealthiest elites in the country and significantly lower than the industrial promotion regime in Tierra del Fuego, it is evident that Investment in higher education and science is relegated in the face of the interests of the richest sectors,” they conclude.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.