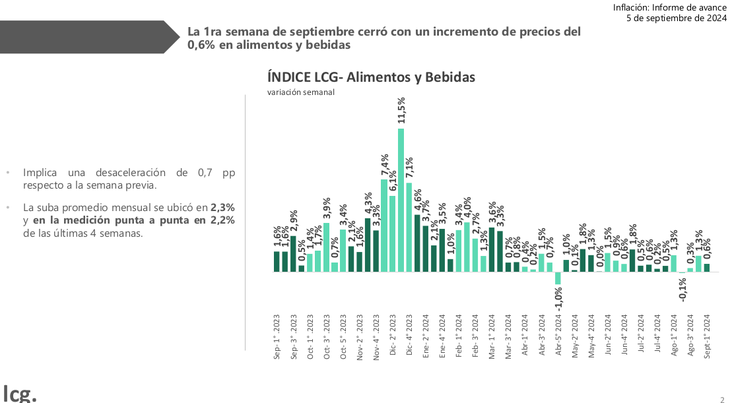

The first week of september started with an increase in the Food and beverage prices of around 0.6%, what marks a growth 2.3% on average in the last four weeks.

The data, which corresponds to the consulting firm Labor, Capital & Growth (LCG)implies that the reduction of the rate of COUNTRY TAX from 17.5% to 7.5% that started this month had a almost zero impact on the shelves and that the price slowdown would only be focused on those goods with high integration of imports or those that are entirely of foreign origin.

According to the Minister of Economy, Luis Caputo, inflation was going to fall in September as a result of the tax reduction which is charged every time a company or person buys dollars, in this case, for imports. However, there are doubts as to whether this is really the case.

In fact, In July, between the second and fifth week, price increases in supermarkets were recorded similar to those of the first week of September, even with the tax in force.. By comparison, it can be said that there was a significant drop compared to the last one in August, which had an increase of 1.3%. In other words, in the case of food, The reduction in tax pressure did not alter the usual behavior of prices, at least for the moment..

inflation-1st-sep-lcg.png

That has to do with the fact that, for the reduction of tax pressure to make any difference, It is necessary that the members of the value chain decide to transfer the benefit to the final price.In the meantime, stocks of imported products, inputs and intermediate goods will be renewed. When this happens, it will impact costs.

One detail to keep in mind is that lThe collection of the PAIS Tax in August did not grow in real terms, which indicates that companies stopped importing while waiting for the tax to be lowered.

As for the impact that this tax reduction could have on mass consumption, it is limited, in the case of A product with a 2% incidence of imports in its production, for every $1,000 net of Value Added Tax (VAT), the incidence would be only $11according to data from the Argentine Institute of Fiscal Analysis (IARAF).

Weekly inflation continues its course

In this regard, several consulting firms make a monthly inflation estimate that is more comprehensive than that of LCG, since it includes all items. In this case, Inflation in the first week is believed to have risen by 1.2%, which means the month could close at 3.2%.

“The reduction of the PAIS tax had effect on cars, cell phones and construction materials (-1%), and TVs, cameras and computers (-0.6%)”, states a report.

Companies in the automotive sector, like Toyota and Ford, announced reductions of up to 4% in the price lists. The price of one of the inputs in this sector, steel, fell by 7% for national products and 8% for imported products. In fertilizers, there were price reductions of between US$10 and US$24.

It should be noted that there are price reductions in the case of imported products They may be due more than anything to a reduction in companies’ financial costs. Until now, they were obliged to negotiate four payments of 25% each with their suppliers, but now they have moved to two of 50%. This implies an improvement in terms that is reflected in the interest rate that importers have to pay while they cannot access the Single and Free Exchange Market (MULC).

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.