Personal income rose 0.2% for the month, while spending grew 0.2%. The respective estimates were for increases of 0.4% and 0.3%.

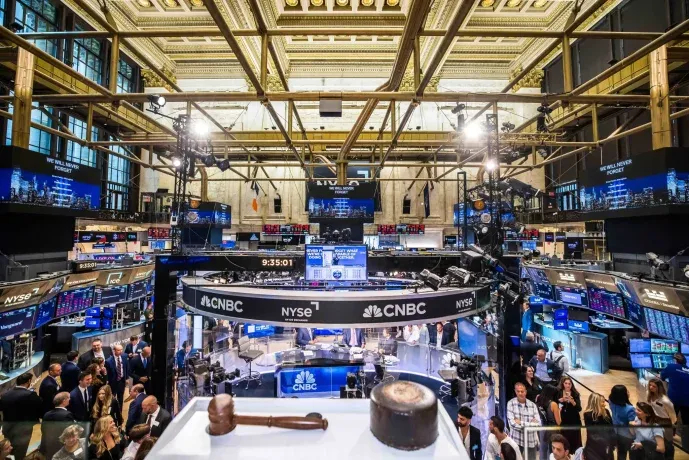

Wall Street extends the positive streak this Friday, while Investors assimilate new data that pointed to more progress in reducing inflation. The New York market is also on track to post solid weekly gains.

The content you want to access is exclusive to subscribers.

The S&P 500 rose 0.9%, while the Nasdaq Composite remains near the breakeven line. Gains in the technology-dominated index were capped by a more than 1% drop in Nvidia. The Dow Jones Industrial Average is the best performer with 0.4%.

All three major indexes would close the week higher, with the S&P 500 up nearly 1% and the Dow on track to rise 0.5%. The Nasdaq is on track for a weekly advance of about 1.5%.

Investors also received encouraging data on inflation that could give the Federal Reserve more reason to lower interest rates with confidence. The price index of personal consumption expenditures for August —the Federal Reserve’s preferred measure of inflation—rose 0.1%, in line with the expectations of economists surveyed by Dow Jones. PCE rose 2.2% at an annualized pace, below the 2.3% forecast.

Wall Street and reaction to strong data

Both policy makers and Wall Street expect a persistent reduction in monthly inflation figures, which would allow borrowing costs to continue to fall and relieve pressure on corporate and household balance sheets.

wall street markets NYSE.jpg

Investors also received encouraging data on inflation that could give the Federal Reserve more reason to lower interest rates with confidence.

NYSE

“As long as inflation stays under control, and we continue that trend, the Fed can focus almost entirely on the labor market, which implies a tilt toward lowering rates,” said Chris Zaccarelli, chief investment officer at Independent Advisory Alliance. “As the Fed lowers rates, especially in the absence of recessionary growth, it is a big boost for both the stock and bond markets, and should eventually provide some relief to those consumers most sensitive to interest rates.” .

Wall Street is coming off a winning session, following a series of economic data that assured investors of the strength of the US economy. Initial jobless claims fell more than expected in the past week, indicating a strong labor market, while the final second-quarter gross domestic product reading was a robust 3%.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.