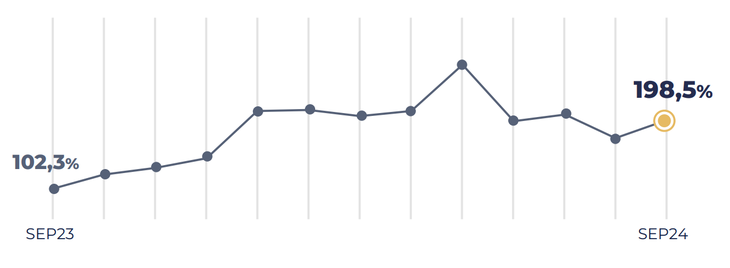

The Federal Public Revenue Administration (AFIP) reported that September tax collection reached $12.8 billion, which implies a nominal increase of 198.5%below the inflation that occurred during that period. Indeed, in real terms, it showed a slight annual drop of 3.4%, according to private estimates, thanks to the strong impulse of Personal Assets.

“He On September 14, the deadline for the cash cancellation of the debt due on March 31, 2024 operated. with the forgiveness of 60% of the compensatory and punitive interests. On September 15, the deadline to obtain 50% of the forgiveness began. The fees for the accessions made in the month of August were also entered. (both for those who chose payment in 3 installments and for those who adhered to the broader payment plan)”, said the AFIP.

The organization indicated that “$278,404 million were collected in the month corresponding to payments on account, cash payments for September and accession fees for August”.

collection-afip-september.png

On the other hand, the Special Personal Property Tax Income Regime (REIBP) contributed $881,183 million. “In September, the payment of the tax for goods not included in the Exceptional Regularization Regime (both the initial payment of 75% and the remaining balance of 25%) fell due. Because the expiration date of the balance was set for the last day of the month (09/30), part of said income will be credited in the month of October,” AFIP explained.

The organization also noted that also last month “the initial payment for the goods regularized in Stage 1, but due to the modification in the calendar of the expiration of the stages, it may be entered on October 31.”

Between January and September, the AFIP raised $92.5 billion, which implies a year-on-year improvement of 231.5%

How much did each tax contribute?

Official information shows thatl Value Added Tax generated revenues of $4.5 billionwhich implies a nominal increase of 157.7%. The tax component, which is linked to consumption, left $2.6 trillion, with a nominal improvement of 164.5%.

He Income Tax, for its part, collected $2.1 billion, with a nominal improvement of 169.2%. “The expiration in September 2024 of the presentation and payment of the balance of the sworn declaration of human persons for the fiscal period 2023. In the previous year the expiration had been in the month of June 2023,” the official report stated.

Meanwhile, the tax on Bank credits and debits It left $874,189 million in the treasury’s coffers, with an increase of 176.4%.

Besides, Social Security contributed $2.6 billionwith a nominal increase of 221.5%. Of them, employer contributions left $1 billion and personal contributions another $1.6 billion. Export duties left $539,862 million with a nominal increase of 217.8%, while import tariffs collected $405,151 million, which implies a growth of 170%.

Meanwhile, the PAIS Tax suffered the impact of the reduction in the rate from 17.5% to 7.5%. It raised $432.52 billion, with a nominal increase of 82%.

In the case of the Personal Property Tax $977,719 million were reached with a year-on-year variation of 1,608.9%, due to the advance payment.

The analysis of private consultants

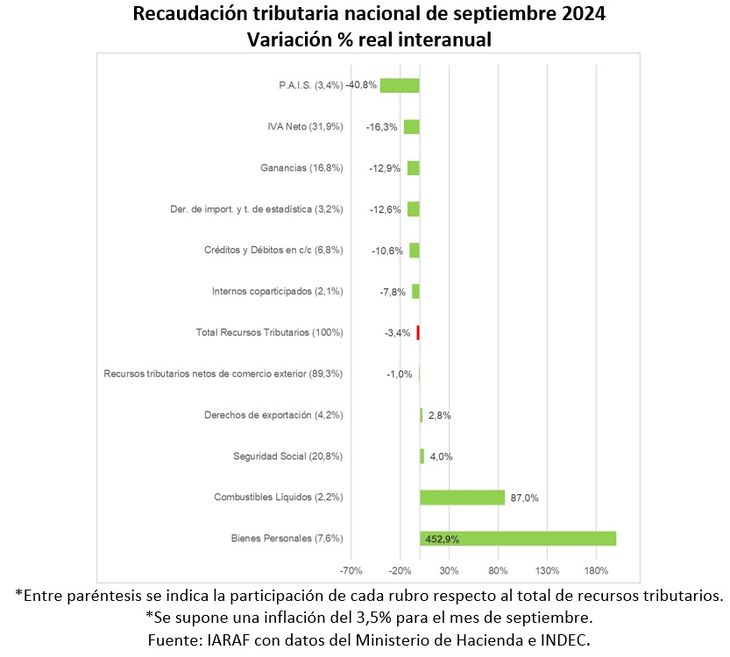

As indicated by the Argentine Institute of Fiscal Analysis (IARAF) in September, thanks to the boost from Personal Assets, “the national tax collection “It would have only decreased by a real 3.4% compared to September 2023.” “By excluding the collection of Personal Assets, the decrease would be 9.6%,” the private report estimated.

The analysis considers that it is “important to clarify that A good part of the good performance of national collection is due to the reform of the fiscal package of the BASES law on the Personal Assets taxwhich consisted of a reduction in the gradual tax rate and the possibility of paying the tax in advance for 5 fiscal periods.”

iaraf-raising-september.jpeg

“This explains the strong increase in collection of this tax, which would have increased by 453% in real terms year-on-year in September. It is necessary to clarify that the amount collected as a 5-year advance is an income that will no longer be available later,” warns the study. The IARAF points out that the collection of Personal Assets is the highest in the last 27 years.

The collection that would have increased the most in real terms would be the aforementioned Personal Property Tax, followed by the fuel tax with 87% and Social Security (+4%).

For the second time this year, the monthly collection The real value of the PAIS tax decreased in year-on-year terms, with a drop of 41%. It is important to remember that, starting in September of this year, the interannual comparison of the PAIS tax will be under the same level of tax burden, due to the reduction of the rate on the importation of goods from 17.5% to 7.5%.

At the other extreme, the collection that The most would have fallen would be COUNTRY tax, followed by VAT with 16.3% and Profits 13%.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.