In September, a surprise came together: the sharp rise in fixed terms that brought down deposits in Common Funds, and the boost in dollar deposits as a result of laundering was added. What is the expectation going forward?

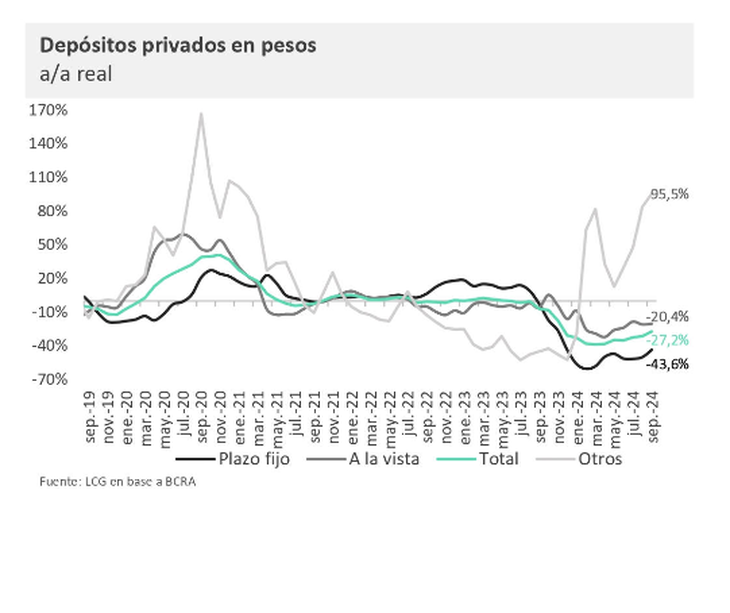

The fixed deadlines They had a strong rebound in September, they won the race against the Common Investment Funds (FCI) and a significant drop in demand deposits was noted (-3.2% real m/m; -20.4% real year-on-year ) contrasting with the general decline in August. For their part, the deposits in dollars They grew more than 60% in the month as a result of money laundering.

The content you want to access is exclusive to subscribers.

The real monthly increase in fixed terms (4.9%) contrasted with the slight decrease of the previous month at 0.6%. However, the floor is still very low, which translates into a real year-on-year drop of 43.6%, explained the consulting firm LCG in a recent report.

The FCI remunerated deposits They have already been rising for four months in real terms. However, the monthly increase in September was only 0.6% real, much less than the increase in the previous three months (average 10.5% m/m real).

For LCG, this lower monthly increase in the FCI was linked to the further increase in fixed termsyou can infer that people preferred deposits with higher remuneration, although they are less flexible. Interannual FCI grew 95.5% in real terms, they added.

Within demand deposits, which have been declining for two months, the real monthly fall in savings accounts by 4.8%. Current accounts suffered a real monthly decrease of 0.9%.

Deposits in dollars: the laundering effect

Its deposits in dollars They grew strongly in September, mainly explained by bleaching. “Taking the last day of the month as a reference, they grew 63% in September, totaling US$31.5 billion, a record in monthly growth. Although the vast majority should have been seen in September, with the extension until October 31 it is likely to see an increase in October, unless the Government offers dollarized investment alternatives,” LCG added.

deadlinesifjos3.png

Year-on-year, FCI deposits continue to win the race against fixed terms

Fixed term and dollar deposits: what to expect in October

Finally, they highlighted that in October they expect inflation similar to 3.5% in September and that this will maintain the growth of remunerated deposits. “On the other hand, a new increase in dollar deposits is expected due to the prolongation of laundering, although we believe it will be less than that achieved in September,” they concluded.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.