Are 7 companies They have something in common: their valuations are very high. What does this imply? What are they? And the S&P 500 Is it “expensive” or “cheap”?

When we evaluate a stock, one of the ratios most important to understand your valuation is the Price-to-Earnings (P/E), or price over earnings. This ratio shows us how many dollars we are paying for each dollar of earnings that the company generates. It’s a good starting point for analyzing whether a stock is “expensive” or “cheap,” but it doesn’t tell the whole story.

The Forward P/E is a variant that takes into account future earnings projections, giving us an idea of what investors expect in terms of growth. He ranking What we bring you today is based on the forward P/E of the main S&P 500 companies. Although useful, this ratio is not a crystal ball, and cannot be used alone to make investment decisions.

Let us remember that companies with a high forward P/E tend to be in sectors with high expectations or in the expansion phasewhich can inflate its share price.

Let’s move on to the ranking:

-

Tesla (TSLA) – Price to earnings: 78

Tesla is the pioneer in the manufacture of electric cars and renewable energy solutions. Its high ratio is due to high growth expectations in a rapidly expanding market, where the mass adoption of electric vehicles is still in its early stages.

-

Intuitive Surgical (ISRG) – Price to earnings: 63

Intuitive Surgical specializes in medical robotics, primarily surgical systems that enable precision, less invasive operations. The market projects solid growth as medical technology continues to advance.

-

ServiceNow (NOW) – Price to earnings: 54

ServiceNow offers cloud-based software to automate business workflows. Its growth is driven by the increasing digitalization of processes and the need for operational efficiency in large companies.

-

Palo Alto Networks (PANW) – Price to earnings: 47

Palo Alto Networks is a leading cybersecurity company, a sector that continues to grow due to the increasing number of threats in the digital world. Their high multiples reflect the importance of protecting data and systems in an increasingly interconnected environment.

-

Costco (COST) – Price to earnings: 45

Costco is a retail chain that operates under a membership model, known for its competitive prices. Its ratio reflects the market’s confidence in its ability to continue capturing a large consumer base, especially in uncertain economic times.

-

Arista Networks (ANET) – Price to earnings: 42

Arista Networks specializes in networking and data center solutions, a market that has grown with the rise of cloud computing and the need for robust infrastructure to support growing digital demand.

-

Nvidia (NVDA) – Price to earnings: 37

Nvidia, a leader in graphics chip and data processing technology, has gained prominence not only in video games, but also in artificial intelligence and data centers. Its forward P/E reflects the enormous expectations of the market, driven by its key role in the revolution of artificial intelligence and the processing of large volumes of data.

Why isn’t just the forward P/E enough?

The forward P/E is a useful metric, but it cannot be the only reference for making investment decisions. In the case of Nvidia, a paradigmatic case, its high ratio reflects the enormous expectations for its growth, driven by its leadership in artificial intelligence and data processing. However, those expectations may not be fully met. Factors such as competition in the semiconductor sector, changes in demand for artificial intelligence or supply chain issues can negatively impact your earnings forecasts, making a high forward P/E not always justify the current share price. .

It is important to consider the sector in which each company operates and the current market circumstances. A high P/E may be reasonable if the company is in a phase of explosive growth, but it may also be a sign that the share price is inflated, increasing risk for investors.

And what is the Price to earnings of the S&P 500?

S&P 500 BOGGIANO.jpg

Today, the average forward P/E of the S&P 500 is at 21, indicating that valuations are generally at high levels.

Does it mean that you have to run out and sell the S&P 500? No, clearly not. The trend is bullish and is in the area of historical highs. But you have to understand its valuation to know what to do in case things don’t go as planned.

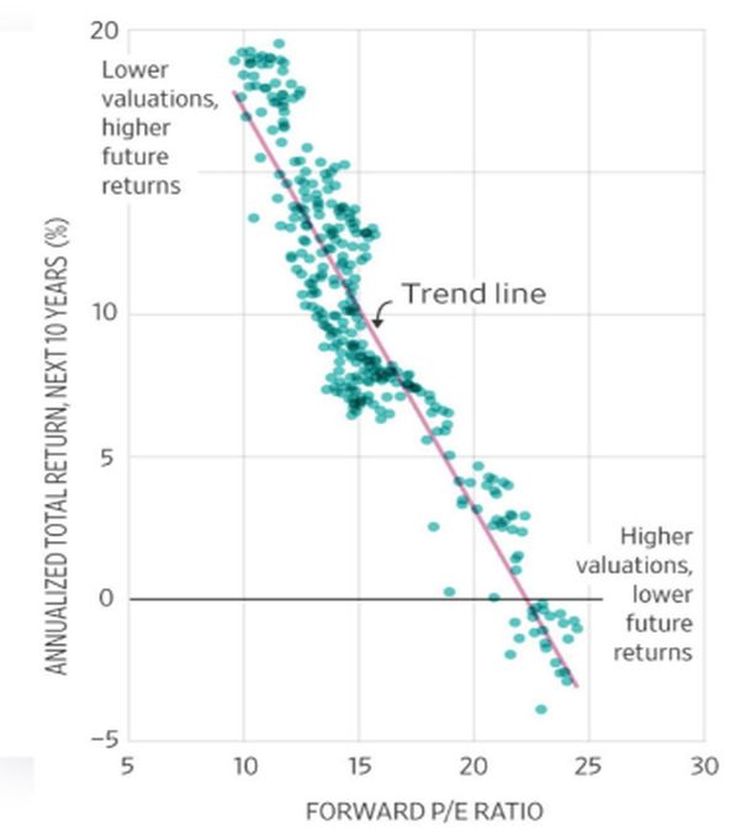

And why is valuation relevant when investing for the long term? Let’s look at the following chart, which compares the 10-year annualized returns of the S&P 500 with the P/E ratio:

BOGGIANO.jpg

We can see a clear trend: the higher the P/E, the lower the expected future returns, and vice versa.

Overvalued stocks tend to deliver lower future returns, while undervalued stocks tend to deliver better results.

This idea is based on the concept of the “margin of safety,” where an investor seeks to purchase stocks below their estimated intrinsic value, creating a “cushion” that helps protect their investment if the market corrects.

That’s why the next few years may be challenging, since with the S&P 500 at high valuation levels, it will be more difficult to generate significant returns.

In this context, it is crucial to analyze the main market trends and understand the fundamentals. What asset meets these two requirements? Without a doubt, the entire metal complex.

If you want to learn more about investments, I invite you to our website: www.clubdeinversores.com

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.