Euphoria invaded the city. The result of bleachthe fury of “carry trade” and the triumph of donald trump In the United States they set the pulse on the operating tables. At the exchange level, the one that aroused the most doubts among economic agents, The market seems to have “bought” Luis Caputo’s roadmap for the coming months and the expectation of a downward staircase for the official dollar “board” is consolidated. However, the appreciation of the exchange rate raises concerns about the loss of foreign currency due to tourism abroad.

For now, The US$20,085 million in cash brought by laundering and the “boom” of the financial cycle allow the Central Bank to increase its purchasing balanceas reflected in October and the beginning of November. It happens that this combo fuels a greater taking of bank credits in dollars and issues of negotiable obligations (ON) in foreign currency by companies, which coexists with an increase in agricultural settlements and boosts the flow of foreign currency in the market. official.

Last month, companies placed US$2.3 billion ON in dollars (more than what was issued in all of 2022 or all of 2023), Bank loans to companies in foreign currency added another US$1 billion and, also uploaded to the “carry” (which, in October alone, left returns in dollars of up to 16%), agriculture settled close to US$2.5 billion (an atypical amount for this time of year).

Meanwhile, the consultant Vector stated: “Financial optimism is particularly supported by the logic of the currency market. On the gaps side, the continuity of the ‘blend’ and the greater supply resulting from money laundering keeps cash with liquidation at bay. For its part, in the official market, the extraordinary agricultural liquidation offer before The prospect of continuity of the ‘crawling peg’ and the returns offered by the ‘carry trade’ have allowed foreign currency purchases to be extended until the fine harvest of November and December”.

Dollar: the market “buys” the declining exchange rate

In this framework, both market prices and analyst projections reinforced the expectation that had already begun to appear: the possibility of that the Government complies with the deceleration of the rate of depreciation of the official exchange rate, which since the December megadevaluation has remained fixed at 2% monthly.

This was reflected in the latest Market Expectations Survey (REM) of the BCRA, published this Thursday. There, the consulting firms and banks projected that the official dollar will be located at the end of the next twelve months at $1,245, which implies an average monthly increase of 1.8%. The same thing happened with the future dollar contractsthat They operated with significant losses on the last two wheels, especially on the longest stretch. The price for September 2025 closed this Friday at $1,257 on Matba-Rofex.

In this regard, Vectorial analyzed the Central Bank’s recent decision to cut the monetary policy rate from 40% to 35% annual nominal and the compression of debt yields in Treasury pesos, boosted by the Economy’s decision not to offer Lecap or Boncap in the last two tenders. “The Government continues to show its willingness to converge rates and inflation at 2%,” said the consulting firm that directs Eduardo Hecker and considered that this would imply a reduction in the juicy profits offered by the “carry trade”, which could reduce the flow of foreign currency that benefited the BCRA.

“For that reason, It would not be strange to evaluate the possibility of the Government reducing the ‘crawling peg’ from 2% to 1% in the coming months in order to maintain the exchange rate anchor strategy and returns in pesos that beat the devaluation,” said the Vectorial report.

Appreciation and “boom” of tourism abroad

Of course, the other side of this is the deepening of the exchange rate appreciation dynamics and in the city they monitor the numbers carefully. The concern lies in the expected “boom” in tourism abroad for this summerwhich has already begun to take shape in the queries received by companies in the sector.

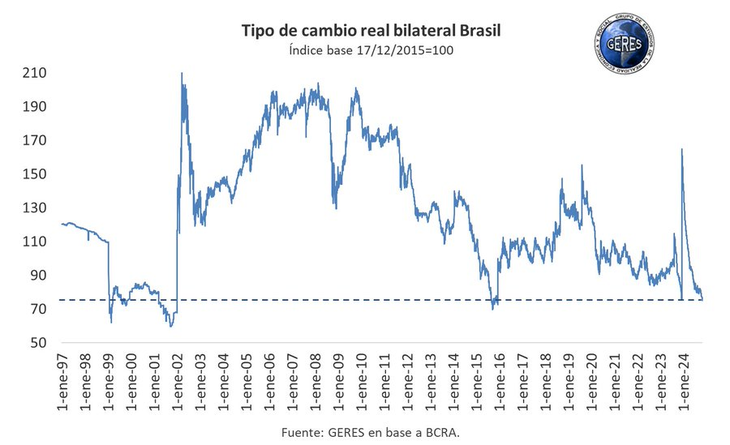

The economist Nery Persichini calculated that The current situation is the most convenient for vacationing in Brazil (compared to doing it within Argentina) since 2001. An alternative that is already being enjoyed by segments of the population that still have the ability to afford summer tourism. To travel to the United States, it is “the most attractive window since 2017.” “Bye Gesell. Hello Miami and Rio”Persichini summarized.

image.png

In this way, the consultant Epycawho directs Martin Kalos, projected a loss of more than US$3 billion during the summer due to tourism abroadas the economist himself anticipated Scope days ago. In fact, already in October the consumption of Argentines abroad reached its highest level since 2018, as highlighted by 1816 based on BCRA data that shows a jump in credit card loans in foreign currency.

In addition to the drain of foreign currency and the blow to the local tourism sector, the dynamics of exchange appreciation generates problems for the Argentine industry: Foreign products are becoming cheaper, also benefiting from the reduction in tariffs ordered by Javier Milei’s government, and the arrival of more and more imported competition in an advantageous situation is expected.

Donald Trump’s triumph

Additional pressure could be added to this trend by the Donald Trump’s victorywhich won with a protectionist program of raising tariffs on imports (contrary to Milei). He strengthening of the dollar in the world was the main reaction of the markets to the electoral result. Until here, The reaction in Argentina was euphoric: Bonds flew, country risk pierced 900 basis points and financial dollars fell.

“In the rest of the emerging countries, the immediate consequence was a depreciation of their currencies (this is the case of the Chinese yuan, the Mexican peso, the Brazilian real), discounting a more protectionist trade policy of the United States, which raises the equilibrium exchange rate of these countries. This is detrimental to the Milei-Caputo plan, as it automatically implies a greater appreciation of the real multilateral exchange rate. “which today is already at similar levels (although still higher) than those at the end of 2015, prior to the devaluation of (Alfonso) Prat-Gay and (Federico) Sturzenegger,” he analyzed. Vector.

The report of 1816which emphasized that exchange risks look increasingly smaller Regarding what was outlined until the beginning of the money laundering, he also pointed out that “it is important for Argentina that the ‘sell-off’ of emerging markets does not deepen too much (which until now has not affected assets and local currency at all) because the economic program is based among other things in a marked appreciation of the real exchange rate which can cause concern ifFor example, real and soy spread weakness of recent times.”

image.png

He GERES Group he put numbers on it: “The real bilateral exchange rate with Brazil As of November 7, 2024, it stood just 1.7% above the level recorded on December 12, 2023, the day before the devaluation jump, and 7.8% below December 7, 2023prior to the start of the current administration.” In the last 22 years, only during a handful of months in 2015 did it remain below the current level.

For its part, the economic team bets on financial flows to sustain the BCRA’s buying position. The Economic Studies Management of the Province Bank calculated, based on official information, that since mid-September the issuance of ON and bank loans in dollars totaled more than US$4,000 million between them.

Proof that Luis Caputo and Santiago Bausili are committed to promoting this process was the flexibility of dollar purchase terms to cancel financial debts (from five days of maximum advance notice it was changed to 60 days). “In the short term, this relaxation could support the supply of currencies more than the demand.”“Lower requirements could encourage more companies to take out credit in dollars, in a scenario where immediate maturities – and expectations of devaluation of the official exchange rate – are limited,” said the Bapro report.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.