He Bank of America (BofA) noted in his latest report on Latin America that “Argentina is the country with the most catalysts in the region: disinflation, possible agreement with the International Monetary Fund(IMF), reduction of regulatory risks”, which is why it maintains an “overweight” position. This indicates a positive view on the future performance of the Argentine economy, and that the Wall Street giant expects better returns compared to other countries.

In this context, it maintains that it has exposure in the country in two key sectors: banks (Grupo Financiero Galicia) and energy (Pampa Energía). This, despite the results below expectations in the third quarter of 2024.

“We see sustainable and positive operating trends. For banks, we expect real growth in loans and sustained asset quality to partly offset lower earnings on government securities. For Pampa“We value predictable cash flows linked to the dollar while increasing oil production,” the document states.

Ignacio Sniechowski, head of equity IEB Group He commented on a trend of recent days in the market. “The rotation of banks to Oil & Gas is clear. It is not only seen in prices. It is also seen in volumes operated for several years now that the Oil & Gas sector far surpasses the banking sector. The flow today goes through Oil & Gas“, slips the strategist.

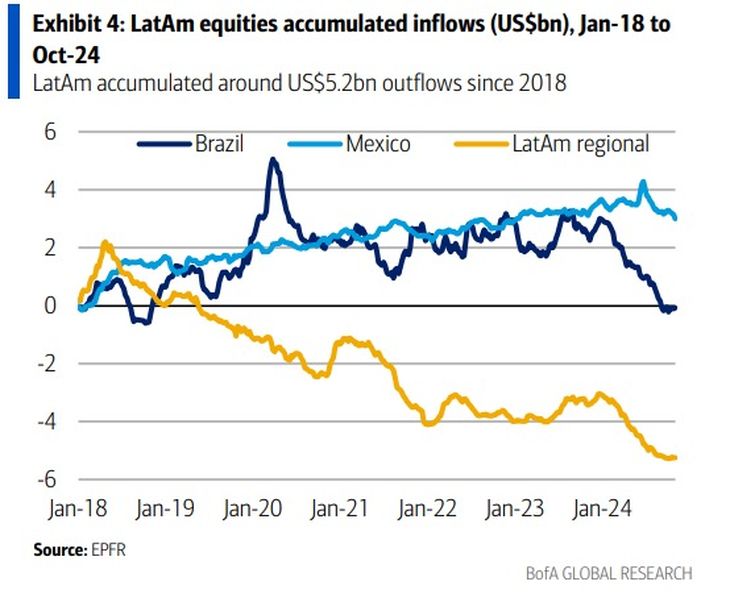

BofA’s position on Argentina is striking, as it analyzes that the demand for shares in Latin America is low. And he warns that “higher rates in the US and a stronger dollar are the biggest risks for the region.” The MSCI LatAm index has accumulated a drop of -18% so far this year, compared to an increase of +25% for the S&P500 and +11% for emerging markets. “The main drag in Latin America was the exchange rate of Mexico (-16%) and Brazil (-15%).“.

Fitch sees potential in Argentine sectors

Fitch Ratingsthe risk qualifier, coincides with the BofA in which some sectors of Argentina They attract the attention of investors for their good “momentum”. Regarding the banking sector, he maintains that “the financial system maintains high levels of solvency, with a significant excess of capital integration with respect to regulatory requirements, which gives entities a good margin to continue increasing your risk assets without the need for new contributions”.

For the rating agency, the sectors with the best growth prospects in the Argentine economy are the technological, the mining and the energy. “The sector is experiencing significant dynamism, favored by a clearer regulatory environment and crude oil prices close to international parity,” he analyzes in his latest document on Argentina.

BoFA.jpeg

Likewise, he highlights that “in credit terms, energy companies show high levels of debt issuancetotaling more than US$4,450 million in 2024, highlighting international issues (48%) and in local dollars (35%). Maturities are balanced and manageable for the sector’s Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) levels,” he adds.

Like some other risk rating agencies and international banks, Fitch concludes that the main risks for the economic program are “focus on macroeconomic volatility and the commodity price cycle.” Two factors that will persist as long as the fiscal and monetary plan is consolidated locally and geopolitical tensions do not worsen internationally.

BofA 1.jpeg

By 2025, the main challenges For Argentina, according to Fitch, there will be debt maturities in foreign currency for US$18.1 billion, including payments of US$5 billion in January and July. It should be remembered that the government has already deposited the funds for the first payment and is negotiating a REPO loan with private banks to temporarily cover the balances.

“If macroeconomic stability is maintained and debt payment is guaranteed, country risk is expected to reducewhich could open the possibility of accessing the debt market in the future,” concludes the rating agency.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.